We are amidst a wealth transfer that will have vibrations for decades.

The Big Get Bigger, The Small Die

As told to me by the gentlemen who created the most recent SBA loan program, here’s what happens usually in small business land:

- There are 30mm small and mid sized businesses in the US

- 600,000 close down each year

- 1mm new ones pop up each year as well

Before Covid-19, we had 10,000 baby boomers retiring a day… oh and by the way 19% of them own a small business that will either get wound down or bought.

In addition this year we have a confluence of events that only accelerated this phenomenon. We have record baby boomers retiring AND a global pandemic AND a government enforced shutdown AND social unrest. 2020 is a real Karen.

Meanwhile, the little guys are tired and beat up.

But this isn’t supposed to be a depressing news article highlighting injustice.

Here, we do things about opportunities—both dark and light.

How To Invest In A Laundry Business: WARNING it’s SUPER SEXY.

How sexy you ask?

LAUNDROMATS:

Ya baby… coin operated laundromats, that’s what we’re talking about.

Here’s a breakdown of a deal my gent will run that we may buy. Just another funky business idea for non-correlated cash flow.

My deal: Buying a Laundromat

– $67k profit a year

– Buy w/ $0 of his own cash

– Use $100k in seller financing (using future sales to pay off owner)

– Finance Rest w/ Equipment loans

(Do you already own a laundromat or are you looking to acquire one? Take your business to millions in revenue! Click here to learn more)

First Why Laundromats?

- Simple – customers do the majority of the work washing and drying their clothes

- Little labor – means training, on-boarding, and labor is relatively minimal

- Upfront cash – customers pay upfront, makes accounting and tracking easier

- Recession resistant -people always need clean clothes

- Good ROI – laundry industry has a 20-35% ROI and nearly a 95% success rate, according to Speed Queen (eek, not sure on 95% but maybe directionally).

- Inventory. – Unlike a restaurant, convenience store, or grocery store, laundromats have very little physical inventory.

- No Seasonality – Not seasonal or weather-dependent.

Cons?

- You (or in my case my gent and our operator) have to run a laundromat. 😉

- $200k price tag – BUT I’m going to use seller financing and a small upfront like $20k. Learn more about how to structure deals w/o capital like this —> UA.

- Low barrier to entry – lots of laundromats out there.

- Get Your Hands Dirty. You’re a plumber, electrician, businessman, marketer, janitor, and a million other things all rolled into one. Or you do what I do and give an equity split to an operator to run it for you and you front the cash.

- Set Costs keep on rising – utilities and rent don’t go away.

- Customers – This is a unique client set, I have someone else do the coin collection, security, oversight, etc. Because well… crackheads.

Here’s a high level of how the balance sheet looks.

It’s about the same over the 5 year period I requested, variable from $50-70k.

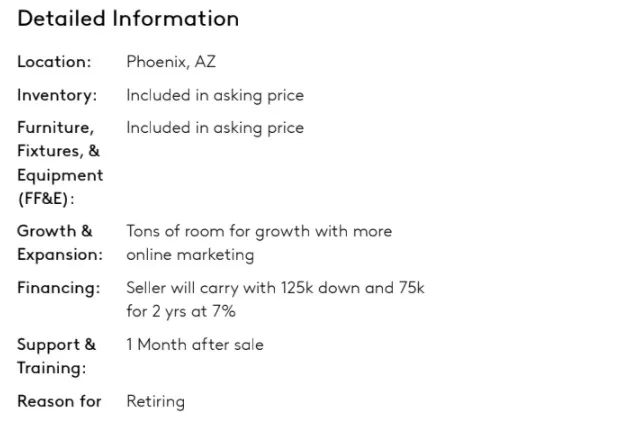

They wanted $200k and would finance through seller financing $125k.

I said, that’s cute. I also want Bloomberg’s balance sheet but sadly he won’t give it to me.

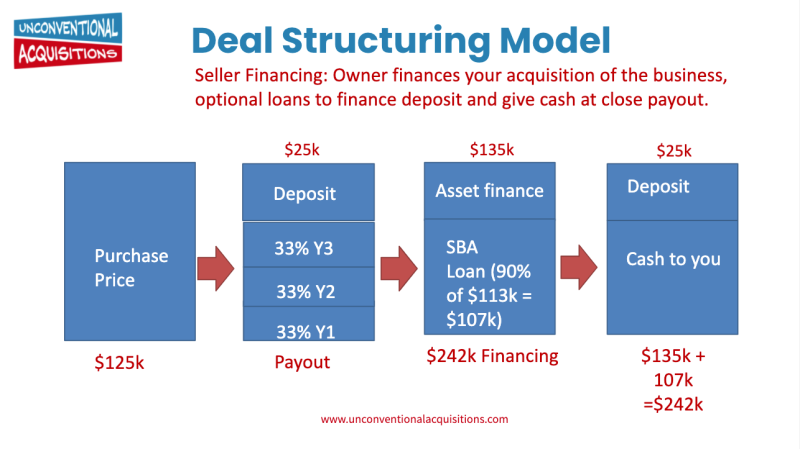

So, given there are 2.5M businesses for sale and he wants a deal, I would negotiate down to only $67k or so for a buying price but let’s say I couldn’t get that deal done and went with his. This is how that would work:

I would negotiate down the price (bc you know world is burning), I’d give him a small down payment, and structure a deal to do the rest of the payment over three years. Lots of ways to get seller to do this that we talk about at Unconventional Acquisitions, I like structuring them so the seller wins too on the upside. If you want to buy a business you should join our Contrarian Community. Click that link.

Let me show you why this is so intriguing… even at his price:

For this deal, I would make about $5,583 a month as the buyer. We got a good multiple of 1.86x. Then, I am at breakeven in 3 months for my initial cash down and my Cash on Cash Return is 268%.

Read that again. WE’D MAKE IN YEAR 1: 268%.

Then again because I like to get paid on the closing AND capitalize the business so I can hire an operator to do all the things I don’t want to do.

I get an equipment loan potentially for the $135k worth of laundry equipment and an SBA loan (they’ll do 90% of the revenue typically).

Which gives me $242k AT CLOSING on a laundromat in my bank account.

Then I start the process to go, find another one, and use those proceeds as the cash down.

DISCLAIMER: Devil Is In the Details

There are 10 steps to buying a small business w/ seller financing or creative structuring. This is just one of them. You have to find the deals (origination), analyze them (due diligence) and on, but my job here is to OPEN YOUR MIND. Open it to the things us on Wall Street make billions on that YOU on Main Street, never do.

If you want to see how Private Equity heads become billionaires, don’t look to Wall Street, look to Main Street. They buy boring businesses, they turn them around and optimize them, then they cash flow off them.

This is a triple-sided win. The business owner gets to retire, you get to cash flow, and employees get jobs as we optimize and grow.

This is the difference between TRADING stocks where someone has to lose for someone else to win. While building businesses, all can win.

Is it EASY? No. Is it SIMPLE? Yes. There is a recipe. Let’s get cooking.

Questions everything (and stack revenue streams),

Codie