Hey Contrarians,

I haven’t written an investor letter since 2019 when I left my private equity fund and decided to invest with largely my own capital.

Back then, I remember 30 versions of compliance edits, innumerable “pls fixes” from my fellow partners, and at the end of weeks and weeks, delivery of a Frankenstein mimicry of the words I wanted to say.

I suppose this will be the first time I ever get to say them in full. I’m nervous and humbled by that freedom.

Inside today’s issue…

Have some perspective

Investor letters always felt like pain to me. Long, tedious, and often unread by anyone. It also felt rather egotistical — “Let me write you a mini novel to tell you all I’ve accomplished this year.” (Sort of like those Christmas cards that include a short story on all the accomplishments of Sally and Susie’s two children. I’m a loving pass.) For that reason, I’ve been largely private with what we own, what we buy, and who we are.

Despite having millions of internet followers, it felt like our companies didn’t sign up for that attention so why drown them in it? Notoriety is tough. We humans barely remember compliments but note every criticism. So at scale, fame feels like rapidly forgotten periods of congratulations buried under more and more criticisms. What CEO of a laundromat wants that?

Yet, following the death of Charlie Munger, I went back and re-read the Berkshire Hathaway shareholder letters. It was beautiful to see the evolution of thinking among two of the greatest investors of our time. In some ways, Munger and Buffett were the original finance content creators. The shareholder letter was their newsletter, the annual meeting their extended YouTube documentary, the sporadic interviews their version of short-form videos.

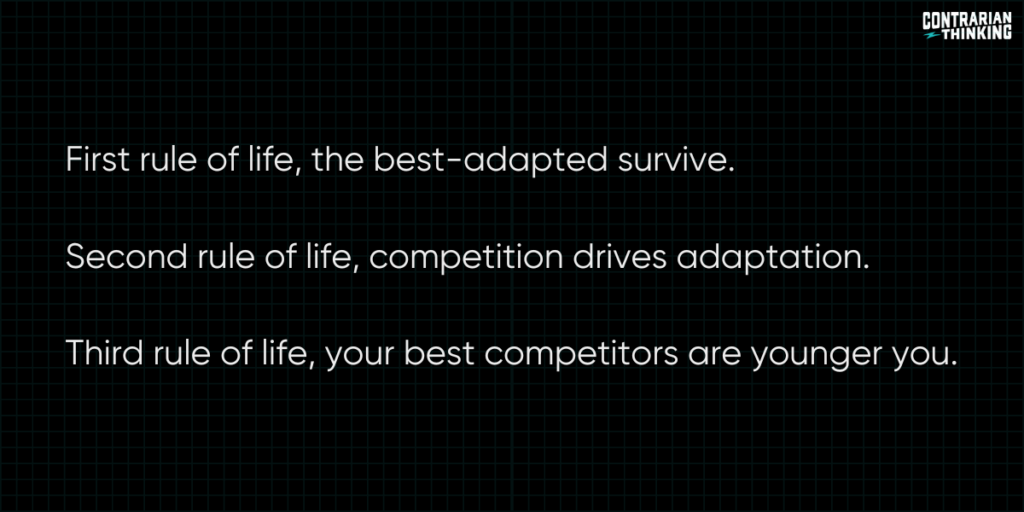

Human survival has many enemies, but perhaps the largest is ourselves. They say that on the planet right now there are an estimated 8.7 million species. And yet, that number is dwarfed many times over by all the species that no longer exist (some 5 billion). Evolution can be beautiful or it can be extinction. If our greatest enemy to progress is in the mirror, we should do all we can to know it.

This letter is a review of what we did right and wrong this year, what we believe is to come, where we hope to go, and why it all matters on a tiny planet spinning in a giant universe.

A brief summary of our year

Contrarian Thinking Media and Capital have only come into existence in the last 3 years, and Main Street Holding Company (my holding company) has existed for 10. We’re still a blink inside a blink. How do I feel about where we are? Optimistically discontent.

I am optimistically discontent with where we are today. We’ve moved fast, we’ve broken things, we’ve won, we’ve lost, and yet I think we’ve really just begun. So I find myself discontent with where we are, yet eagerly looking forward to what we’ll do next.

