‘Debt’ has historically been a negative term. Turns out that the rich actually leverage debt to become even more rich. This week, we discuss how.

Today in < 10 minutes we’re going to talk about:

- Nothing but LIES – Why some of our school teachers and professors lied to us about debt.

- Breaking the Bank – Why the rich take out gigantic loans and still make a sh**-ton.

- Q’s that Matter – Why I ask myself the same 2 questions before I take on debt.

If you don’t understand debt, you’ll never be truly wealthy.

Here’s what you need to know about how the rich use debt:

We wrote a tweet that went a little viral.

It’s all about one type of debt that the wealthy (and many others) use that I consider GOOD debt. I’m going to break it down further for you and also answer the 150 questions posed on this tweet.

But first…

We were taught a bunch of lies about debt.

That debt is always:

• bad

• irresponsible

• dangerous

• even predatory

Scrolling through the responses on that tweet is a hysterical exercise. Some mention that the Aramaic word for sin and debt in the bible are the same. Another says in Islam taking interest is forbidden. A quick scroll of the internet says even the fat and happy Buddha has a framework on money called Buddhist Dhamma which says, “money that originates as interest-bearing, centralized, privatized debt is harmful, unethical, and delusional.”

So our conflict with debt runs deep.

Perhaps all those things CAN be true, in fact there are echoes of what we are going to talk about today that are incredibly dangerous and just led to massive bankruptcies.

But when you actually understand debt it can be a lever that lifts the world. Removing the emotion from it and inserting the efficacy is our goal today.

How do the Rich use debt?

One of my favorite examples is stock collateralization.

In one sentence: Avoid taxes, take loans.

