One couple’s cubicle-ditching path to freedom

Hey Contrarians,

Some of the best career advice I’ve read: “Don’t be a career.”

Clear. Deep. Shouldn’t surprise you that Steve Jobs said it – oh, and that careers are “one of the most dangerous and stifling concepts ever invented by humans.”

Even I might not go that far. But I do believe buying a small biz can be safer than building a 9-5 career. Not more comfortable, but safer.

Today’s newsletter is about that risk. The risk involved in going from owned to owner — and the ever-greater risk in not doing so.

Today in 10 minutes or less, you’ll learn:

✔️ Contrarian framework: Safety > comfort

✔️ The risk of being owned

✔️ Finding safety in the great outdoors

✔️ How it all could’ve gone sideways

CONTRARIAN FRAMEWORK: SAFETY > COMFORT

There’s a secret the entrepreneurship gurus don’t want you to know…

It’s okay to prefer the comfort of a 9-5.

Being a builder isn’t everyone’s cup of tea. Society would collapse if we were all entrepreneurs. Heck, I’ve played the comfort game myself.

But comfort and safety don’t always go hand in hand, and it’s important not to confuse the two.

Here’s what I mean:

From an early age, we’re damn near programmed to focus on “building a career.” To climb the corporate ladder. To have the luxury of saying, “Not my job.”

It makes sense – these jobs pay the bills. But that employment is at someone else’s will. Is that safe?

Business ownership isn’t a cakewalk. It has risks of its own. It’s gritty, unpredictable, and requires courage. But I believe it’s a path to real security and safety. Security over your future, and safety from seeing the value you create go straight into someone else’s pockets.

Because when things go south, who gets the axe first…?

THE RISK OF BEING OWNED

Right now, if there’s one group facing a reckoning of 9-5 risk, it’s employees at venture-backed companies. I mean, sheesh.

For a good decade, folks working for unprofitable tech ventures have grown accustomed to posh office perks and growth at any cost (Translation: setting money on fire).

Well, that London Bridge is falling down.

The good news? People are finally waking up to the smell of smoke. Investors are getting critical, and companies are shifting focus back toward making money instead of losing it.

The bad news? In belt-tightening eras, those who hurt the most are the employees – the ones with little-to-no skin in the game.

In 2022, tech firms laid off an estimated 165k employees (and they thought that was bad). So far this year, layoffs are up to 235k.

The truth is, the sheer talent in this pool is remarkable. We’re talking innovative builders, talented analysts, world-class marketers, and seasoned operators. Sharp people.

Imagine if even a small fraction of them found a way to pivot from here down the path of ownership.

Imagine the impact on Main Streets across the country if we supported a portion of them in building enduring small businesses.

I think the risk of not doing so is greater than we can imagine.

And it all starts with breaking free from a comfort zone.

Time to gather ‘round the campfire for a story about a couple who did just that…

FINDING SAFETY IN THE GREAT OUTDOORS

In 2016, Mark Lemoine was itching for something more.

He was burning out making $200k as a Michigan government employee, and another 20 years felt like a life sentence.

At the time, Mark’s wife Karla was a stay-at-home mom and two of the pair’s four children were in college.

Mark’s mentor threw him a lifeline in the form of two questions:

- If you could do anything in the world, what would it be?

- When you’re 80, what will you regret not trying?

The answer to both, his mentor said, should be the same.

“You’re going to think I’m crazy, but I’ve always wanted to own a campground.”

“Then you gotta do it.”

When Mark came home and told Karla his idea, she agreed. As lifelong campers, “It just felt right,” she told CNBC.

The duo held themselves accountable and got to work, both of which are easier said than done.

