The information contained here may not be typical and does not guarantee returns. Background, education, effort, and application will affect your experience. Your results will likely vary.

Hey Biz-Buyers,

Data about the small business acquisitions community is spotty at best.

So we recently surveyed hundreds of people in our business-buying group…

We asked our members about:

- Family status

- Net worth and income

- Employment status

- Motivations for business ownership

- Target income from an acquired business

- Time & resources spent on acquisition efforts

- … and more

Then, we wrote about all of it in our 2024 Small Biz Buyer Insights report for the SMB community.

But be sure to download the report for free right here:

It’s loaded with unique and valuable insights — survey data, expert perspectives, and market research from our community, Live Oak Bank, and others. Below, we’ll preview some of the findings.

Today, in 5 minutes or less:

3 unique findings from our research…

There are about 33,185,550 small businesses in America.

Thousands are transacted every year (often by the big guys).

But buying and owning a small business isn’t what it was like 30, 20, or even 5 years ago.

There’s a rising crop of next-gen biz buyers out there. Folks like those in our community. People of all ages and walks of life, each with their own entirely unique background.

We wanted to know more about them, their biz-buying efforts, goals, needs, and more.

So we asked them a whole bunch of questions. Here’s some of what we learned…

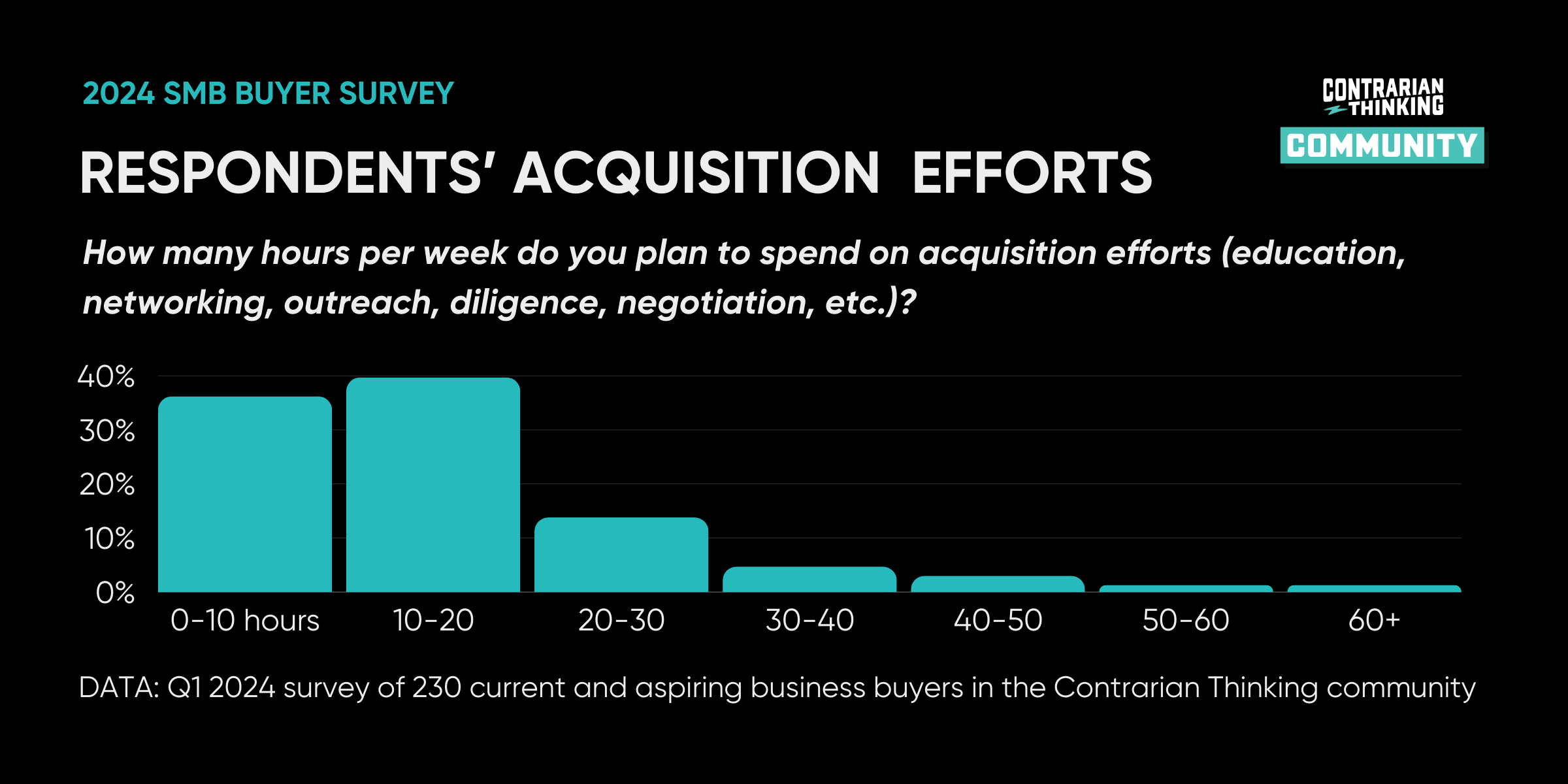

1. The majority are working up to 20 hours per week on biz-buying

Across net worth and income levels, many respondents plan on spending up to 20 hours per week on their small business acquisition efforts. (20 hours per week equates to 2.86 hours per day.)