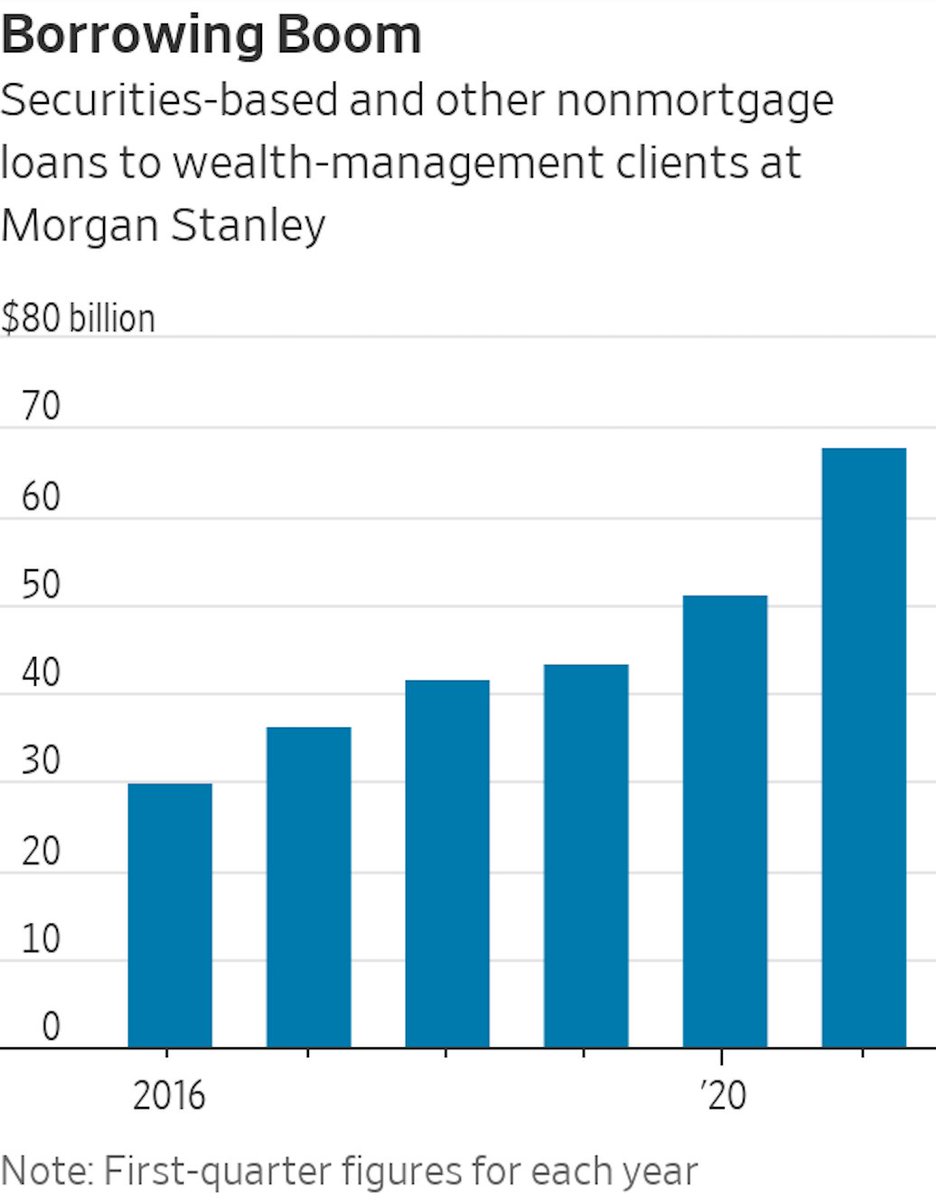

The rich: ie Elon Musk, Larry Ellison, Bill Gates, all borrow against their stock to get $ and avoid capital gains tax. These types of loans are called Securities-based Loans or stock collateralization. Btw – I think finance peeps just like to add vowels to words to charge more, eh?

How does this work?

Well – IF you hold sizable shares of a listed company, you can often do the same.

Musk for instance has an evergreen credit facility for $90Billion+ where he uses this exact strategy. The rich like debt, because you don’t get taxed as income or as capital gains on a loan. So they essentially create loans for themselves through their brokerage accounts:

Let’s Break it Down:

Let’s say Musk has 175 million Tesla shares with Merrill Lynch #NBD. He calls up his banker & pledges (puts up as collateral aka the bank could take them if he defaults) 88.3 million Tesla shares.

That’s 36% of his stake which gives him $94 billion.

Now he has $94B to spend without having to sell a single share.

How common is this?

Over 32 billionaires in the Forbes 400 have this type of line of credit that we can track. Of all Fortune 500 companies that are more than 560 executive officers who use stock loans, and 5%+ large shareholders currently pledge collateral.

The average pledge is $427M. Pennies really. While the total amount tracked and pledged from this group is $239B, according to a report from Audit Analytics.

How do you repay the loan without selling?

Aren’t you just kicking the can having to eventually pay? Maybe. Or your stock keeps growing and covers your debt service. If you’re getting a return of 10% over time and you’re paying less interest than that you are ahead. Or your dividends pay for the interest.

SPONSORED BY THE MOTLEY FOOL

Don’t Go the Stock Market Alone…

…Because panic selling ain’t cool. We’re big fans of investing in yourself and finding a mentor.

But alas, since we have yet to figure out a way to carry a mini Warren Buffett in our pockets, we searched around for another guide after getting pummeled by the market.

Motley Fool fit the bill. Their recommendations for their Stock Advisor members have returned 314%* vs the S&P 500’s 109% since inception.

If you’re not a member yet, don’t fret. Their analysts have released 3 new ‘double down’ picks for us.

Be greedy when others are fearful.

Returns as of 6/22/2022. Past performance is not an indicator of future results. Not all Stock Advisor picks have performed as well.

Why do the rich take these unholy loans?

Because they’re not dumb.

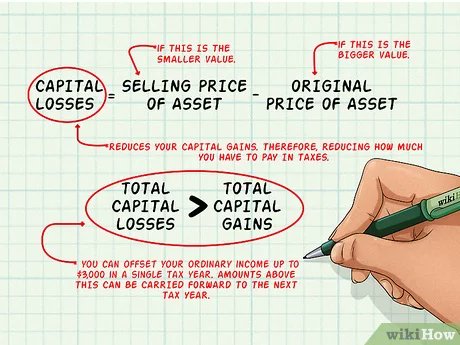

#1 Taxes

It far cheaper to borrow against the value of your shares than to sell and pay taxes on the gains. Think about this for a moment. Federal capital gains tax can be 37% at high end. States also tax capital gains. So if you live in the tax prison hell hole (with beautiful scenery) aka California you have a 13.3% capital gains tax. Which is probably why Joe Rogan picked up to Tejas before that Spotify deal came through or why most executives do the same before they sell their stocks. It’s pretty simple:

Capital Gains Tax = Price of stock sold – Original purchase price

How does this cost compare?

