Hey Biz-Buyers,

This is where we share some of the best insights, tips, and stories from Main Street and our private biz-buying community. We’ll get to that below.

But before we dive in…

We want to tell you about something special… Something purpose-built for those looking to grow their biz-buying muscle and actually take action.

If learning how to:

- Get clear on what you want as a buyer

- Find deals that fit your deal box

- Evaluate whether to make an offer

- Make a strong offer (and negotiate)

- Perform due diligence and avoid red flags

- Finance a deal

- Close on an acquisition

- Focus on what matters post-acquisition

… All sounds interesting — then listen up.

We’re close to launching our COMPLETELY reimagined, beautifully produced, step-by-step system for buying your first business.

Signing up to the list below will help you get reminders so you can secure a special introductory price.

This is the one you’ve been waiting for. And yes, Contrarian Community members will automatically get access.

Alrighty, and with that, let’s get down to business.

Today, in 5 minutes or less:

Buyer tip: “What do you like to ask owners?”

Here is a commonly asked question in the community:

“So, what do you like to ask owners in your conversations with them?”

So much so, actually, we’ve started developing a resource around it.

But in the meantime, our community members have been trading ideas…

For those curious about:

- How to get the acquisition juices flowing in an owner conversation?

- What’s the right (and respectful) way to get useful information out of an owner?

- What you can ask to move the conversation forward?

Here’s a high-value list of ideas…

Ben: Start with “why”

- What is your WHY for starting/buying the company?

- What is your WHY for selling?

- What’s important to you in the sale? Money? family legacy? Brand?

- What traits do you think your business’s new owner needs to be successful?

- What is your experience with or understanding of seller financing?

- Do you have a clearly defined date you want to have the business sold by?

- What is the most important aspect of or your greatest achievement in building this business?

- How important is company culture to you and what does that culture look like at your business?

Lisa: Build some rapport

- How did you get into this business?

- What are you most proud of about what you’ve built?

- What does your day-to-day look like?

- What’s your team like?

- If you were going to stay, what would you do to grow the business?

- What do you care about most when choosing who to sell your business to?

- There are a lot of other [insert type of business] businesses out there. How do you differentiate yourself in the market?

These are the “warm & fuzzy, build-rapport-on-the-first-meeting” kind of questions, as Lisa put it.

Zach: Get a sense of the owner

- What does being a business owner mean to you?

- How do you feel about what you have built?

- If I take over, what is going to scare me most about owning your business? What will my blind spots be?

- How have you handled difficult employees? Suppliers? Customers?

- How much time do you spend on marketing, employee management, behind-the-scenes operations, and delivering the service or product?

Veronica: Get a sense of the business

- Why are you in this business? How long have you been doing this?

- Why are you considering leaving right now?

- Besides money, what else is important to you?

- Tell me about your business. How do you run it?

- How many partners, employees, and key employees are there?

- Tell me about your sources of revenue. How are they structured? What is recurring and what is transactional?

- What is your source of business? How do you think you can expand your target market? Has your sales strategy evolved over the last 5 years?

- What sets the business apart from competitors? What do you do really well and not so well?

Kim: Get to know the vision

As Kim put it, “I love to hear the owner’s 3-5 year vision (to make sure I’m not going to be doing things that frustrate them if the deal is seller financed).”

- I want to honor what matters to you. What is the most sensitive issue for you?

- What is most important for you? Employees? Legacy? Sale price? Reputation?

- What do you need to get this done?

- What does this year look like for you?

- What’s next for you? What do you hope will happen when you sell your biz?

- What do you care about? What is important to you?

“Reiterate nothing is set in stone — just want to put ideas out there to understand what they want and what matters to them. If our desires align then we can make it work, if not, no harm or foul.”

Sage: Start with some praise

I like to start with some praise if I’m able to do initial research on the company and use that to open the door to open-ended questions like:

“[Local/global event] must have been difficult for your business, I’m impressed that you were able to keep up with the work. Was it hard to keep up with employment?”

Generally, something like this will open up to more stories about employee culture and how long-tenured they are, which is critical in most (if not all) service industries.

Alex: Understand the motivation

Ask, “What are your plans after you sell?”

This allows you to understand a part of their motivation for selling. Then circle back and use it as a goal later in the talk.

Owner: “I’d like to go golfing 3 days a week.”

Buyer: “Alright, then let’s work on closing this deal so we can get you out on the golf course.”

Wes: Don’t follow a script

Here’s a suggestion on how to organize the information you want to ask:

Make an outline organized by subject matter.