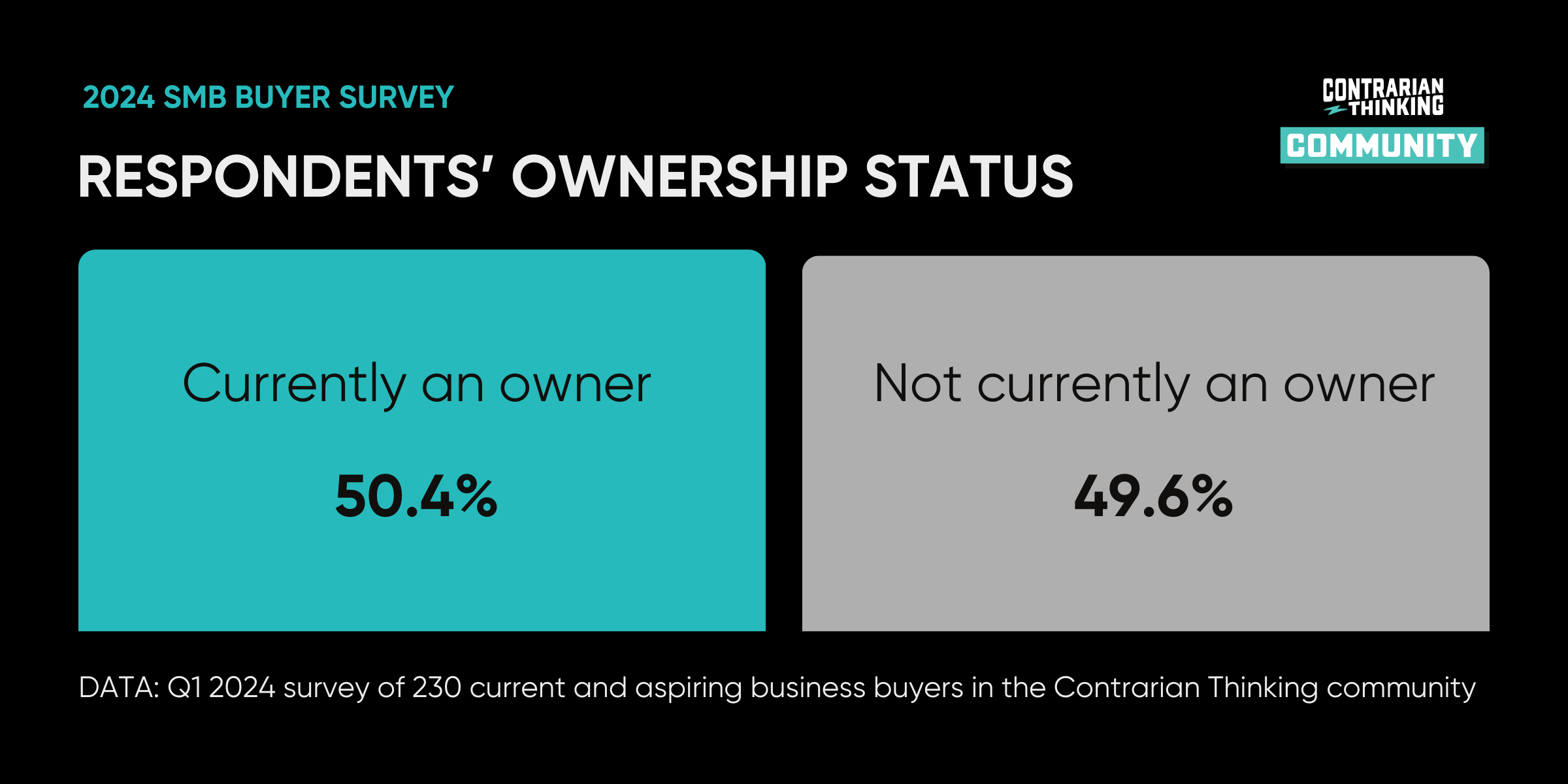

2. Today’s buyers are a mix of current and aspiring owners

Some Contrarian Community members are already business owners looking to learn and grow. Many others