(Oooo there’s a statement) Plus the investor matrix that creates millionaires…

In <10 Minutes, We’re Going To Dive Into:

- Why Rich Dad Poor Dad got it wrong…sorry Robert

- What’s more important to billionaires than tax status

- The Investor Matrix: what it is and how it works

- How you can move to Master Allocator – AND WTF that is.

Hello Contrarians,

Robert Kiyosaki sold 32 million books called Rich Dad Poor Dad.

He’s worth more than $100 Million dollars from that book.

And today, I’m going to be aggressive and say: he got it wrong.

Yikes. Let me explain so that you and I can get it right and truly become financially free. Someone asked me the other day, “How do I know if I am progressing towards financial freedom?”

- “Is it a number? Like a $20 million FU fund target?”

- I said no.

- “Is it an employment type? Like business owner vs employee. W2 vs K1.”

- No again.

- “Is it cashflow? As in how much you have of it?”

- Also no.

It’s not a number, it’s not the type of worker you are, it is something different. I’m calling it the Investor Matrix.

You see there are 4 types of people in the world, we are all one of them. To truly achieve financial freedom and mastery of money you have to first know where you sit. ****I’m gonna explain it to you. After all, it took me the better part of a decade in investing and finance to learn this, I hope you beat me to it. Ok, here it goes…

WHEN I REALIZED RICH DAD POOR DAD HAD IT WRONG

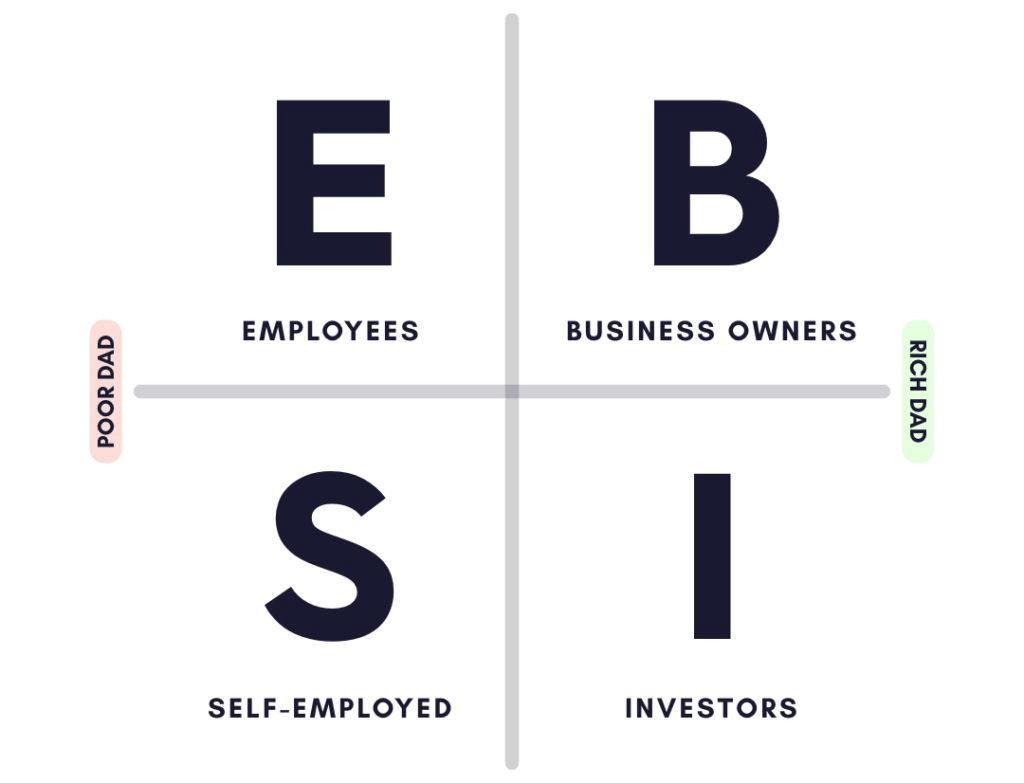

I was sitting reading Rich Dad Poor Dad when I realized something, all he was talking about was your tax status… self-employed, vs biz owners, vs investors, vs employees.

This is what Robert Kiyosaki preaches… it is called the Cashflow Matrix. In one sentence summary, he tells you that you need to move from employees to investors.

Ok, that sounds good in theory. But something niggled at me. So I thought what is he missing? Well, really he’s just telling you how the IRS labels you. Your taxation status. That is, maybe, step one in financial freedom but it is far from the closing of the chapter. That is when I realized, the IRS categorization matters so much less than the type of investor you are. It does not matter how you label yourself as a worker, it matters if you have that unique ability to take your money and send it into the world to collect friends and bring them back to you. That is all.