List topics, words, and phrases — not fully worded questions.

This allows you to jump around without getting thrown off or lost in voluminous notes.

Because if you ask a question, you don’t know exactly where it will end up going, and no conversation will follow your script.

Buyer tip: “What happens if I buy a business and the employees leave?”

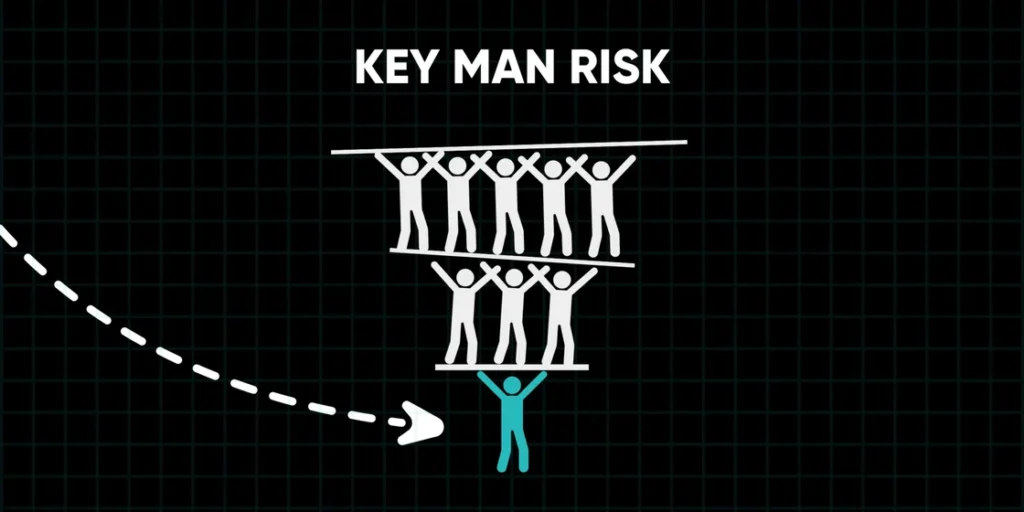

The has to be one of the biggest concerns on the minds of buyers. People ask about it all the time. And they’re smart to do so — key man risk is real.

With small biz buyouts, the question becomes: How do you keep key employees post-sale? Reduce your key man risk, improve your outlook post-acquisition.

One member, Ella, is curious about this right now.

“Folks who have acquired a business: Did you go in with a defined employee retention plan?” she recently asked, adding:

“Which strategies worked for retaining employees? Which ones didn’t? We are about to submit an LOI on a service-based business that relies a lot on the quality employees it has. I have some ideas but want to hear what everyone else has to say!”

Here’s what Robert, one of our community ambassadors had to say:

“You are correct, the employees are THE KEY to service businesses. Employee satisfaction significantly affects customer satisfaction and profits (there is plenty of research on this).”

Here are some things Robert said to consider:

1. Compensation

“Get the rates of increases for the current crew. Go in with a retention program that offers increases based on longevity and performance.”

2. Recognition

“Ask current owners how they recognize their current team. No matter the level, you will want to go in with an elevated recognition program (awards dinner, trip, memorializing the achievement).”

3. Advancement

“Use performance metrics and skill/personality testing to identify which people you want to advance and move up in running the business. (You asked for what doesn’t work, be careful here to immediately advance the current people, take your time, and have a plan to advance the position and not just the personality).”

4. Training and up-skilling

“Have a day-1 plan to start training and providing opportunities to up-skill your current employees.”

5. Get the current rundown

“Get the rundown of the team from the current owner upon closing. BUT, don’t take 100% of their word on everyone. They tend to have favorites and blinders, so spend the time to make your own call, and don’t be afraid to go against the grain.”

6 (NEW) things we’re hearing on Main Street…

SMB memes never miss: Here’s one you’ll love…

SMB memes never miss: Here’s another one you’ll love…

From Clint: What it means to be great at LOI structuring

Fascinating read: The M&A Doom Scenario (and how to avoid it)

Real talk: What’s hard for 1 person might be rewarding for another

Check it: Fox Business featured Codie in this biz-buying story

Who’s looking to buy a biz?

Quick question: What do a…

- 📊 Management Consultant at a major accounting firm

- 🌮 CEO and Founder of a Mexican superfood brand

- 🤖 Cybersecurity sales leader

- 🏠 Real estate investor

- 🧑🎓 MBA candidate at a top business school

… All have in common?

They’re all real people who began their Contrarian Community journey recently.