How to Passively or Actively Invest in Sneaks w/ only $1k? Or tap into a HF model.

Well hello, you big strapping minds you. Welcome to those of you new here.

What’s Comfy, Cool, and even Beats ROI on Gold?

Sneakers. Apparently. I’m skeptical.

SHORT CONTRARIAN RANT:

Everyone wants a shortcut. I get it. Me too.

So, ya’ll asked for ways to invest passively and double-digit cashflow with $0-$1,000. Here’s one way, sneakers.

BUT A REMINDER: There’s no such thing as a free lunch. There’s no way to have a portfolio with one item in it. You have to do the work to reap the rewards. While we try to make it easier on you every week, these strategies are simple but they’re not always easy. So take a good long look in the mirror, and ensure you’re actually doing the things to create the life you want.

YOU are the only real determinant. No one else.

If you’re like me, you’re a voyeur into micro-niches. Communities where people are obsessed on some subject that perhaps I couldn’t care less about. The opportunity in investing is to see what most DON’T. So as you read about things we use to not dirty our feet, see the bigger picture. Niches in riches. Voyeur arbitrage.

Surprising Sneaker Facts

- GOAT: A sneaker marketplace for top sneaks got valued at $1.75B and looks to be doing about $60M+ in revenue a year. Ok, that’s interesting.

- JV Ortiz: Makes about $10K a month, while hanging in Bali, reselling sneakers. Sick bro.

- The global market for sneakers alone is estimated at $79Billion

First A Framework

Sneakers + Scarcity = High Future Resale Value

Did you know sneakers kick-started (hehe) the classic chain reaction of Hyped ‘Exclusive.”

Sneakers proliferation allowed for shoes to move from selling in department stores in the 1980s to luxury retail stores in the 2000s to selling at Sotheby’s for 800K.

Enter JV Ortiz, who went from a complete outsider in the sneaker flipping space to making 10K/month in half a year. Here’s the playbook with all the know-how you need from the man indeed:

Not Just Any Old Shoe

At an expected 7% growth this year, sneaker resale is expected to grow at more than double the rate of the overall shoe market which is crawling by at 3%.

