And maybe, what to do about it?

I am basically a professional worrier by training and genetic gene pool encoding.

Maybe that comes with the territory of being a former journalist working in conflict zones, or investing people’s money in the bipolar public markets? Who’s to know? What I do believe… there is change afoot.

A question:

Do you know what the biggest success of the nation-state has been to date?

Uplifting people out of poverty? Yes, assuredly.

Innovation and technological advancement? Certainly a portion of it.

But the truth…. eventually, you live long enough to see the hero become the villain.

One of the biggest successes of the nation-state is its ability to confiscate wealth from its citizens.

This is a bold, controversial statement.

Let’s pause before anyone gets all hot and bothered. To be clear, it is not a political statement, all politicians lose power if the nation-state is on its sunset hour. Both red and blue. It’s just a theory I’ve been ruminating about.

Do you want to hear what keeps me up at night?

I believe we may be in the midst of one of the most tumultuous periods of our day and age in the US (and perhaps globally). That during our lifetimes we will see the internet age run headfirst into the nation-state. They will battle, one will reign supreme, and the world will look much different following. The truth for us contrarians is:

Those who are successful in life are the people who notice what’s wrong or missing and find opportunity in it.

My hope here is that this starts to get your wheels turning and you begin to ponder the “truths” about our society today and how to invest, protect and thrive in a world amidst massive change.

No one knows the answer for sure, but the thing about rising tides is, if you ignore them, you’ll drown just standing still.

My thesis: The ENTIRE reason we have government is one thing – protection. They maintain law and order. Life in a society without laws would be unsafe and unpredictable. So we trade some of our freedoms, and money for, in essence, some degree of safety. By almost any measure nation-states are wildly expensive for their citizens to partake in.