THEY STAKED IT ALL

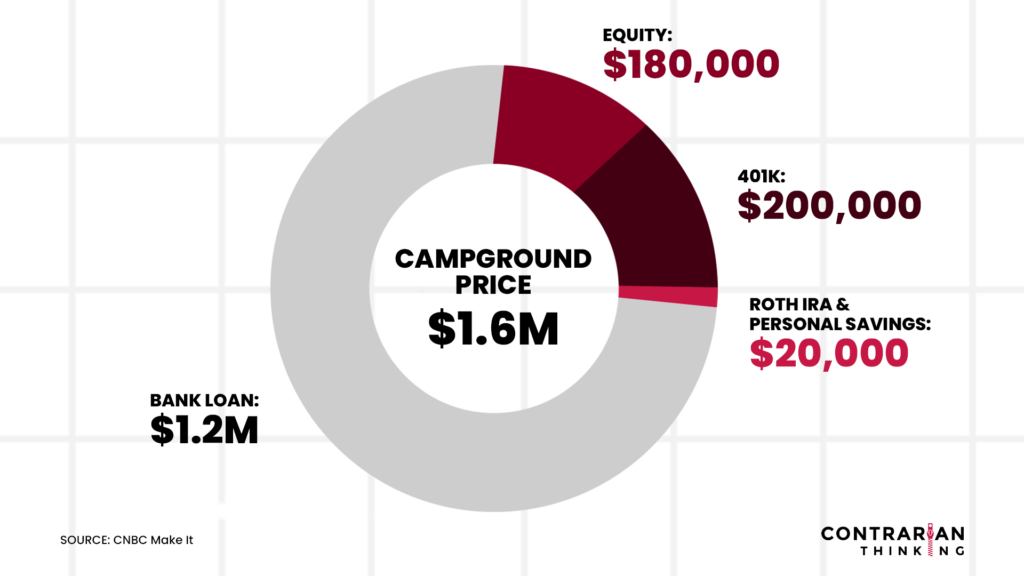

After exploring their options, the Lemoines settled on a $1.6M Kampgrounds of America franchise in southwest Michigan.

Did Mark have any experience franchising? Nope.

So he took the time to get educated. Through a course, he learned about the Rollover as Business Start-up plan (ROBS), which helps people finance start-up costs with their retirement funds.

It sounds risky because it absolutely can be. Even so, the Lemoines did their research and felt confident about acquiring an established cash-flowing biz.

In total, Mark and Karla financed the acquisition with a bank loan, 401k funds, Roth IRA savings… and the sale of their house.

All in, as they say.

“People think a steady job, a steady paycheck, and a good employer is security,” Karla told CNBC earlier this year.

“We decided to take control of our own future, our own destiny.”

TURNING THE BUSINESS INTO A 401K

Remember how the Lemoines sold their house to finance the purchase?

To answer your question, no, the family did not move straight into a tent, though they did move into an apartment above the campground’s general store.

Then they got cranking.

Their first order of business? Giving the 42-year-old campground a much-needed facelift.

That meant investing even more in the project – revamping bathrooms, adding a family fun zone, and building premium lodging options – all in the pursuit of better returns later on.

They also reworked the general store, adding a café, souvenir, and supplies shop that’s become an engine for reinvesting in other parts of the park.

The payoff wasn’t instant, with the first season bringing in $390k.

But with all their improvements, things have moved up and to the right.

In 2021, the campground brought in roughly $1M, up $150k from 2020. In 2022, the number grew to $1.23M. This year, they were on track for $1.41M with annual costs of $600k-$700k.

While they’re still paying off debt, the site is now worth $6M.

No, they’re not rolling in any dough.

But they’re in control and happy. Their future is in their hands, and they’re working in an industry they love and that’s growing. (There were an estimated 58.5M active camping households in the US last year, up from 32M in 2014.)

The Lemoines now consider their business their 401k, which they’ll live off comfortably when they sell it one day.

Most of all, they feel safe.

HOW IT COULD’VE GONE SIDEWAYS

Mark and Karla bet it all on leaving corporate America, and it’s worked out well for them.

But the truth of the matter is it could’ve been a disaster.

- Selling their house, dipping into life savings, taking on debt… If not researched thoroughly and handled with care, their delicate finances could’ve spiraled out of control without day jobs.

- 80% of the campground’s annual revenue is generated between Memorial Day and Labor Day. Managing an all-new business and income stream is already tough. Throw in seasonality? Tougher.

- Campgrounds require constant work and upkeep. Broken toilets, faulty pumps, infestations of god knows what… It’s not for everyone.

But the Lemoines did their research, took ownership of their decision, and de-risked their bets, finding financial security in the process.

In risking their 9-5 comfort zone, the Lemoines found real comfort. They were grounded by their acquisition of a cash-flowing asset, and working around a business model they’d long loved gave them the confidence to take on a calculated risk.

The world could use more of this.

I want your work to mean something.

– Codie

👔 Speaking of 9-5’s, fewer people are hanging out after work

🧁 Smucker just baked up a sweet $5.6B Twinkies takeover

📖 Musk-read? Walter Isaacson’s Elon Musk biography is out

🧀 Actress Gal Gadot’s mac and cheese brand raised… $13M!

🤖 AI money management tools? 37% of adults are on board