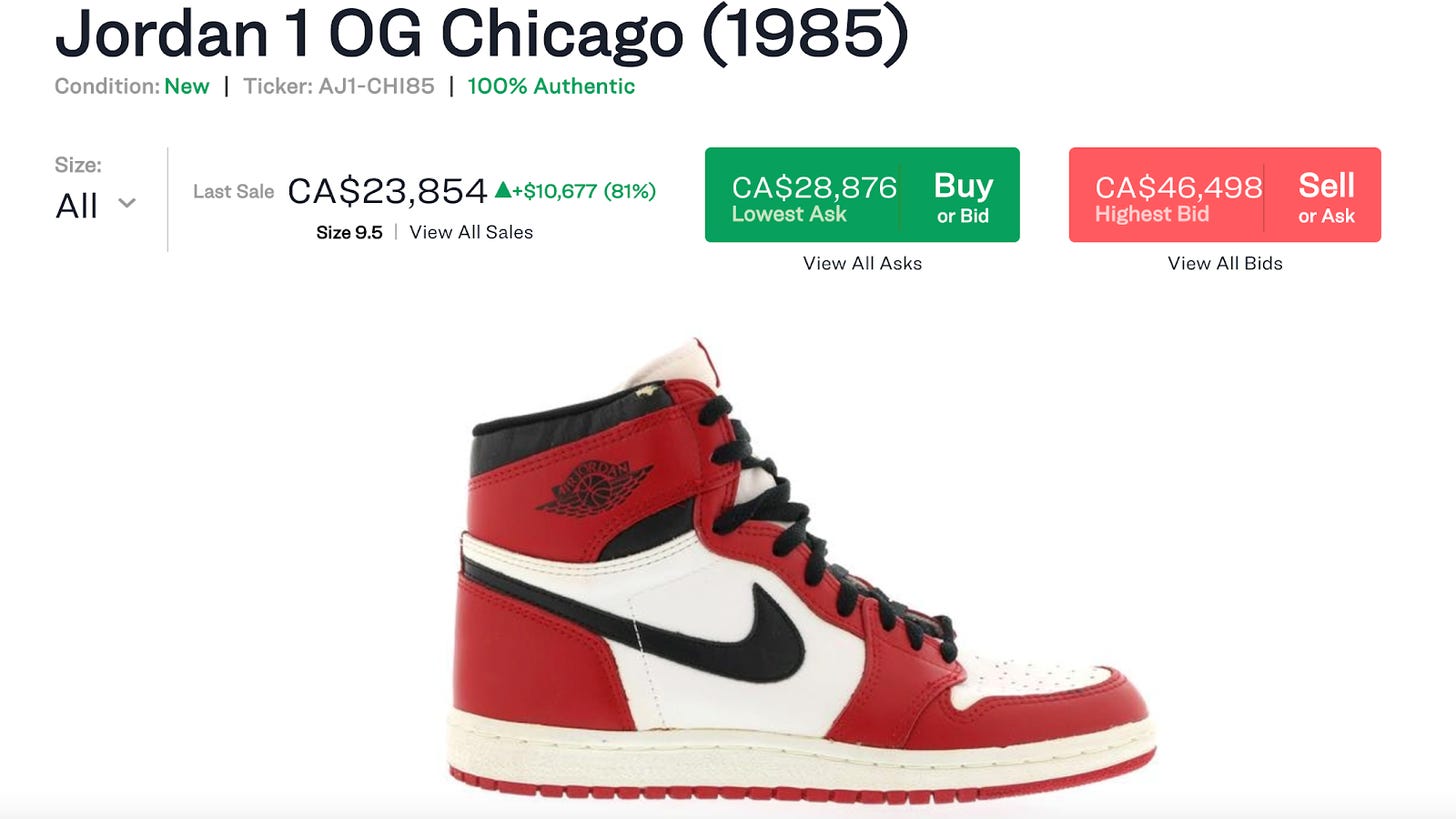

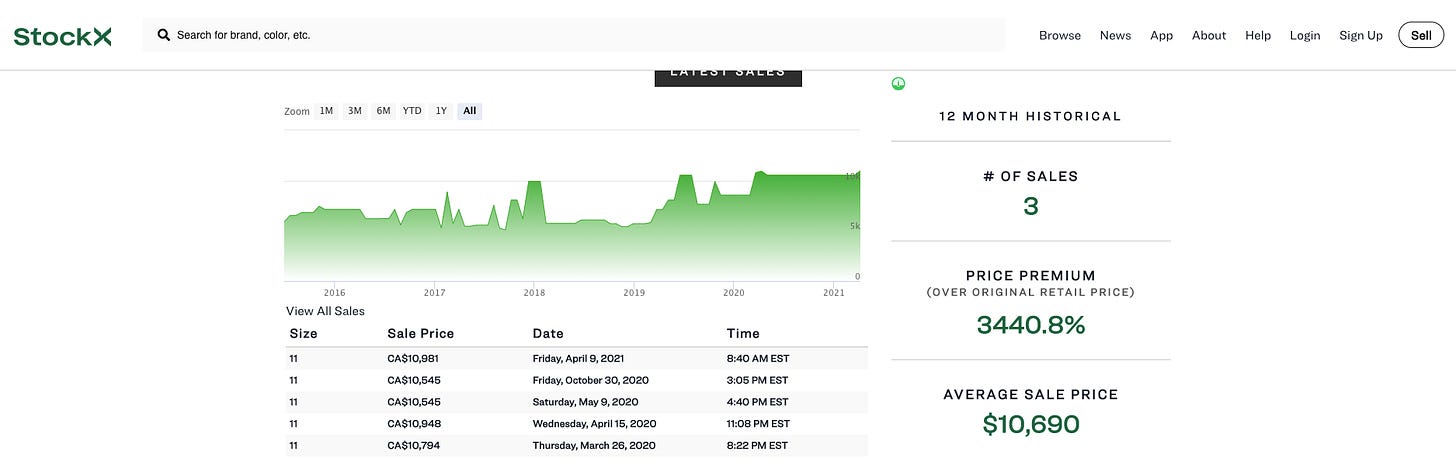

The original Air Jordan 1’s had a retail price of $65… now we’re talking tens of thousands.

What’s driving this growth:

- International Gen Z-ers from Asia and Europe are entering the market. According to Cohen, the non-U.S. sneaker resale market is expected to reach $19 billion by 2030.

- Women-identifying Sneakerheads are stepping up their game (get it), causing women’s sneakers to outperform the total market by 70% on StockX.