Stock loan interest expense is much less than the capital gain tax. I’ve had loans as low as 1.5% and I’m certainly no Elon Musk. Right now they vary around 3-7%.

Let’s do an example:

Over 5 years let’s say you have a $100 million dollar loan:

- Loan Numbers:

- $100 million dollar loan @ 3% apr

- = $3 million paid in interest

- $3million x 5 yrs = $15 million paid

- Capital Gains Tax No Loan Numbers:

- $100 million @ 35% tax

- = $35 million paid in taxes

- $35 million x 5 yrs = $175 million

I’m no genius but $15 million vs $175 million sounds pretty good to me. Depending on the scenario you may be able to write off the loan interest expense against new investments which further decreases capital gains. I ain’t an accountant so get one on all of this for your unique situation.

#2 No Limitation on Loan Purpose

Mortgage loan -> you have to buy a property.

Stock margin -> you need to buy stock.

Stock collateral loan -> you can do pretty much whatever you want.

The interesting thing about these types of loans is that banks usually do not request loan purpose. You can use it to invest, buy a home, travel, or pay off expenses. The options are as flexible as you and your bank allow them to be.

#3 Simple Process

Have you gotten a mortgage lately? Colonoscopy much?

Stock loans are generally easy and fast. You don’t need a certain credit score, or to submit proof of income. You just have to hold the asset. Which of course means you need to have money to take loans on the money. In this case it does take money to make money.

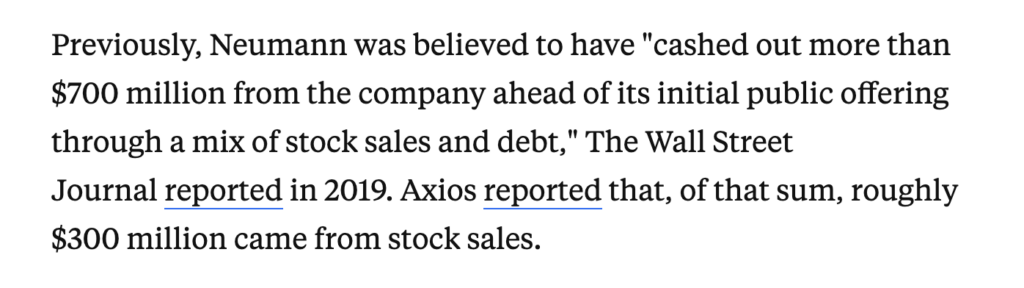

#4 Invest More Long-Term

A stock collateral loan allows you to increase liquidity without selling stock. For founders that could mean that it helps them avoid equity dilution and retain control as a way to monetize their shares without selling & losing control. If you’ve seen Wecrashed, you watched a stock loan deal go down live when Adam went into his bank and took out a large loan on his non-publicly held stock at his brokerage account. Business Insider and Axios reported that roughly $400 million came from stock loans and the rest from outright sales. That’s how he bought those 8 mega-mansions.

#5 The Trend Is Normalizing

I have a loan out on shares in one of my brokerage accounts. I’ve had them many times. For instance:

- I took out a loan at a 2.5% interest rate

- To invest in a debt deal that was paying 13%

- Deal pays for itself, I don’t have to use cash to buy it

Most of my friends with higher net worths do this as well. But it’s not just for HNW as Wealthfront, Wells Fargo and many other firms do it for smaller accounts.

