11 business-buying mistakes to avoid like the plague

Hey Contrarians,

I know, it’s Thanksgiving. I hope this newsletter finds you strategically positioned on the couch, recovering from a food coma, and dodging awkward comments from your uncle.

In honor of the holiday, I want to say THANK YOU all. This newsletter recently reached 500k readers. That’s 500k Contrarians working together.

Want to know what else has me grateful this season? Mistakes.

Mistakes have helped lead me to some of my biggest biz-buying wins. So today, I want to pay it forward. Here’s what I wish I had known before diving into my first deal…

Today in 5 minutes or less, you’ll learn:

11 biz-buying mistakes to avoid like the plague

1. Quitting your day job too quickly

An entrepreneur telling you NOT to quit your 9-5? Now THIS is truly contrarian. But I mean it, I kept mine for many years. Your salary is like an oxygen lifeline. Until you learn to swim and unless you have one of the big three…

- Cash to cover any downside

- Inside knowledge of an industry (AKA you’re an accountant and you buy an accounting firm)

- Investors who can cover your a**

… Keep the salary around until you’re certain you know what you’ve gotten yourself into.

2. Not proceeding with caution around partners

A partnership can be really, really powerful. But it’s also REALLY hard to get right. Bad partnerships have cost me a lot of money and uncomfortable conversations. I didn’t have a lot of rules for small biz partners when I started, but I do now.

- Rule 1: No partners get equity without cash (skin) in the game. They need to be in the deal with you, and they can’t just walk away leaving you holding the bag.

- Rule 2: No 50/50 partnerships. Someone needs to be in control, and you should always have a partnership agreement. Think of it like writing a prenup before you get married.

I’ve made enough mistakes here that I built an entire partner due diligence checklist I use. Reply if that sounds interesting to you and we can do a full breakdown on it here.

3. Not having an exit plan

A business you buy today may not be the one you want to own and operate in 10 years, so plan for that.

Sure, an exit plan could go in 1000 different directions, but think seriously about which you’re eyeing. The direction you choose early on can make a big difference later on, and if you start with an outcome you want in mind, it’s easier to guide yourself to the destination.

4. Buying another job

You want to make sure you’re not trading a job you don’t like for a business you don’t either.

Remember, you can’t leave a business as easily as you can leave a job. This is something I see a lot of people fail to research adequately and struggle with down the line.

5. Buying in secret

You shouldn’t keep your deals a secret. You want them to get beat up a bit to see how they hold up. That doesn’t mean you have to go make a YouTube video asking an owner if their biz is on the market…

… But it does mean getting trusted guidance when you’re serious about an opportunity. This is one reason why I built our Contrarian Community — so that members can get hundreds of critically thinking peers to guide their strategies.

Also, ain’t the postal shop above cool? Quin’s owned it for 25 years. How awesome is that?

6. Rushing the process

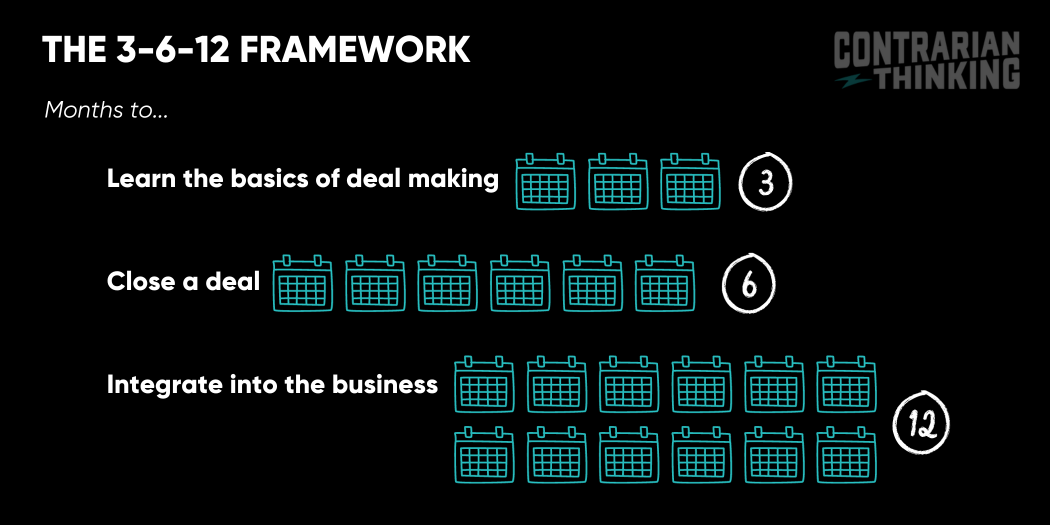

Rome wasn’t built in a day, folks. It wasn’t built in a few weeks either. For deals, I like to have new buyers focus on the 3-6-12 framework:

At least 3 months to learn about deal-making. The terms. The financials. The roles, responsibilities, and tactics.

