But first, a hello to you good looking. If no one’s told you, you make us all tingly on the inside. You, yes you, matter. Now let’s not get crazy. You don’t matter more than our relentless search for freedom and free-cashflow (amirite?) but you do matter.

Now, back to the market. Eesh.

Today in < 10 minutes we’re going to talk about:

- Window of Opportunity – The Overton Window, what it is and how it translates to tolerance.

- YOLO-ing – We’re adding a new window. What stage are you in?

- Follow the greats – Instead of trying to time, read about what the greats are doing.

- Everything’s on sale – Plan for the sale and ask yourself the right questions.

If you prepare for the storm, you can weather it.

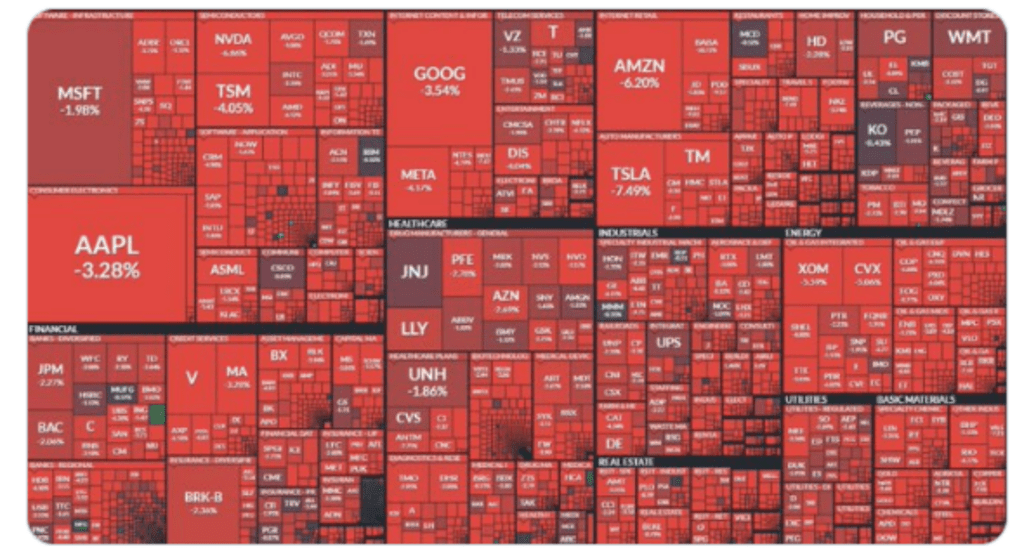

That message especially goes to all the bitcoin HODLers out there. I haven’t seen that much red since I stumbled onto a clash between PETA advocates and a fur convention. Bloody, baby.

That said;

- If you don’t know what to do in this downturn…

- If it all seems overwhelming or a constant background whirring noise…

Perhaps today’s newsletter will come to you like a summertime Santa. Ho-ho-HODLing. Ok sorry. I’m done.

If you know what is coming, it won’t scare you.

If you’ve seen it before, you’ll see how it echoes.

We’re not here to tell you the price targets for the S&P or when bitcoin is going (is it?) to turn. We’re here to open the aperture.

Window of Opportunity

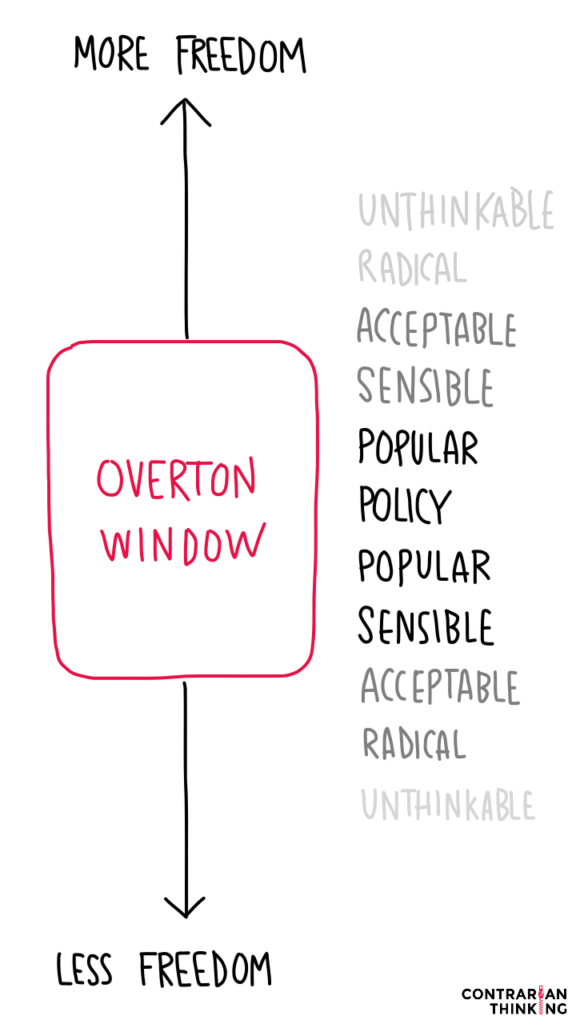

There’s a concept in politics called the Overton Window. It is the acceptable window of thought that is allowed to be expressed by society at a given moment. Society moves from more free thought to less free in cycles similar to market cycles. Step outside of the window and expect public shunning, stay inside it and you’re in the safe zone.