are learning how to hunt for their first business.

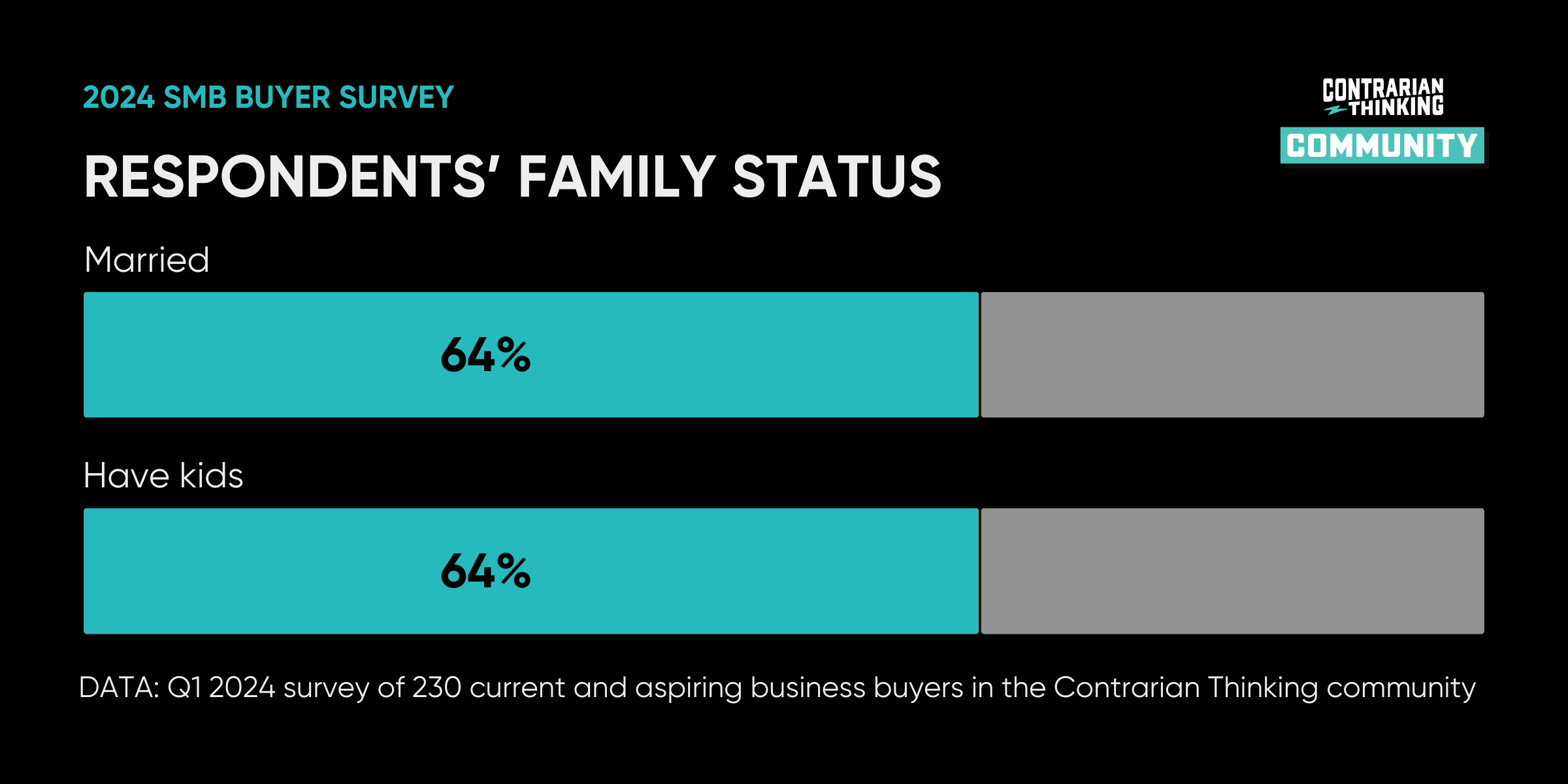

3. Having a family is the norm

The majority of our members (who responded) are married and have kids.

