Yes, that’s quite the title.

What’s also weird, I have no such title. Entrepreneur Mag, feel free to call me the Sage of Omaha at any time. But alas, this isn’t about me, this is about Justin Donald also dubbed the Godfather of lifestyle investing.

Whatever they call him, Justin takes the mic. We are breaking down the secrets to investing like a pro so that when you get into a deal, they assume you were a former investment banker. The not-so-sexy way he replaced his high-figure income a few times over, might also surprise you. Cool?

But first, my favorite part about Justin is actually not that he is a classically trained investor. He used to:

- Sell knives…

- Door to door…

- Aka he worked for Cutco Knives…

- Then he used the money from slanging sharps to invest more intelligently

He didn’t go to an Ivy, he didn’t work on Wall St but I’ve done deals with him, and he’s on it. He’s got the smarts to ask for the right terms in a deal, and that midwestern charm to actually get it. Since he’s my literal neighbor now, I’ve gotten his secrets for all of us. You’re welcome.

This week, in <10 minutes, we’ll talk about how he invests:

- His rules for investing that I promise Robinhood won’t tell you

- Things Justin Believes That May Trigger You…

- What’s in his portfolio? Assets no stock meme account will share

- How you can invest like him ways to play it

- Which sector I’m most intrigued by where I’m putting some $$

4 Investment Triggers: What We Wish They Taught Us

Rule #1, F*ck Angel Investing

Alright, just assume from here on out all the cussing and snark is me. He’s much nicer. But we both agree on this one—until you are worth $1M+ in liquid net worth I’d largely avoid angel investing. Too easy to lose, takes 10+ years to cashflow, and the best deals are hard to get into. TLDR: if you are going to angel invest, never lead the round, always follow bigger smarter investors and ask how much $ they put in.

Rule #2, Pay Me, Now

Straight equity investing can be okay, but it’s short-term gains and not long-term wealth accumulation. Start cashflowing in your deals day 1. We’ll talk later about how.

Rule #3, Use Cashflow to Pay For Your Life

Instead of buying the bag, house, car, sneakers, etc. Buy the asset that produces income enough to buy the thing. This is how to have the lifestyle you want WHILE building net worth. Save the $1k per purse 10 times to hit $10k, then take that $10k and buy a vending machine route that cashflows you $2-3k a month. Now buy a $1k purse a month if you want to get your Kardashian on.

- Instead of “if you want something, save for it.”

- —-> “If you want something, buy an asset to pay for it.”

Rule #4 He’s Made $7 M w/ This

Never take a deal at the offered terms. Not your salary. Not your babysitter’s cost. Not your next employee. Not your next deal. The initial terms are usually good for the proposers but never the best for you.

- When he sees a term sheet, he asks himself: “Is there a way to reframe the conversation or opportunity to reduce the risk?” He may add a kicker that generates revenue share beyond the ordinary deal terms. Perhaps he’s paid as an advisor or gets a warrant that grants additional interest or a percentage of gross sales. Always think, how can I add a little icing to my cake?

All opportunities are negotiable.

Equation is: The best deal + for both + without compromising your values.

Rule #5 Boring is Beautiful

What we do here is get us all to change conventions in thinking and money so we can free our brains and our bank accounts. Not everyone needs to work in AI or build the next Tesla, there’s beauty in the boring too.

What’s In His Portfolio?

The TLDR, a lot of things. But one he really specializes in is fascinating, hint they can move, but not easily…

Mobile Home Parks:

Justin did the whole stock investing thing for years as his salary went up. But then he realized his assets were invested but they weren’t working for him. He was doing the work. So he started looking for low-priced assets that cashflow. Enter his first trailer park. He and his wife wanted to home-school and travel the world. Small problem. Her boss wasn’t too into that. She had a traditional 9-5 as a teacher. So he looked around for assets that were not too expensive, that you could use debt for, were simple to understand, and MOST IMPORTANT could make at least $20kish a year (her salary).

Mobile parks. He went and took a course on investing in them, and started dragging his family to visit them. Then finally pulled the trigger. Then bought another. Then he accumulated enough to replace his income. Then he bought enough to have a manager run his portfolio #NBD.

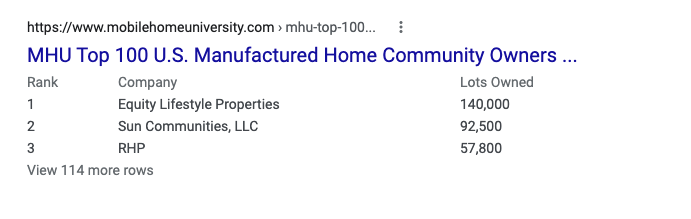

And it turns out Justin isn’t alone.