In our Main Street Holding Company, we’ve invested $12.1 million (not including debt) into 5 acquisitions and an incubation. Across our holding company, there are now some 24 businesses, some owned outright, some just a portion. Through Contrarian Thinking Capital (our VC fund), we now have 17 startups in our portfolio of early-stage investments.

We’ve decided to swing for the fences. We recently got a new office in Austin, Texas, and made 14 full-time hires in 2023. We held our first full-day educational event on small business acquisitions, with 13,000 attending virtually. Throughout the year, we saw around 150,000 registrants for our free acquisition masterclasses. We held our multi-day Main Street Over Wall Street event, where 150 people from our now business-buying Contrarian Community came together in Austin, and we’ve hosted and facilitated other events across the country for the next generation of owners.

I’ve stopped aspiring to build a $10 billion holding company. While we hope our holding company goes beyond the $100 million mark, I thought it’d be more interesting to see how many people I could help build multimillion-dollar businesses of their own. A nation of many owners is a better one for us and our children.

So perhaps what I’m most proud of is this: In 2023, our Contrarian Community grew from a couple hundred to over 1,000 members actively learning and working to buy a business on Main Street, all over the globe.

Oh, and our tiny little media company that someone once called “cute.” Well, it’s not so cute anymore. Our YouTube channel now counts over 4 million hours watched, and across platforms, we have more than 5.5 million followers and subscribers. What I’m most proud of here is that we did not raise millions to achieve this. We are the example we teach of bootstrapping with our own capital in a world that wants to get rich fast.

I do not take this attention and trust lightly. I believe we are at a precipice in society between those who own, with skin in the game, and those who live forever renting under the yoke of others. We stand strong behind the idea that ownership is incredibly hard to achieve and yet worth it.

Why do we do what we do?

“Main Street over Wall Street” has been our cry for years, not to diminish those on Wall Street but to remind them that they serve the people, just as those in Washington are purported to do the same. Our mission has always been to bring more humans into the fold of ownership and financial freedom. I am optimistically discontent that we are on our way to doing that.

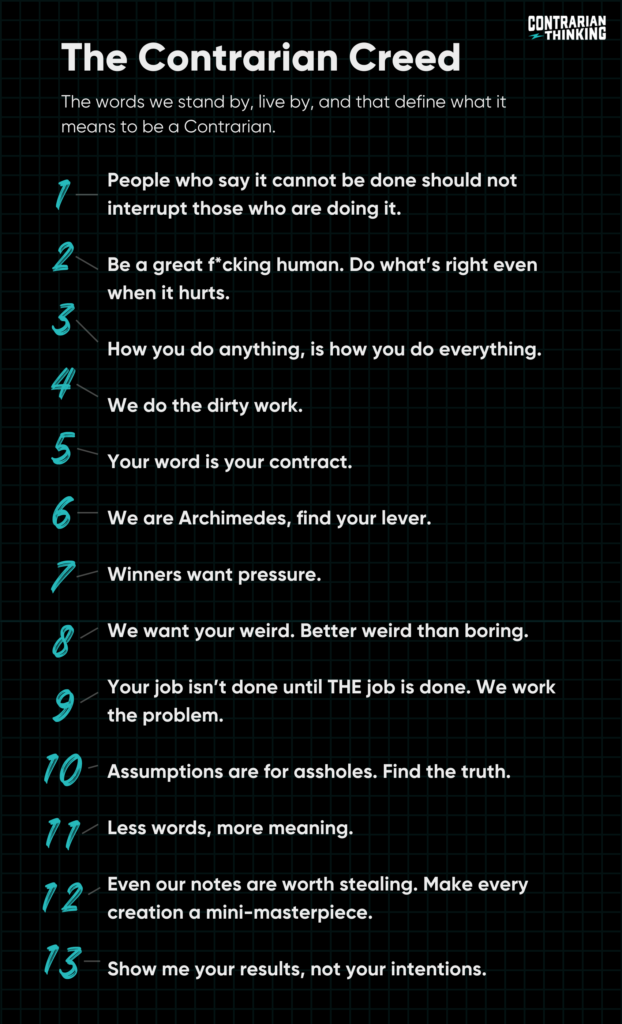

We have a creed at all of our companies, The Contrarian Creed. Every Monday I give a short update to the team highlighting one of the 13 beliefs. For this investor letter, I’d like to focus on the first: “People who say it cannot be done should not interrupt those who are doing it.”

What are we investing in through Main Street Hold Co?