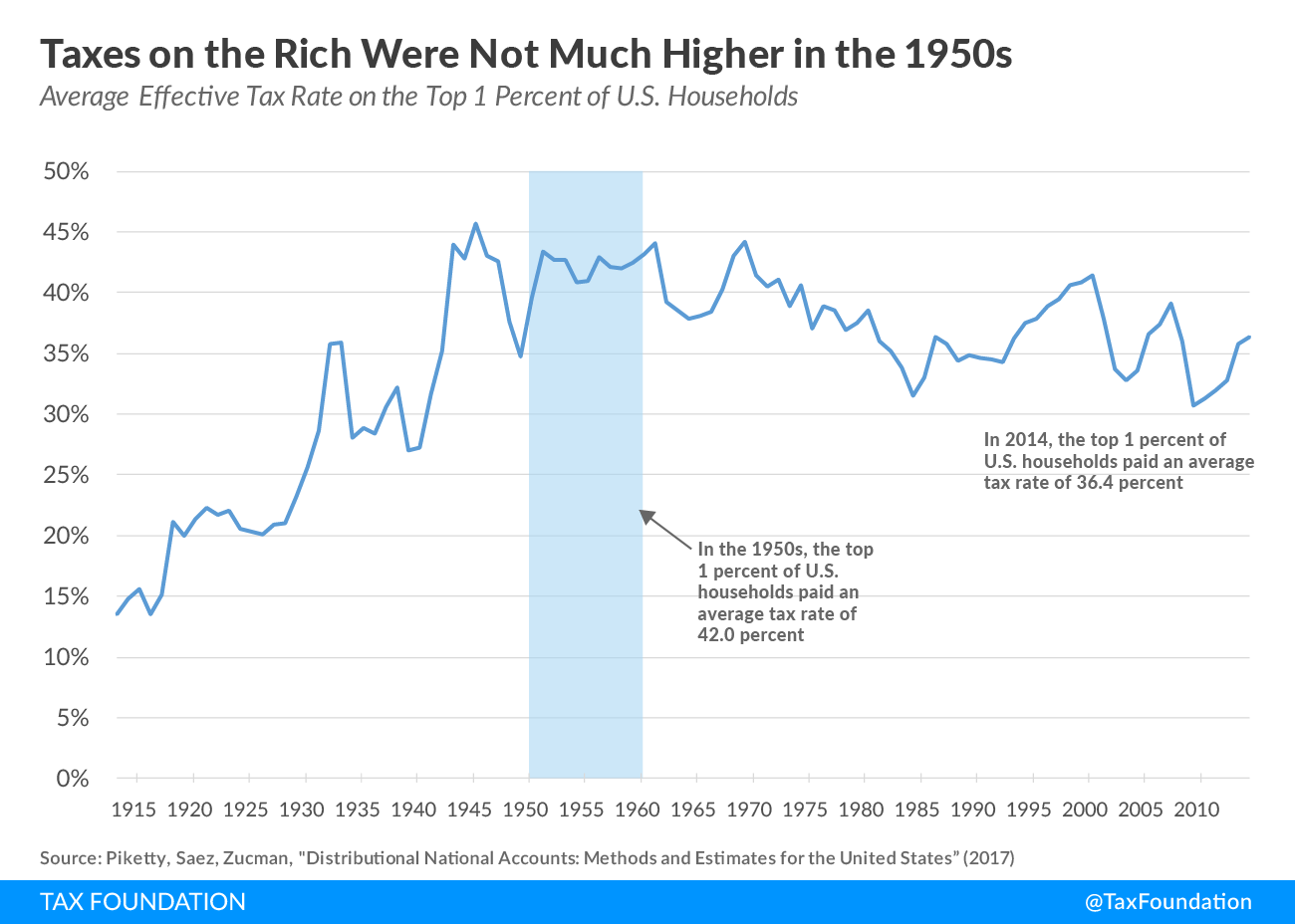

There’s a false narrative that says that in the 1950’s we taxed at 90% (fake news). In fact, taxes on the top 1% were at an effective rate of 16.9% instead of 36-40% today.

Their incentives are misaligned (they don’t have to make the $) so they spend at high levels and instead of businesses who look to do things efficiently – they are incentivized to have bigger budgets, not smaller. That is why they continue to take more taxes, increase spending and blow out their budgets.

Maybe you say philosophically you don’t agree. That’s fine. But here’s the rub – when government overreach and *especially* monetary overreach happens… humans throughout history don’t stand idly by. So even if you think I’m a black heart who cares naught for humanity… our feelings on the matter may not matter.

Washington Has Become the Vatican & Rome

Here’s an argument compiled from research in The Sovereign Individual, Fourth Turning, and Revolt of the Public (all worthy reads).

Before we take a step further, WE ARE THINKERS HERE. If you disagree in the comments tell me—why? If you have ideas, share them. Don’t get angry, get educated. I will too. We don’t talk about the world as we WISH it was, we look the ugly brute in the face and say I see all sides of you, now how will we best tame you?

Let’s take a walk through history to the days when the Church reigned supreme.

The Catholic Church from the 12-15th century was in fact very similar to the nation-states today in some respects. They reigned both in law and in the regulation of money. Take yee care those who did not abide.

- Instead of the IRS tax code, and federal regulations they had canon law.

- Instead of giving a percentage of your wealth (income taxes) to the state you tithed a percentage of your wealth to the church or had papal income taxes.

- Instead of going to jail for non-payment, you were sequestered (aka they took your property) often by force or you were ex-communicated.

Why did the Church fall from power?

Some say:

- The Roman Catholic Church began to lose its power as church officials bickered. At one point there were even two popes at the same time, each one claiming to be the true Pope. Eek, sound familiar?

- The Black Death (the plague) and the Church’s inability to deal with it led to its decline. Hmmm, cough cough COVID?

- The clergy was seen as corrupt, ignorant and lazy. They sold “indulgences,” which was how you bought your way out of sins. Political pardons or insider trading allowances anyone?

- The people resented the increased monopoly of the Church (it was both the largest landowner, tax collector, and fishery owner) and wanted the freedom to speak, earn and increasingly learn, as writings became more widely available. Like ya know, the internet and decentralized currency.

- Protestantism was created and allowed for the idea to change that wealth was to be given entirely to the church now, it could be kept.

What happened to the Church’s constituents and followers?

“When failing systems have the power to do so they often seek to squeeze their constituents with pressure. This is worth remembering.” – Sovereign Individual

The twilight of systems in the past has never ended nicely and orderly. Knights from the Church tracked down citizens for their taxes, confiscating property, and humans. The Church did all it could to cling to power. In addition, as the Roman Empire fell there are records stating the Romans mercilessly tracked down citizens to confiscate their wealth and deny them the ability to leave. The same was true in Egypt as ancient records show more prosperous properties were abandoned along the Nile than kept as the Roman nation-state devolved. The “propertied” class was held at their mercy. There is an echo here.