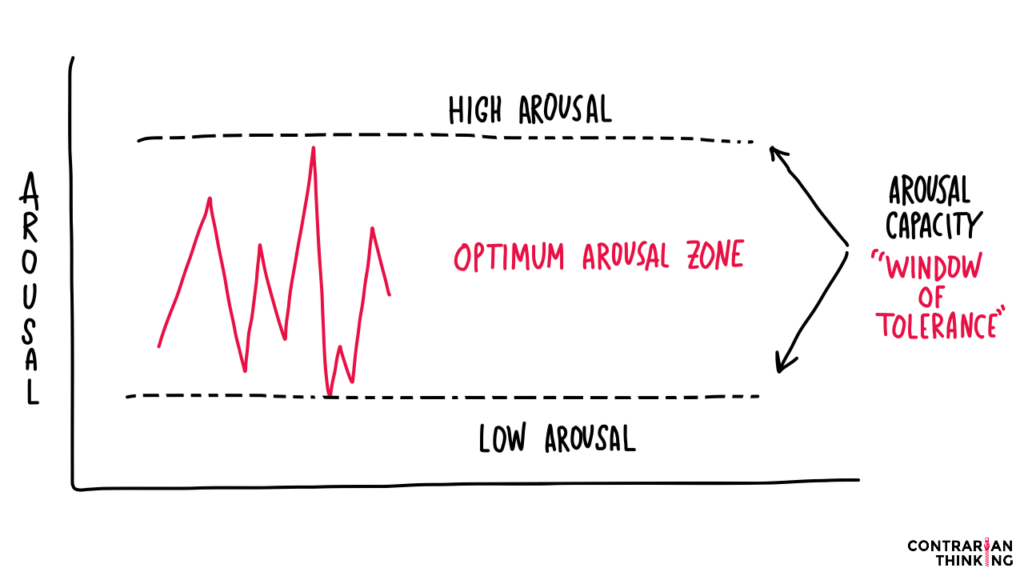

There is a similar window we have for investing. It’s our tolerance window or at least that’s what I thought it was called, turns out a tolerance window is actually about this…