I’ve been buying and selling business for over a decade. I did it on the side. I did it with partners. I did it in funds. I did it poorly and, a few times, I did well. Our portfolio exists as it does today because I was too scared to leave Wall Street entirely and acquire without a paycheck. Because of that, many of the companies we have are still small.

They’re what I call my “businesses as bonds,” or “gateway drug businesses.” Small beautiful little companies that likely won’t grow into giants. These are the one-off laundromats, carwashes, and service businesses that are critical to communities but a monster to scale up. (If you’ve never tried to scale a laundromat to millions a year in revenue, you won’t understand. But if you have, you’ll know why the space is a business graveyard for many of those who raised millions trying to brute force laundromat fragmentation into wash-and-fold consolidation. You don’t know their names for a reason.)

I tend to believe these tiny businesses are there as gateway drugs to business. They’re not necessarily meant to be someone’s last acquisition but they sure are an interesting first, just as your first job often isn’t your last. You learn by starting small and scaling up with your skills.

Coming into 2024, we sold many of these businesses as we realized something: Our unfair advantage is no longer just staying small (businesses sub-$20 million in revenue), using our media attention to attract deals, and our ability to use creative financing to acquire them without paying millions out of pocket. In the PE world, it has long been a measure of vanity to talk about how much money you invest annually. My not-so-secret secret is that I would like that number low. I like my investors to be few and my margins to be high. I’d much prefer to use the profits of the business to buy it than my bank account. Terms, they are the only thing that truly matters in deals. Now, our unfair advantage may also be accelerating fewer bigger businesses with our media arm.