The point of this is not to hate on taxes. There is a price we all are willing to pay for protection, intellectual property, ease of doing business, infrastructure and rule of law. The thing is – when people start charging you when you want to leave a concert, not when you come in, that’s typically called a shakedown, not a tax.

You are seeing this play out right now in front of our eyes.

Just ponder:

#1 On the Good Side: States & Cities Are Competing For YOU – the Citizen

- When was the last time you had mayors and governors actually fighting publicly for citizens, not companies? Think hard. This has never happened before in our lifetimes. (Mayor Suarez’s billboard in San Francisco trying to get tech talent to Miami).

- Or Greg Abbott – tweeting out about Texas being open for business as a human.

- Abbott Campaigning for Texas as the Best Place to Live. Minus ya know when it snows apparently. Chuckled that Texas could get shut down by a few snowflakes, although it was less funny when I was in it without power or water. (I’m at least equal opportunity trolling on both sides).

#2 Bad Side: The States with The Exodus Will Not Go Quietly Into the Night

- Hotel California: You Can Check Out Any Time But You Can’t Ever Leave? California levying a proposed wealth tax, and a recouping tax that comes after you when you leave and based on any days spent there. Might want to rethink starting your company in the Sunshine State I so love.

- Elizabeth Warren proposing a 3% wealth tax on Billionaires & Multi-millionaires. Listen, I get how easy it is to hate on billionaires. But these people are liars. First of all, it’s also people with a $50M net worth AND more importantly, what politicians don’t want you to realize is that they just start at the top and work their way down. We’d do well to remember: Every freedom you take away from another, expect it to be taken from you as well. I call it trickle down regulations.

“We yearn for civic character but satisfy ourselves with symbolic gestures and celebrity circuses. We perceive no greatness in our leaders, a new meanness in ourselves. Small wonder that each new election brings a new jolt, its aftermath a new disappointment.”

Excerpt From: The Fourth Turning, William Strauss & Neil Howe

#3 America’s Exit Tax

I was sitting in a London pub (oh yes, there was a world in which we did such things), chatting with a very successful founder friend who lived in Southeast Asia. He had been there for a decade-plus, his kids speak 5 languages, business is booming, he’s married to a local. So he thought about renouncing his US citizenship. As anyone living abroad still has to pay federal taxes, EVEN IF they earned entirely in another country. So he was shelling out a lot of money for an inability to use any US resources. That’s when I first learned of the US exit tax.

To grossly overly simplify, if you have over $2M in assets or $100k+ in earnings get ready to pay a 23.8% tax on “gains” as if you sold all your assets.

Why is this happening?

There is a widening gap between the haves and the have-nots, the in the knows and the on the outs. Here’s the problem, it’s not from ANYTHING you hear about in the media. Do you want to know the REAL reason why there is a rift larger than the Grand Canyon that is growing? It comes down to who has self-ability and who doesn’t.

Who can:

- decide to no longer work for corporations

- take their children out of school and do it themselves

- have multiple passports

- can move from cities, states and countries

- diversify their revenue streams

- invest in decentralized assets (hard to seize someone’s millions from a thumb drive)

Here’s my concern. When people try to make it harder to leave it’s usually not a good sign. It means they think the value they will give you is less than the value you will give them. Otherwise, they’d have to build a wall to keep people out not in.

The government cannot survive without you working to pay for it.

We’d do well to remember that government SERVES THEIR PEOPLE. We do not serve them. Government is funded BY THE PEOPLE. They do not generate wealth themselves. They are a wildly beneficial parasite. Parasites can be symbiotic, even crucial to life. But sometimes, parasites can kill the host.

That is one reason I created Contrarian Thinking, we need to think critically right now. Or drown standing still.

What to Do In the Case I’m Not 1000% Wrong

There are always ways to earn, protect and learn in these periods of great transition.

So here’s what we’re doing about it:

1) Read: The Sovereign Individual, Fourth Turning, and Revolt of the Public (all worthy reads).

2) Watch some alternative voices such as Nomad Capitalist. If you like him we’ll do an interview with him.

Hope I’m wrong, if I am, the worst you’ll have is options, diversified income, assets, financial freedom, and peace of mind. I’m so sorry about all that. But if I’m right… oof.

Question everything and luck favors the prepared,

Codie