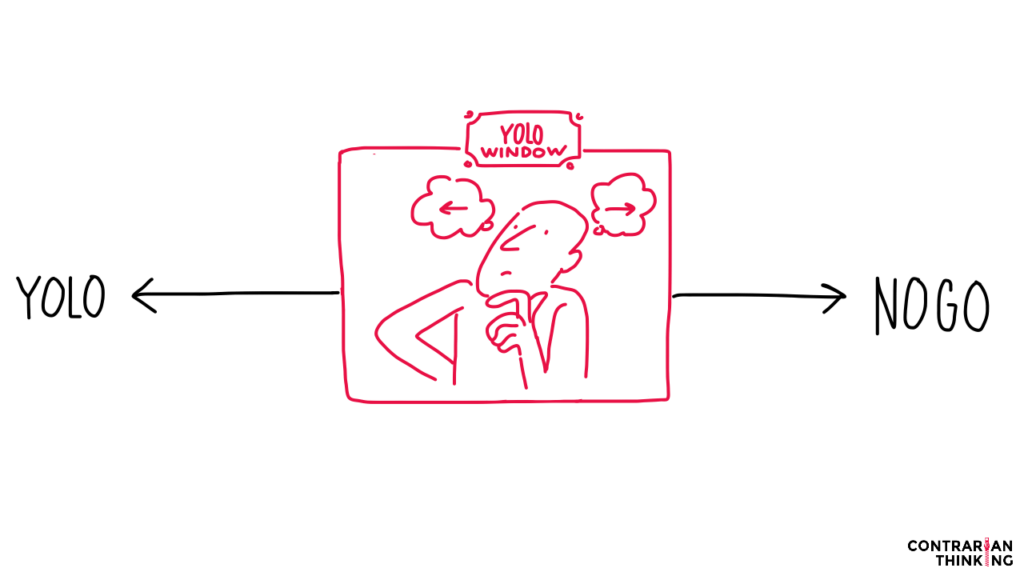

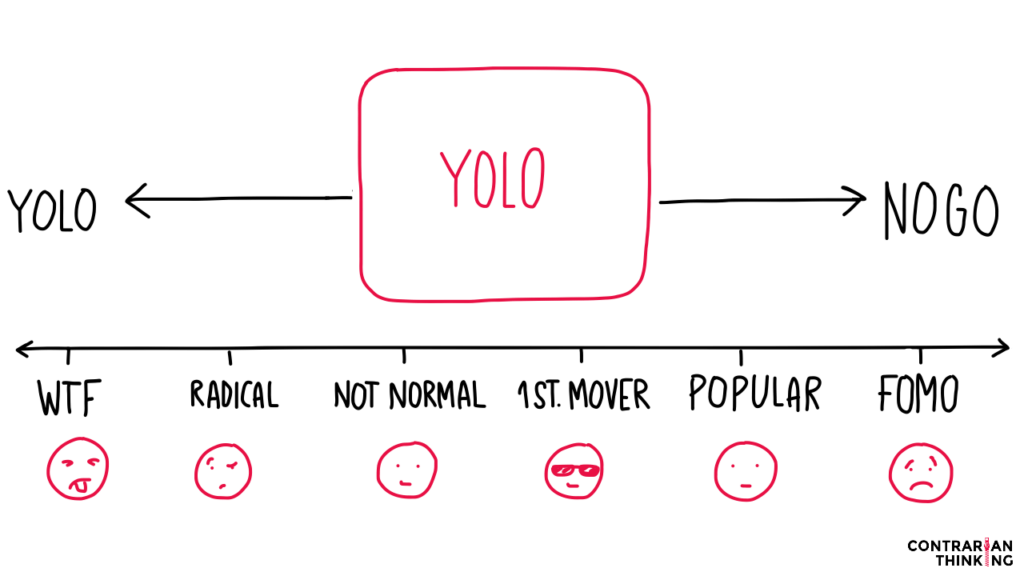

How, ahem, “excited” we are in a given situation. Oops. So I’ve come up with my own new window let’s call it… the YOLO Window. In any given scenario how open to investing (or as the kids say – YOLOing) into an asset class are you? It’s a spectrum just like any other. From the middle when we are most open to the idea being:

- FOMO (fear of missing out) stage – everyone is investing

- Popular – lots of people investing

- 1st Mover – some people investing

- Not Normal – Few people investing

- Radical – who would invest in this?

- WTF – that’s a horrifying idea

What I’ve found is that most investors get whipsawed like a middle aged dad dancing to Earth Wind and Fire. Lots of failing, no strategy, even less rhyme or reason.

It’s like a car wreck you just can’t stop watching. I don’t want that to be you. Let’s get the beat.

First, context… What is the full window?

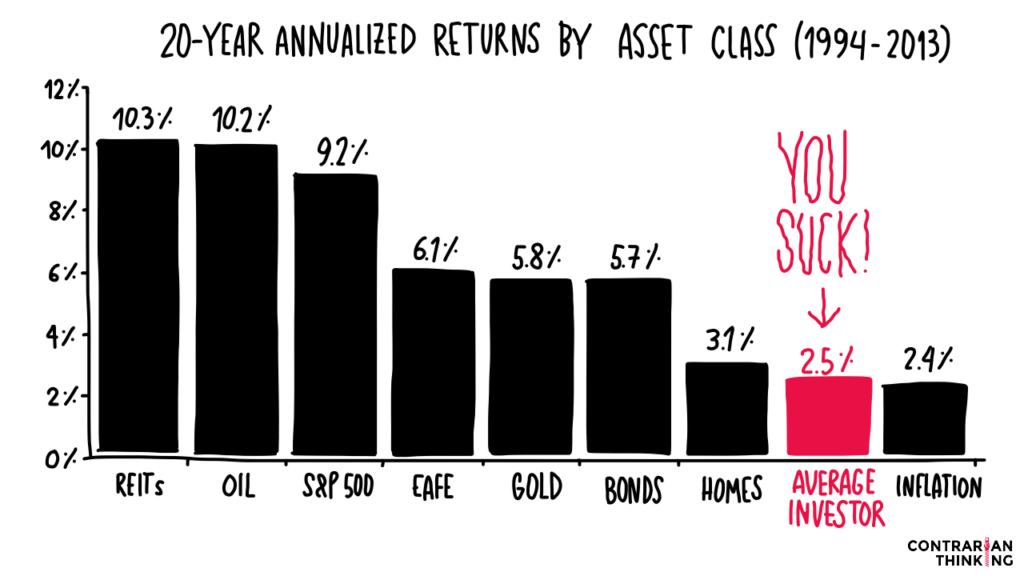

The biggest mistake most retail investors make is trying to time the market emotionally. It turns out you and I are pretty abysmal at determining when to get in or out of the market. Now imagine inflation at 8.6% and us only on average getting a 2.5% return, yikes.