- Covid Catastrophe (…or not): Sales took a bit of a hit in early pandemic times but quickly surged and perhaps unsurprisingly stayed at higher than above levels throughout.

Some Simple Math

While you might be wondering if this is just another fad, the sneaker hype seems to be establishing into a long-term trend.

FRAMEWORK #2:

Scarcity + media hype + cater to super-consumers aka “hypebeasts” = $1000 sneaks.

These consumers spread product hype through organic social media marketing. Brands like Nike and Supreme refuel the momentum by releasing a large number of different sneakers with a catch — they limit the availability of each style to create artificial scarcity. Therefore a reason for hypebeasts to be even more ahem, hyped? Sneaker drops aren’t just limited to the highest tier of basketball players anymore. Today’s we’re seeing the roster of sneaker influencers expand into other areas like music and film with Rihanna’s Fenty X Puma Trainer and the Avengers inspired Adidas ZX 2K Boost.

According to Cowen, the sneaker resale market currently sits upwards of $2 billion, the resale market is expected to become $40 billion+ in the next decade.

Demand for sneakers is also rising causing sneakers to sell well above their retail value (from thousands to ten thousand more) in sometimes less than a year. That’s a 3,440% ROI.

Getting in on the Sneaker Secret

Ortiz did a lot of research before getting to where he is now, consistently making 6 figures a year and getting into GQ (NBD). He started small, first flipping clothes, then moving onto bigger and better things in the sneaker world. (Alas, he actually compiled all of his knowledge into a super sleek eBook, which he’s offering only to us Contrarians at 20% off with code sfscontrarian, here.) Unleash your sneaker fantasy my friends.

Method #1: Acquiring Sneakers Passively

How To Invest w/ 0 Time Commitment:

Sidenote: I’m SUPER uninterested in selling used shoes, or any shoes. So I said, “How could I play this in the easiest way HUMANELY IMAGINABLE but still diversify the ole portfolio into what these damn kids like?”

Rally and Otis (Tagline: Culture is a New Asset… hmmm).

They take sneakers (and lots of collectibles and securitize assets like sneakers with the SEC, then break them up into shares which you can buy.

So I did the responsible thing… bought some shares of Jordans. Bought $1,000 worth. This could be a terrible idea, we shall see.

Method #2: Investing In Sneakers Actively

Rise of the Bots

This sh*t is crazy. The world is rapidly becoming securitized, automated, and engaged online.