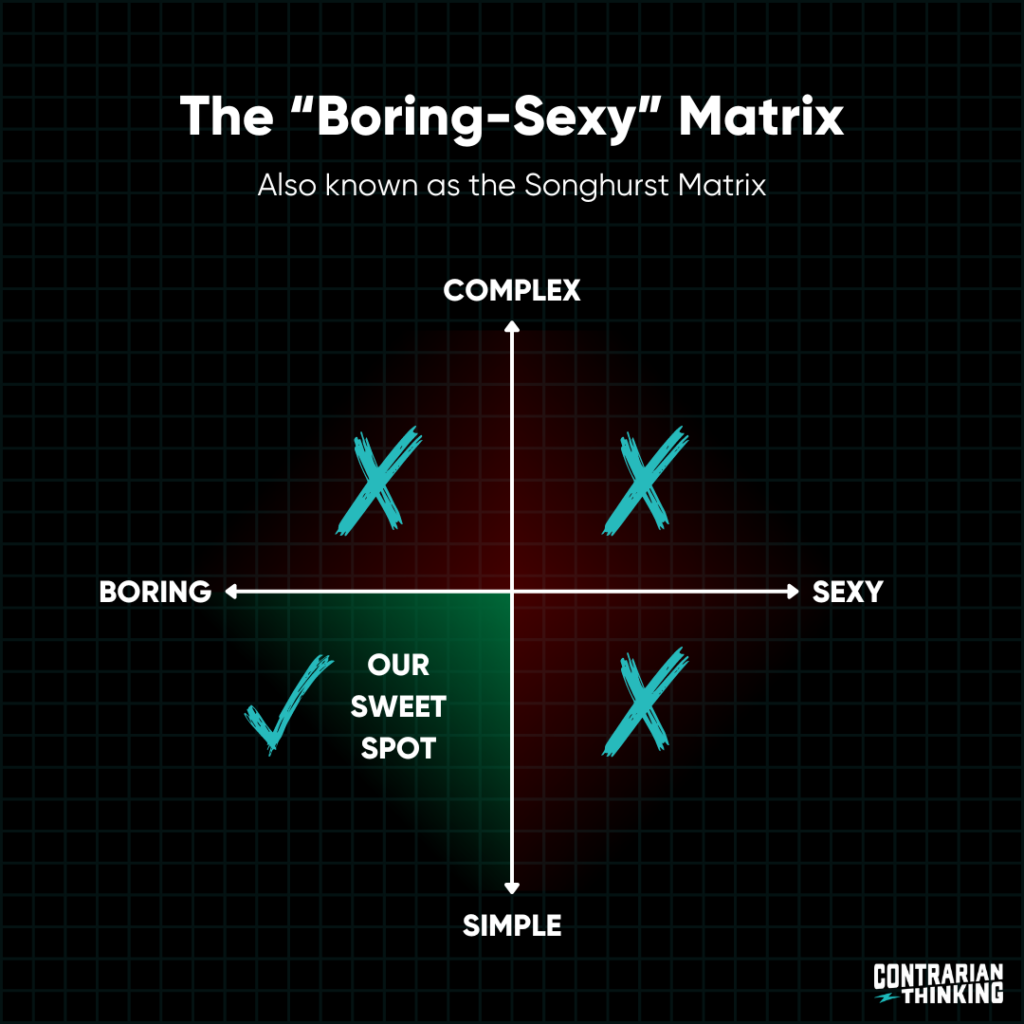

In some ways, it pains me to say this, but I think there may be just as much to learn from The Rock, Kardashians, Ryan Reynolds, and Taylor Swift as from Buffett and Munger (add this to the list of reasons why I’m not invited into normal investing circles). During the time of Buffett and Munger, they knew that understanding the makings of a good deal, being patient enough to “get rich slowly,” and having access to capital were the most important paths to wealth. Now there is an additional paradigm: attention and intention. In a world of abundance, the only scarcity is time, and attention is how you value it. Thus, increasingly at our scale, we are buying more of the first of the business profiles below. Perhaps you’ll see why.

Profile #1: Media Accelerated Businesses

We are looking for companies we can accelerate by leveraging our media entities or businesses we can help operationalize using our systems and processes. These businesses are:

- Longer-term: 3-5+ years of operating history at a minimum.

- Profitable: A minimum of $500,000/year in annual profit, as high as $10 million.

- Operator-focused: A high-quality team or operator is already in place. This is negotiable if the business is in our wheelhouse and we have an operator to insert.

- Owner-flexible: We are open to owners sticking around, leaving, or transitioning out over time.

- Diverse: They can be simple internet, SaaS, and service businesses that have high margins, don’t require high CapEx or overly complex technology, and can leverage our audience and formats to grow. (For example, an accounting service, a dominant brand, a large and loyal community, a niche vertical, a media business, or a productized service business.)

Profile #2: Boring Businesses

We will never stop believing that brick-and-mortar businesses, community businesses, and small businesses are the lifeblood of a country — it’s why we buy them. Another reason? The Lindy Effect. Many of them, or at least their business models, offer proven histories of durable cash flow and will likely be around for a good while longer.

- Longer-term: 3-5+ years of operating history at a minimum.

- Profitable: A minimum of $500,000/year in annual profit, as high as $10 million.

- Operator-focused: A high-quality team or operator is already in place. This is negotiable if the business is in our wheelhouse and we have an operator to insert.

- Diverse: Our deal box here centers around consumer or home services, professional services, real estate-enhanced businesses, and product companies. These can be anything along the lines of roofing, landscaping, pool cleaning, home cleaning, accounting, advertising, marketing, legal services, laundromat, carwash, self-storage, mobile home parks, camping sites, etc…

What types of businesses does Main Street Holding Company currently own?

By and large, I believe a business is a business — if you love the game you can have just as much fun running a local car wash roll-up as you can a popular dating app, we just prefer the former. Whatever the case, there’s nothing more beautiful than seeing the businesses you run have real-world impacts.

Here’s what we’ve found: With the right business model, the right market dynamics, and the right operators in place, we believe we can be successful across multiple industries, but far from all. Today, there are a variety of majority and minority-owned businesses under the Main Street Holding Company umbrella, including:

- Agencies: ViralCuts (video agency), Strike Fire Productions (podcast production)

- Brick and Mortar: Sweaty Capital (carwashes), Seacoast Garage Pros (garage install), The Well (restaurant)

- SaaS tools: Bizscout (business search)

- Services: Approachment (lead gen chat services), Endstate (consulting)

- Finance: Contrarian Thinking Capital, BCI Integration

- Products: Garden Society, DEHY, Phat Fudge

- Communities: Unconventional Acquisitions (biz buying community)

- Media: Contrarian Thinking, RSCS (education)

As you may have guessed, we do have an allergy to things like biotechnology, non-SMB-focused AI, Web3, and other areas where we lack real domain expertise (or that stinks of too much Silicon Valley sex).

What can we do when things aren’t in our deal box?