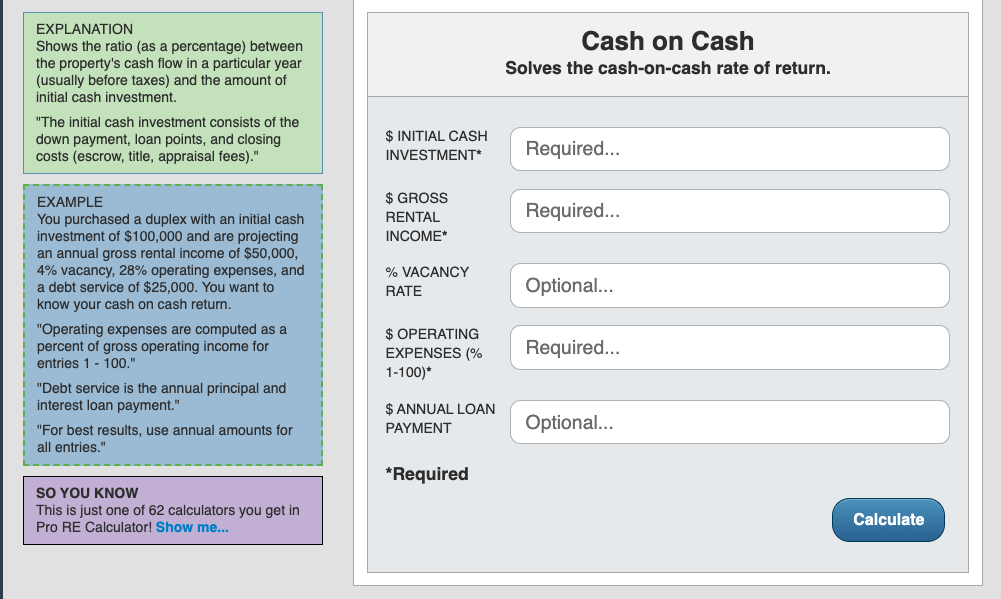

Why are PE funds rolling these bad boys up in record levels?

The Pros:

- Cities don’t typically want mobile home parks and try to redevelop them. So there are only about 44k in the US. Limited resource = opportunity.

- Least consolidated asset class in real estate. This means a lot of mom-and-pop shop owners.

- Typically they are bought at a high cap rate. Fancy speak for they make the most money at the lowest price to buy.

- One of the lowest default rates in all real estate, so loans are usually pretty easy to get.

- You can use accelerated depreciation (at least until the government sucker punches you). Ahem, le-what? Means you get a great way to write off your taxes.

His first mobile home deal: How do these deals look?

- Justin put down 15% or $65,000 (on a property worth about $633k)

- He profited $2k per month, or $24,000 a year

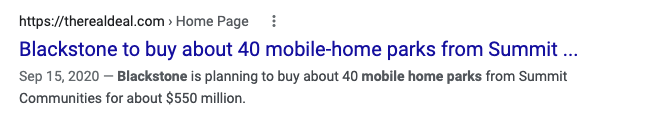

- With a cash on cash return of 36% (Wtf is that? It shows you how fast your investment $ returns to you), here’s a calculator below

Second deal: Tip – a little larger every time as you learn the business

- He put down 15% or $75,000 on a slightly larger deal

- profited $3,375 per month, or $40,500 a year

- with a cash on cash return of 56%

Then continued to rinse and repeat, often selling them at substantial multiples.

How you can invest like him ways to play it

Let’s say you fancy yourself a regular mobile home landlord. How do you play it? Well, my man just got out of the military and I want to help him diversify his assets. So we are in a buying a mobile home phase. Let me tell you what I told him, eh?

Three Steps to Mobile Home Kingdom

#1 Learn from Someone Else’s Losses:

Sign up for a Mobile Investing course like this one on Udemy (it’s $17 – go big baby splurge). Then go to a conference, or ask for a consulting call with an expert in the space. I’d also go a bit ham reading a bunch of resources like these:

#2 Find A Guide:

After I took a week or two and became a 30-second expert on the asset class, I wanted to know some players. So I set up a call with Justin to sit down and go through all of them in-depth. I asked for him to co-vet the deal with me. My suggestion, find some players from the biggest investors in the space and see if you can pay them to help you.

This is when you LinkedIn stalk like a mfer, searching for mobile home park experts. It’s not the HOW it’s the WHO. Find your who.

#3 Find A Deal:

Go on Loopnet, or mobilehomeparkstore.com (real creative name), or google a super creative search like “mobile home parks for sale.” Rocket science, I know.

Some of the metrics are usually on the listing:

- cap rate (how fast do you make your money back)

- size, # of spots

- value add services

- price

Others you have to ask about, such as:

- financials

- expenses

- tax returns etc

Want the downloadable guide with editable templates and exclusive call replays? Grab it here!

How I’m Playing It

I’m going to buy one. Something smaller probably $1M or less in the purchase price to start. Because I believe in affordable housing, I am going to do some value-added repairs. I’m going to make it cool while focusing on profits. I’ll report back with how it turns out. If it was up to my man we’d downsize everything and live in this one…

There you have it, Warren Buffet of cashflow investing.

Just out there buying mobile home parks and cashing checks.

Damn animal just texted me he closed on one today.

Let’s not let him be the only one.

Happy hunting & question everything

Codie