You can read about all this and a WHOLE lot more right here:

The report includes valuable insights from Contrarian Thinking’s biz-buying community, Live Oak Bank, and others.

Everything from community survey data to big-picture sentiment on the SMB economy.

Member Spotlight: Perspectives from a Contrarian

Who are you and what do you do?

I’m Sage Price, an engineer, investor, and serial DIYer from Oahu, Hawaii. I help professionals transitioning from the tech industry and into entrepreneurship establish meaningful relationships that lead to mutual growth, support, and business success. (You can learn more about Sage here).

How would you describe the current state of small biz buying in 2024?

Buying a business isn’t easy, it takes hard work, time, and dedication. As more listings appear “on-market”, the competitive landscape for off-market deals is becoming a challenge. Lending is getting tight and interest rates remain high so seller financing is becoming more common but sellers still resist the idea. More owners are catching on to selling their businesses and valuations versus expectations may have a larger gap. It all boils down to a longer and more careful approach to building relationships with the seller, broker, and community members to source, negotiate, and close deals. I made more headway in 2 days at a trade show, face-to-face with owners, than I have in several months of searching.

What’s your motivation for pursuing small business ownership? How has your biz-buying journey been so far?

My motivations are surrounded by a long list of who I want to help and the impact I want my legacy to have. I want to increase my wealth only to increase my reach and ability to pursue my passion projects and to take care of my parents in retirement. They worked hard and lived poor all their lives and I want to help them live comfortably, enjoy their grandchildren, and have time for their passions. Even with nothing they have always given what they have selflessly — I do my best to honor that lesson in how I interact in the community and pursue my dream of financial independence.

It has been a challenge learning the RIGHT methods in my area (Hawaii) because it is a small market. Most “on-market” deals have been less than ideal and have taken up a lot of time trying to make them work. Off-market searching has mixed results, but is ultimately a game of both numbers and relationships — people here don’t want to sell to a stranger or give their business up to a large company. With our economic bubble, we understand the importance of locally owned businesses that care about our impact on the islands, the community, and future generations. Getting to the owners in smaller groups, making mutual introductions, and talking face-to-face have moved my progress forward much faster than cold calling a long list of potential businesses.

What would you say to someone weighing whether to pursue small business ownership?

Don’t quit your day job (yet). Going “all in” sounds heroic, and it is a great step in the process, but only once you are ready. It can take months, or more than a year to find the right business, and if you are pressured by the need for an income you may make an emotional decision that jeopardizes your ability to continue acquiring other businesses. You may end up buying a business that holds too much risk — you’ll need to take time to dial in your search.

Take time to learn and build a foundation around what it means to buy a truly good business. Find a business where your superpowers will make your leadership unfair to your competition. Buying the RIGHT business is more important than buying any business — understand that the time horizon for this commitment is going to be longer than a fix-n-flip. We expect 3-5 years of financials to be a stable business, you should plan to hold it for 5-10 years and cashflow that entire time.

Educate: Learn the basics and then advanced topics. Emulate: Watch how others have successfully done what you are trying to do — offer them value and learn their methods in exchange, to set yourself on a similar path. Iterate: Keep doing what works, modify your methods to incorporate your skills and expertise, and continue to press on until you reach or surpass your goals while continuously monitoring your progress and making small changes.

3 GREAT links from the week:

😂 No doubt about it: the SMB Meme of the Week award goes to this post right here

🎧 Love to hear it: Contrarian Community Facilitator Clint Fiore is launching a podcast!

🧠 Important to know it: “The wealth you can build by buying a small business is compensation for the mental toll…” (Read the full thread)

Who’s looking to buy a biz?

A partial list of real people who began their Contrarian Community journey recently…

🏠 The owner of a multimillion-dollar roofing biz

🚚 A couple who own a rental property, RV park, and dumpster franchise

🎥 A real estate investor and commercial producer at a production company

👷 A design manager on a large transportation design-build project

🔨 A project manager for a commercial demolition company