It’s in this regard where our structure is truly unique, if I don’t mind tooting our own horn. When a business comes along that doesn’t fit our deal box, we don’t have to give the singular “No.”

My philosophy is that there are far fewer bad businesses for sale than most people think, simply bad structures, terms, prices, or partners. So when it makes sense, it can be worthwhile passing on deal flow to another set of potential buyers.

Through our Contrarian Community, full of people laser-focused on learning and working to acquire businesses, we are arguably one of the largest (in terms of buyer count), most geographically diverse groups in the country focused on small business acquisitions. To date, we have not leveraged this position nearly as effectively as I would like. But again, there is that “optimistic discontentment” that this is just out of reach. I hope we change that in 2024.

Stay tuned.

Partners, processes, and, when needed, turnarounds

The thing that few of those running a portfolio of businesses openly talk about is that at any given time, something is almost guaranteed to go wrong.

This year we had our mettle tested on three key fronts:

Partners

On the partner front, we grew so fast that a good decision one day quickly became a bad decision a few months later. One of my key realizations has been that not everyone should actually “get on the f*ng rocketship” when offered a seat. Not everyone wants to go to space. It’s rather lovely by the beach playing in the sunshine and wrapping up work without a worry at 5 pm. I did a poor job this year of letting a few people in who never should have had a seat. This is a hard sentence to write.

I didn’t spend enough time putting a few of our partners through the harsh realities of the speed at which we sprint at Contrarian Thinking. Because of that, some simply weren’t cutting it and made poor decisions trying to cover that fact up. Even people bite when cornered.

Now we have a process I call “It’s worse than you think,” which is how we run new partners and employees through our system. Describe all the misery and set incredibly high standards up front, and surprise them when it’s a lot more fun than that sounds.

Processes and turnarounds

When it comes to processes, we were short of them. We have long operated as a glorified family office. Few rules. Fewer systems and processes, and a lot left at the altar of “someday.”

This year was a year of clean-ups. Thankfully, my husband and our Head of Portfolio, came on board with his militaristic attention to detail, high pain threshold, and ability to lead. He was tested on just about all fronts but has done a spectacular job cleaning up our (read: my) messes and creating order out of chaos. Founders are a characteristically messy group and I admit to that fault many times over. Putting in place a serious finance, accounting, and operations team has us building the foundation for 2024.

We’ve also started laying the foundation for education and support that our portfolio companies can opt into across the venture fund and the holding company. It’s starting with marketing and social media lessons, but will expand. I’m always reminded when we bring our founders and operators together that there is no lonelier job than sitting at the top.

We bought an office this year. It’s devoid of fluorescent lights and drop ceilings. It’s our Contrarian home replete with an American flag that flew over a FOB in Iraq, my grandfather’s Federal Justice drawing, and the newspaper on the day we were founded. But if I look to the future, through the processes we’re putting in place now, I imagine we will outgrow it quickly.

As we do, I’d like to do as another investor I admire, Brent Beshore, does and just keep buying houses around our home base of Austin, Texas. It seems to me there’s a reason we don’t want to go back to the way buildings were before. I hope we make giant ripples without having to become a literal giant.

The year ahead

If last year was the year of being optimistically discontent, this year is the year of “sending it.”

It’s a military slang expression for “fire the shot.” It’s apropos to some big announcements we’ll be making over the next few months where you’ll see us “sending it.” It does feel a bit like that moment when you have the finger on the trigger and you nervously shoot downrange in hope of hitting your target. A bit shaky, a little clammy, and sometimes surprised by the gun’s kick.

Shots have recoil, which in business just means when you move forward you often get pushed back. I imagine 2024 will be that kind of year for us. Big shots fired, juxtaposed by some recoil. Hopefully, we hit our very big, very aggressive targets.

Looking ahead, potentially more so than any legacy group or investment firm, I probably fear the younger, smarter us who see around the corners we haven’t even considered yet. So, as Jeff Bezos always closed his shareholder letters, “It remains Day 1.”

To end

My husband has a line I love: “You can’t build community when you need it.”

So thank you for being here, for believing in us, in me. So many did not. I often wear their words like a badge of honor instead of a chip on my shoulder. But it’s actually all of you who I admire the most — the doers in a sea of talkers.

Optimistically discontentedly yours,

Codie Sanchez

The Contrarian Thinking Capital & Media Teams