The key to not being average is having a wider window, more context to history. As we cannot time travel, let’s be voyeurs. I have a reading list for ya’ll to weather this storm. Read or listen to the greats to see how their windows widened and closed:

- Sam Zell – Am I Being Too Subtle – how to engage in a downturn and amass assets

- Lords of Finance – on the great depression of 1929

- Thinking Fact & Slow – psychology of investing

- The Most Important Thing – Howard Mark Oaktree Capital Management

I might even suggest you follow those allocating billions right now such as Howard Marks. His monthly investment memos the Bull Market Rhymes, pull us into the context of a man who has accumulated billions from investing since 1969.

30 Second Thesis

“The most important thing about bull market psychology is that most people take rising stock prices as a positive sign of things to come.”

Many are converted to optimism. Relatively few suspect that the gains to date might have been excessive and borrowed from future returns and that they presage reversal, not continuation.

That reminds me of another of my favorite adages – one of the first ones I learned, roughly 50 years ago – “the three stages of a bull market”:

- the first, when a few forward-looking people begin to believe things will get better

- the second, when most investors realize improvement is actually underway, and

- the third, when everyone concludes that things will get better forever

Now, to Ask the Right Questions

We have no answers for anyone. Our job is to make you question everything. I’d rather the most powerful question than others’ answers. So here is the question my husband and I pondered this weekend on the shores of a family who had accumulated assets and land since the 1920’s right here in Texas.

“What is your plan for the sale?“

You know on Black Friday back in the day before it was online, people used to plan what they’d rush into the store to get. They stand outside of Best Buy like a stampede at the gate. Who’s grabbing the $100 tv? Who’s got the toaster oven? I want you to think about this market like that.

SPONSORED

Today’s Contrarian Thinking brought to you by Motley Fool….

You know we’re obsessed with two things: cashflow and buying real returns not dreams. That’s why we try to invest when everyone else thinks you are crazy. I have NEVER partnered with a stock specific app before, because the market was at all time highs. That is now completely different.

We’re breaking down our plan to invest in public AND private markets. This is where help from people like The Motley Fool Stock Advisor come in. We combed around to see who could do real analysis. They shake out. Their average stock pick has returned 314%* vs the S&P 500’s 109% since inception. Is that always going to be the case? No. Can you and I use the help? Yes.

We got them to give us 60% off* for new Contrarian Thinking members. Why? So we can all become smarter, wiser, more informed investors…and potentially add some green to that bloody stock market screen.

Returns as of 6/22/2022. Past performance is not an indicator of future results. Not all Stock Advisor picks have performed as well.

*Discount based on $199/year list price. Introductory promotion for new members only.

Flipping The Script

Most people have millions wiped away during a downturn, how could you flip the script on that?

There are two types of plans I’m putting in place, public markets vs private markets plans.

Public Market Sale Plan

That means when the stock markets and other liquid assets tank do I know when the numbers and my thesis tell me to buy back in? For instance:

- when the price of Apple falls below its 5-year average I’m a buyer?

- when the 10 year average of Amazon hits?

- when companies are trading for less than their liquidation costs?

Setup some stock signals. Don’t let someone else be a master of your fate. Most will panic sell, will you strategic buy? There is not a singular right answer but I’d have a plan on what you want in the sale.

Private Markets Sale Plan

Well ya’ll know we love boring businesses so you better believe I’ve started an acquisition plan for when things get bloody. Let me stimulate your senses:

- when profitable 10 year businesses start selling for 1x multiples

- when businesses start closing and I can buy up their assets

- when loans are too expensive because of interest rates so I can use cash

- when funds I wanted to get into before drop their expense ratios

Or more fun:

- My husband and I want to own a ranch with at least 20 acres in Austin or Houston area, when those prices start coming down we may be buyers.

- We also have our eye on one of those 4 wheel houses otherwise known as Vans.

Be a cool prepper, not a psycho,

Codie & Contrarian Crew

The ‘Not So Boring’ Section

Sometimes they do save the best for last. Our favorite things, the most interesting things… sh*t I wish my mama done told me.

- Growth Spurt – We hit 120,000 on Youtube WTF?!

- Foutain of Youth – Codie thinks she looks young again thanks to this

- VC Baby – We invested in this company – if you own a small biz you’re dumb not to try it

Also, this is funny…

How I Made my First $100k

Watch and I’ll tell you the exact steps I took, the way you should negotiate to get more at each job you take, and how to turn your income into six figures and beyond. SPOILER ALERT. This is not some BS video saying it’s going to be easy. You will have to do the work. But you can copy my homework…if you want to copy my strategies.