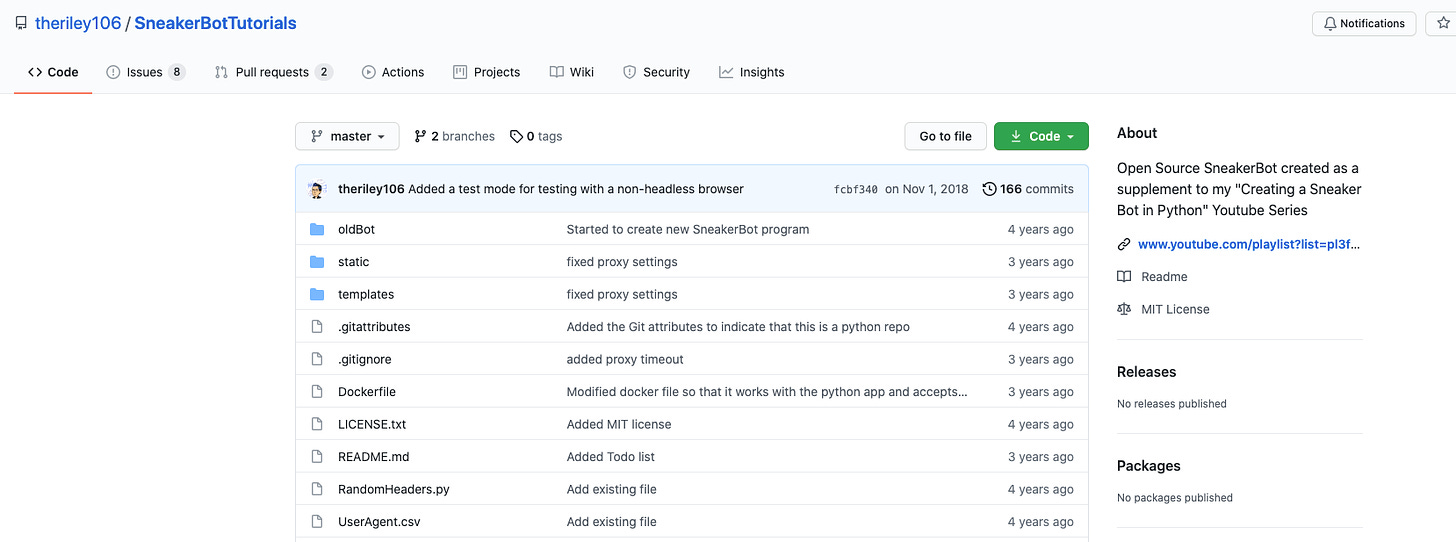

Back in the day most reselling was done by word of mouth. In today’s world, we deal with The Bots. These are usually automated web scrapers/purchasers/and other scheduled, responsive tasks-doers that can send out a humanly impossible number of direct messages, raffle prize entries, and purchases in a heartbeat.

Increased competition = need for an edge, aka bots.

Part of the source code for a sneaker bot created for the 2017 Yeezy’s Boost 350 drop.

Source: https://github.com/theriley106/SneakerBotTutorials

Unless you plan on hiring someone who can code, it’s probably wiser to hire a bot (which can range anywhere from ~ $500 – $8,000/year).

Setting up a bot does require know-how, but unlike building from scratch, there is plenty of advice, as well as online communities known as “Cook groups” you can join for guidance. These groups, such as Notify, are usually hosted over existing platforms like Discord and are exclusive in the sense that only a certain number of memberships are sold at a given time so you’ll have to keep an eye out for when they open. Sites like EasyRental make it easier for you to pick and choose while also providing some support to newcomers in the sneaker-selling hustle.

IS ANYONE AMAZED THAT THIS UNDERWORLD EXISTS?

*I’d 100% have my knucklehead teenager go figure this out and make them pay for their vacation. Or if I was in college get in z game.*

War Against the Bots

Old & Gold

Now all that being said, using bots isn’t considered illegal, however, they can get you banned from many websites if caught. This ban would not only include your account, but your IP address, and possibly even your payment information.

The other option would be to stay old-school and collect your shoes from brick and mortar stores.

Insider tip: that’s kinda sketchy. Get to know the small boutique owners and managers who sell sneaks at drop, often you can buy your way to the front of the line… Ahhh capitalism.

Ortiz focuses on older models specifically, preferring to go through eBay and Facebook. It’s a good lesson on the power of side doors. Skip the front ones, they’re always crowded.

Selling Sneakers

StockX was created by putting together a theoretical index fund of 500 sneakers that outperformed the S&P 500. While the platform allows you to buy and sell the same shoe multiple times and provides quality control, it takes a pretty significant chunk as a commission (ranging between 9.5 to 14.5 % + a 3% transaction fee). Can someone get me into the platform investment instead?

GOAT is similar to StockX, however, the fees include a flat fee from $5 to $30 + a fixed $9.5% commission.

eBay put an end to its commission fees on sneaker sales over $100 in 2019 and more recently announced it would start authenticating sneakers over $100. With these two changes, the platform is the cheapest of the three, though with some extra risk.