At least 6 months to work toward identifying, negotiating for, and securing a deal.

At least 12 months post-purchase to fully acclimate to the ins and outs of a business.

Lots of folks lose money fast because they try to expedite one of these steps. It’s good to move fast, but it’s better to be intentional and methodical. Only fools rush in.

7. Not bringing in the experts

If you’re going to buy a business, you want partners or employees with sector-specific expertise to help run it successfully, not into the ground.

My friend bought a CrossFit gym without fully knowing how to own and operate a CrossFit gym.

But that didn’t really matter, because he partnered with a trainer who had managed the gym and knew the ins and outs. Focus on finding your who, not how.

8. Buying a turnaround

You’re not a pro, so don’t do pro-level things. Derelict businesses or turnarounds are really hard.

Only play the turnaround game if you know what you’re doing and have the capital. If you’re just easing your little tootsies into biz-buying, make sure you’re not starring down the barrel of a turnaround.

9. Not knowing your numbers

Today, I might be able to lose anywhere from $100k-$1M… and be okay. But in the beginning, I wouldn’t have been fine losing $50k, $10k, or $1k.

You’ll need to know the numbers that can get you skin in the game but won’t wipe you out. You’ll need to learn about the impact and weight of loans and debt. You’ll need to train your mental muscles to read small biz financial statements and leverage outside expertise when necessary.

Most importantly, knowing the numbers will help you protect the house, value assets, plan for downturns, mitigate risks, and negotiate all of these things into the terms of a deal.

10. Falling in love too easily

My dad always said, “Never fall in love with something that can’t love you back.”

The kiss of death is that you get too far down the road on a deal and you’re hit with a healthy dose of sunk cost fallacy. This means because you spent all this time and cash on a deal, you think you still have to do the deal, even if you’re hit with tiny paper cuts (bad terms and details) that’ll bleed you out.

11. Failing to diversify your risk

Let’s say you’re like me and you don’t want to take on all the risk in a deal. The good news is you don’t have to be a titan of transactions to craft a creative financing strategy for a small biz acquisition, like seller financing.

The idea is to get a seller to maintain some of a deal’s risk by keeping some skin in the game.

For a seller, financing a deal could offer potential tax benefits, a more attractive selling price, and faster closing times. As a buyer, it’s considered more affordable, and since you’re paying a seller back with the profits from their own business, you could be more likely to get a healthier business.

The cold, hard truth about buying businesses

I just listed 11 areas where I’ve made mistakes and learned from them. But the truth is, the BIGGEST mistake you could make is thinking that buying a business will be easy or glamorous.

Entrepreneurship through acquisition is hard, and it’s certainly not for everyone.

It includes managing employees, debtors, suppliers, customers, investors, vendors, administrative tasks, marketing, financial tasks, and so much more, all while balancing a personal life. You’ll lose money, time, and sleep. You might get stolen from or sued.

But working a nine-to-five is hard, too. You can be underpaid, under-promoted, under-challenged, and have to work under bosses you hate — all of which is out of your control.

It’s up to you to choose your hard.

1 cool number: Why we do what we do…

I want to share something cool. Our job at Contrarian Thinking is to help equip smart, normal people with education, skills, guidance, and connections they can use on their biz-buying journey.

We don’t do the dirty work, they do. We’re just there to support them. And we’re stoked to see the progress some members are making. To date in 2023, total revenue (that we’ve been able to track) bought among Contrarian Community biz-buyers is in the tens of millions.

It’s important to remember that, for this subset of successes, there have been many, many other hurdles, fails, and deals lost.

So more than anything, today we’re thankful for all those out there who are choosing to be builders in a world of users.

We’re thankful for those who are working to get skin in the game.

We’re thankful for those supporting Main Streets everywhere.

Above all, we’re thankful for those looking to reinvent the American Dream on their own terms.

So not boring…

🦃 Yummy? The cost of a Thanksgiving dinner is down slightly from 2022…

👨🏫 Lessons learned from spending $120k on… business coaching?

🛍️ Want to watch the world shop in real time this Black Friday? Here’s how

🍁 Hmmm: An interesting “$600B” opportunity that went viral on Twitter

🫵 You will fail: Our video on the hard truth most entrepreneurs don’t want to hear…