DISCLAIMER: Don’t Be an Idiot

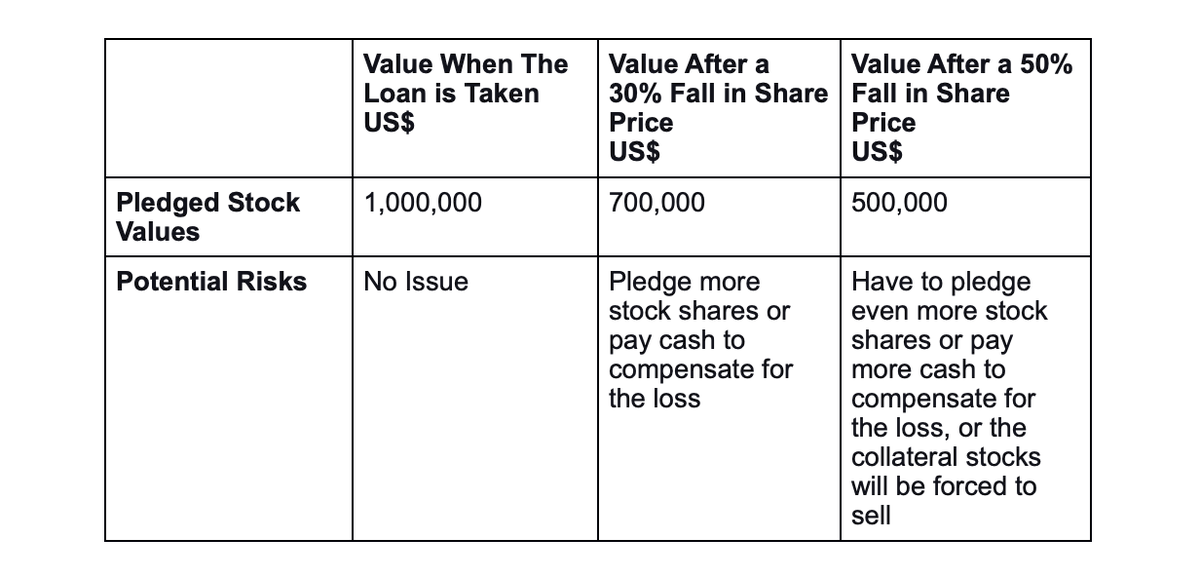

Downsides?

They’re big.

The worst-case scenario: Lose it all

The stock goes down, you need more stock or more cash to compensate, you don’t have enough money, and you lose everything.

Opportunity cost:

Or your stock could be locked up unable to sell until your loan is repaid and you miss out on a great deal.

This is why firms are thoughtful on who is allowed to do this.

Here are the questions I ask myself:

There are really 2 main questions to ask yourself about debt before you take it on:

- Will it pay for itself?

- What if it doesn’t?

#1 Will it pay for itself?

I only take on debt when whatever I’m using it for will pay me more than the debt service. Aka I don’t buy boats, or fast cars etc. I do deals.

- Ex: Buy a rental property with a stock loan, use the income to pay for the debt service

- Ex: Buy a business with a stock loan, and use the profit to pay for the debt service.

#2 What if it doesn’t?

What if I am totally wrong and I end up not being able to cover the debt service? What will I do? I never take risks (that I’m aware of) that can bankrupt me. How do I cut my losses?

- Ex: Sell the rental property.

- Ex: Sell the business.

Chaos theory reigns. If something can go wrong it probably will.

Debt is neither good or bad. It is simply a tool. A tool that the wealthy (largely) truly understand and wield intelligently. A tool that most of us do not use well.

Just remember the old Warren Buffettism:

- “Never risk what you have and need, for what you don’t have and don’t need.”

Question everything & stack cash,

Codie & Contrarian Team

The ‘Not So Boring’ Section:

- Terr(Think)ific – There is no better time than the present to grow a brand based on Y-O-U to educate your audience on your skills. We love using The Thinkific platform to do just that…matter of fact we have our Email List Building course housed there.

- ‘Fall’-Mart – As the world is spending more on food and gas, even the world’s biggest retailers are forced to make some cuts to clear inventory.

- Rip Off & Duplicate– In all my years of owning 26 biz’s, I’ve NEVER done a customer ‘poll’ for these reasons. Do you agree?

She Bought Her Own Real Estate Company and Makes Millions?!

As one of the top producing realtors in Las Vegas, my friend Lisa decided she didn’t just want to be a Realtor, but that she wanted to have ownership in the Real Estate industry. So that’s what she did…

This week’s YouTube is brought to you by our friends over at Fundrise, the future of real estate investing. (Note: we may earn a commission for this endorsement of Fundrise.)