So now we have 32 million people plus out there trying to change their tax status and obsessing about whether they get a K1, vs 1099, vs W2, when in actuality they’re on the wrong path entirely.

IN FACT, IT IS A TOTAL AND COMPLETE FING FALLACY THAT YOU CAN’T BE A WORKER AND BE A BILLIONAIRE, OR MASSIVELY FINANCIALLY FREE.

Just ask Sheryl Sandberg (W2).

Just ask the 54 of the 400 Forbes Billionaires who are employees, not owners.

Just look at all the billionaires who bought out the companies they worked for or got equity.

Just ask all the W2s of large corporations who pay themselves $1 salaries and thus avoid taxation.

Your W2 status has NOTHING TO DO WITH BEING FINANCIALLY FREE.

Sorry Robert I think you are wrong. So now we go from Poor Dad, to Rich Dad, to Wealthy AF Mama over here.

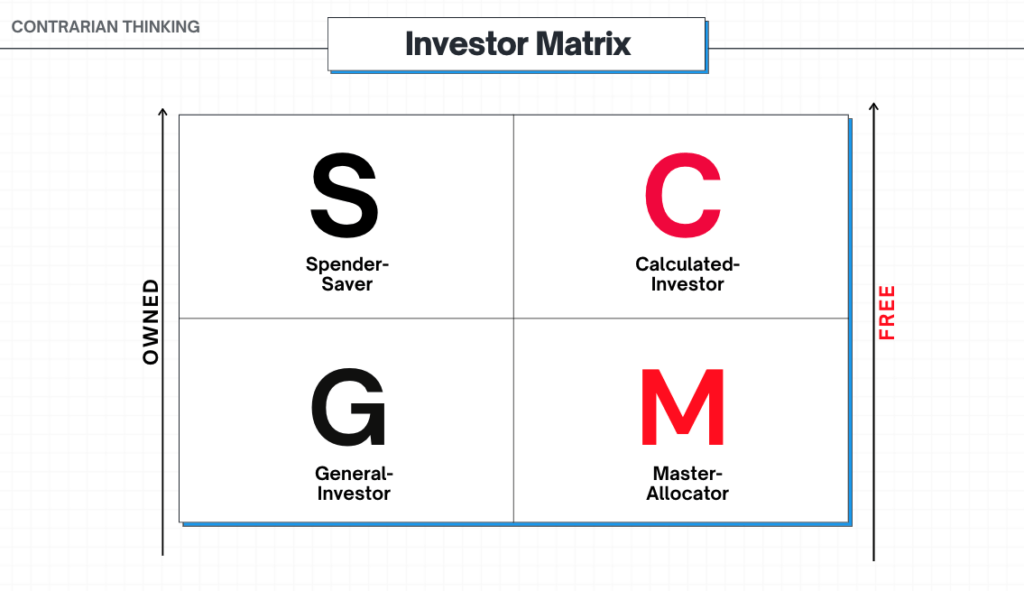

Thus here’s my first iteration of the Contrarian Investor Matrix. It is something I am going to grow and build on with each of you.

It is something I never named previously but I used to amass my wealth. In the 124 conversations, I’ve had with 8-9 figure net worth humans what they told me is, they don’t care about their tax status, they care about their investor status.

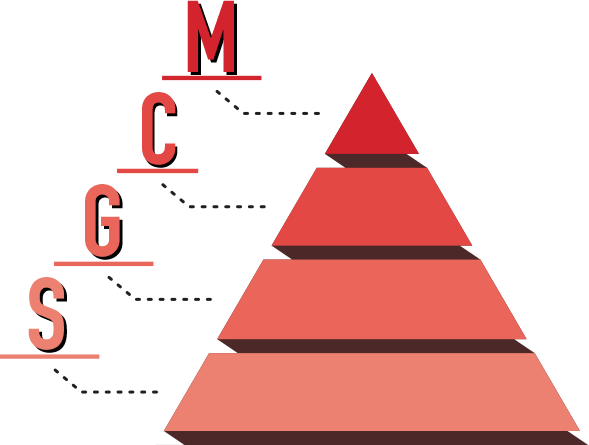

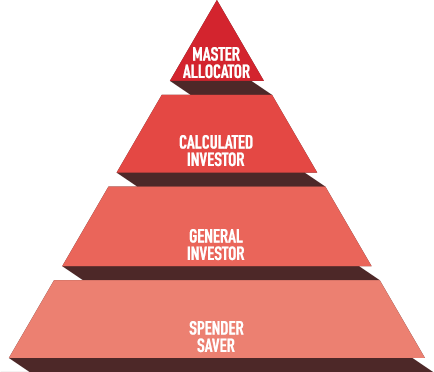

So if you want to climb the pyramid to financial freedom, I think this may help you.