No Time For Decision Paralysis

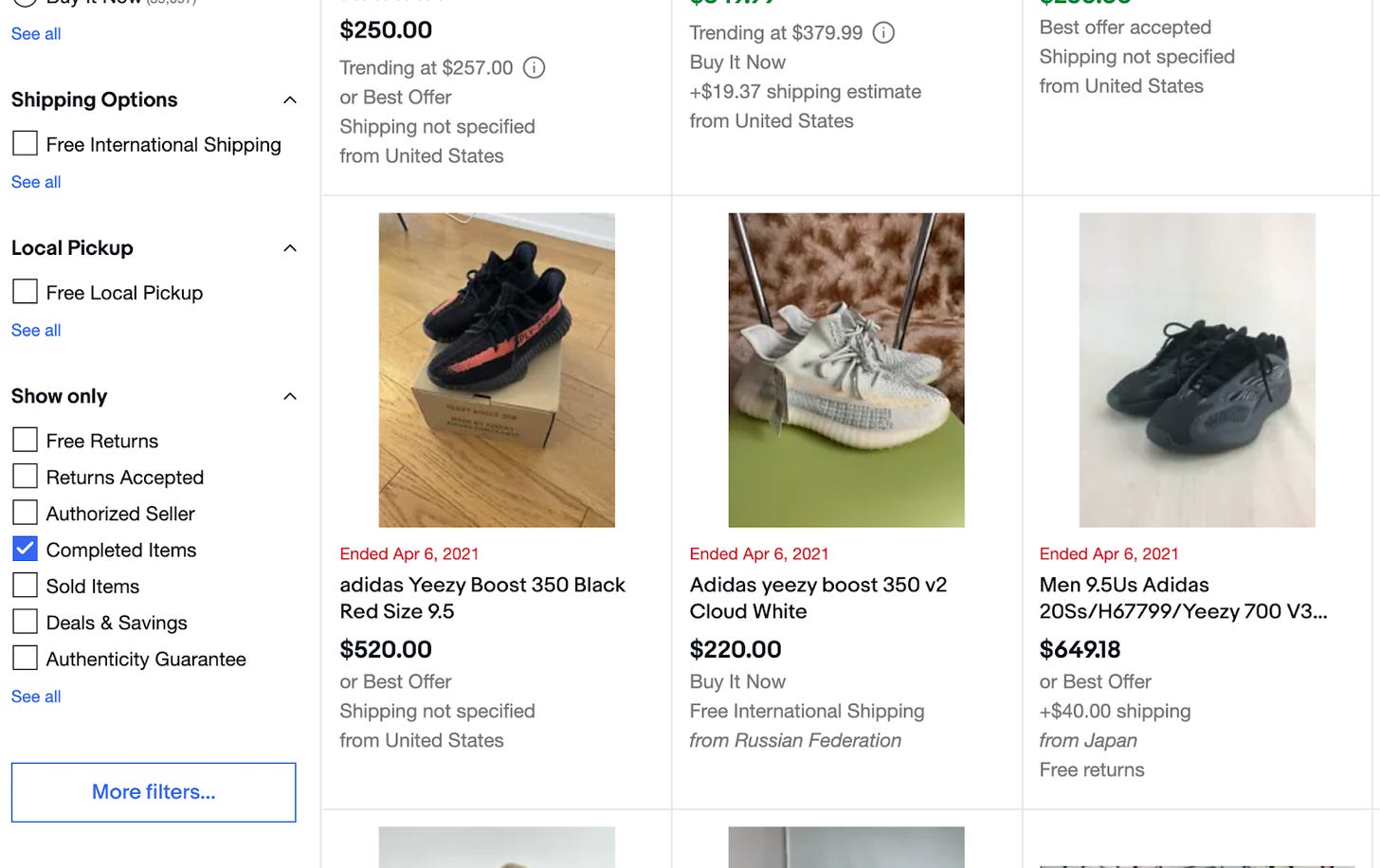

Now would probably be a good time to ask how to know which shoes are best to buy. There are some tricks to keep up with the market like using Ebay’s filters such as “Completed Listings” to see which brands and releases are selling well. This feature can also be used to see what prices you can/should be selling your stock at.

It’s important to keep up to date on the happenings in the sneaker world, follow sneaker and fashion publications and social media accounts (Hypebeast and High Snobiety in particular), designers, and influencers.

You can also check out my pal Stefan’s website here, which provides its subscribers recommendations for investment opportunities in the sneaker space twice a month!

NFT’s Are Coming in Hot

Blockchain is making its way into streetwear. Nike patented its blockchain-compatible sneakers known as “CryptoKicks” in 2019. This move was largely to address issues of authenticity, by connecting a physical pair of shoes to a digital ledger and cryptographically securing the asset digitally. (Say that 10x fast).

Ownership can still be transferred either physically and or digitally and for the latter, there are few fun options for owners such as “breeding” different sneakers together to create a unique sneaker baby (any excited CryptoKitties fans out there?).

Startups like SUKU, an app that serves as a way to determine sneaker authenticity, also comes with a physical NFT tag within the shoe.

Where is this going? Well, RFTK Studios in collaboration with artist Fewocious (yes, that’s spelled correctly) just did some ridiculousness.

They recently sold digital sneakers… (wait what?)…. for $3.1 million…(take a breath)… in 7 minutes…(let that sink in).

While these new kidneys of digital assets haven’t been rolled out to stores just yet, keep your eyes peeled.

Question everything and kick the tires,

Codie & the Contrarian Team