Here is the Contrarian-Investor Matrix:

Investor Matrix is divided into four types of people, inside of each category is a sliding scale but let’s simplify it to:

- Spender-Saver

- General-Investor

- Calculated-Investor

- Master-Allocator

To The Left

On the left side of the matrix are S’s and G’s.

They know the least about investing, pay the most in taxes, and have the least financial freedom.

Each is a bit different.

S is for Spender Saver

A spender brings in money and thinks he’s using it, but it’s really using him. He buys liabilities like cars, houses, vacations, and things to fill the houses, cars, and vacations with.

Savings: Whatever money is left after earning goes into savings accounts, which he doesn’t realize don’t keep up with inflation, or into purchasing the next thing. He feels like a hamster on the wheel.

Vanity: Somehow looking rich has become more important than being rich. Feeling financially secure has become more important than becoming a master of money.

Non-fluency: S’s work hard but because they don’t truly speak the language of money and investing they get owned by it. They haven’t yet learned how to have money work for them so they chase bigger jobs, more savings to feel safe, and things that make them feel good at the moment.

This was me for many years, working in Investment banking, living the life, and at the end of the day not having much to show for it. It’s ok, everyone starts here.

G is for General Investor

Desire: People in this quadrant have started realizing they need to invest because they desperately want freedom. They want to escape having to do a job or take on a client and instead move to want to do either of those things.

Reliance: People in this group invest in things like the stock market with their financial advisors. They pay 1% for her to figure it all out and leave their money in the hands of another. They have portfolios in the market that they don’t check except maybe annually, or panic when it goes up and down. If you were to ask them what they were invested in across the board they wouldn’t know or if they did know they wouldn’t know why.

FOMO: Because they feel this deep need to be free they can be talked into get rich quick schemes like day trading, crypto trading strategies, throwing money into crowdfunding, or Angelist. This is where most people sit all of their life.

The right side of the Contrarian-Investor Matrix

On the right side or on the tippy-toppy are C’s and M’s. They pay the least in taxes and create or invest in assets that produce cash flow for them even when they’re sleeping.

They know the most about investing, pay the least in taxes, have cash-flowing assets and know-how to get other people’s money to work for them.

Each is a bit different.

C stands for Calculated Investor

Unlike those in the G Matrix, these investors allocate money, and they do it strategically.

Education: They have educated themselves on how investing, finance, money, taxes, and varying asset classes work. They understand the language of money, the terminology, why each investment makes sense, how to use it, and the risk-reward tradeoffs. They can smell b*llshit and never blindly trust another with their finances.

Awareness: P’s know themselves and their financial picture. They know how much they are worth for their all in net-worth number. They know where all their money is at all times.

Strategy: They have a strategy for their money. They know where they want to go, they know what they want the money to do and they have a roadmap for how they are going to get there.

System: P’s have a system to ensure they reach their destination with tools, teams, software, and tracking to ensure that their strategy is actually put into action. This might mean working with the right tax, financial advisory, and real estate professionals on a continual basis.

Their money is starting to do more of the work than they do.

M stands for Master Allocators

Allocators have the most knowledge and financial education of all the matrix investors, they also have the highest net worth. These are the truly rich.

Expertise: While C’s have education, M’s have expertise. They are the theoretical PhDs in investing due to their understanding of investments, taxation, structures, and dealmaking. They have a niche or multiple and are often the person you go to when thinking about investing in that space.

Access: Due to their expertise they get unfair access to deals, opportunities, research, and insights. This access means they get returns no public markets, mutual funds, or ETF investors would get access to.

Trust: All of this leads to trust. When you’re an expert, you put your money where your mouth is and you share that with others and you get their trust. M’s are trusted so much, people give them money.

Leverage: M’s become allocators or syndicators. Because people trust them, their expertise, and access they give their money to allocators to invest for them. This creates leverage, as the M’s then make money when their own investments do well but even more than usual as they have bigger dollars and things like carrying, management fees, and expense ratios on top of them.

Now their money does 99% of the work, anything they do for the love of it. Their money and their investor’s money are the employees.

As we see the world around us continue to punish those who aren’t financially free, it’s time to raise awareness of what it means to actually find financial freedom.

How do you overcome:

- inflation at all-time highs

- wage stagnation

- the great resignation

- increased taxation

You become a Master Allocator.

My guess is by reading this you can tell right where you are and in what matrix you sit in. The beautiful thing about this life is we rarely end up where we started, the key is just finding the right staircase to climb without getting lost.

Now you know the right path, you can forget about whether you are W2 or not (doesn’t matter) and we can focus on the real beacon… the knowledge inside your head, that you turn into your bank account.

We’ll take you along with us.

Question everything,

Codie