More than 6% of the U.S. population lives in mobile homes. That population spreads across multiple age groups, too. And if that’s not enough to sell you on the opportunity, consider that Warren Buffet has big investments in the trailer park business.

Even if you’re not aiming for a multiple-billion dollar fortune like Buffet, buying mobile home parks is a viable opportunity for consistent cash flow.

Mobile home parks are the real estate world’s hidden gem. Here’s what you need to know about investing in them.

The Business Model and Investment Potential of Mobile Home Parks

Mobile home parks vary in size, location, and rules, but all share a common definition.

Mobile home parks are locations with homes on a residential, continual, and non-recreational basis offered for general public use, not including trailer parks for transient purposes. In general, these include three or more mobile homes.

Mobile home and trailer parks get a bad rap sometimes. Admit it: you’ve binged Trailer Park Boys more than once, and it doesn’t paint the most flattering picture.

Many people underrate mobile home parks as a real estate investment. But they are a cash cow when you know what you’re doing.

There are at least 2 revenue streams with mobile home parks:

- Offering spaces where someone can find and add their own mobile home

- Owning the homes and the spaces and renting out both.

TLDR:

- You can get real estate loans to acquire them

- Mobile home parks are the least consolidated kind of real estate

- You can start making money right away if you buy an existing park

- These are a great passive income source if you have an onsite manager

If you want a real-world example of a mobile home park investment in action, check out this video:

Mobile Home Parks Vs. Other Real Estate Investments

Real estate has long been the go-to investment strategy for anyone wanting recurring revenue or big gains. But mobile homes are a whole different ball game.

You need to know what you’re getting into before you buy and apply the right math to determine if it’s a good fit.

First, the good news:

Less Maintenance

As the owner of the park, unless you own and rent homes on lots, you are only responsible for maintaining the road into the park and any recreational areas like jungle gyms. Tenants take care of the rest.

(Heads up: if tenants are lazy with their own repairs or yard maintenance, it can bring down the appeal of the park. Some general rules go a long way.)

Compared to regular landlords, who must earmark incoming rent for repairs and maintenance, you’ll save money and headaches.

Hands Off

When you bring on a traditional property manager for a home, condo, or apartment building, they will charge at least 10% of your revenue.

With a mobile home park, the main responsibility is collecting the rent. You can do it yourself or hire someone else to do it for a flat fee, usually much lower than 10%. You could even appoint a resident to handle it all and reduce their rent in exchange.

Huge Demand

America is in the midst of a huge affordable housing crisis.

There is a shortage of 7.3 million available and affordable rental homes for people with lower incomes. The number of people in need of affordable housing is up 8% from 2019, too.

Mobile homes offer a potential solution with the average price of a mobile home at just over $125,000. Compare that to the average U.S. home price of $436,000. No wonder people are looking into alternatives like tiny homes, RV parks, and mobile home parks.

Now the downsides:

Zoning Issues

Not every piece of land is zoned for a mobile home park. It can be hard to find a new location to start your business on, so it’s easier to find an existing park to buy.

There’s even a silver lining here: zoning issues may prevent some competition, so you don’t have to worry as much about an oversaturated market.

Popular with Investors

Other real estate investors have caught onto this trend. It can be hard to find an available park in your region due to limited inventory and competition.

If you can spot one, especially one with the ability to build extra mobile home lots and expand, don’t hesitate to check it out and look at the books.

Right now, there are only around 45,000 mobile home parks in the country, which makes them a valuable, constrained resource.

Of course, if mobile homes aren’t available in your area, there’s always other opportunities. Even buying land for camping might be worth looking into.

Trickier to Value

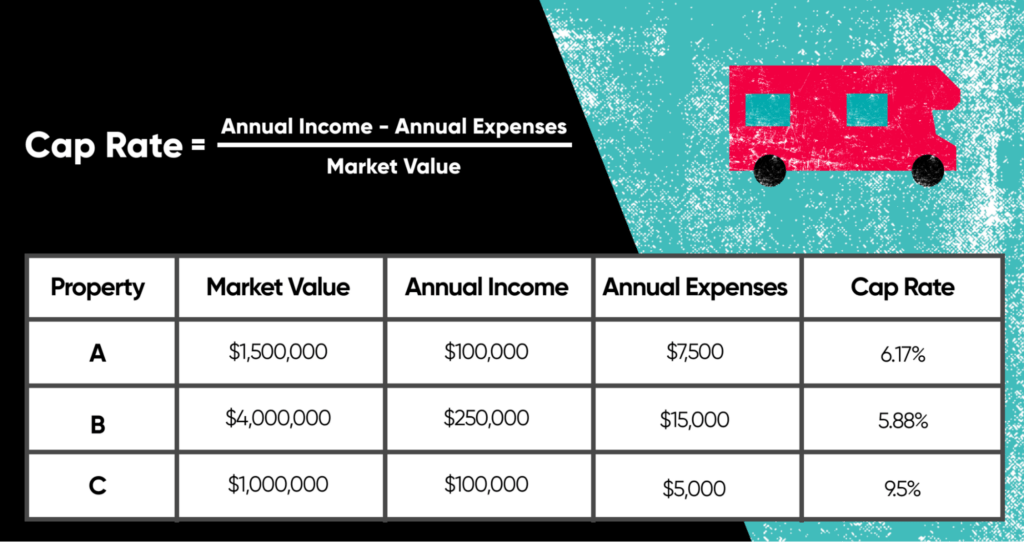

It’s standard practice to apply cap rates to a lot of real estate deals. Don’t do it here without including some other key details.

Quick down and dirty on cap rates: use them to find your expected rate of return on real estate investment properties. Divide the property’s net operating income by current market value.

Lot rent is always charged to tenants in mobile home parks, even if they own the home. Lot rent covers the land under the home and access to available utilities.

You can also charge rent on their homes if you own the units on the land.

Account for both in your valuation. Start by establishing the value of the land first. If you instead apply a cap rate after adding home rent to land value, you’ll wind up overpaying for the park and kicking yourself later.

See below for a step-by-step process of how to value the park with your cap rate.

Not All Eviction Laws are Equal

As with any other real estate purchase intended for rental revenue, you need to know how hard or easy it is to evict people. Check your state’s landowner laws. You need to match the demand for housing with the ability to take legal action if someone violates their lease.

You can’t be hands-off if you have to take tenants to court in long eviction proceedings all the time.

What You Need to Know About Mobile Home Parks Before Buying One

Research and due diligence go a long way toward avoiding a bad investment in a mobile home park.

There are a few other things to keep in mind when buying a mobile home park to protect yourself and maximize your profit on the deal. These include:

- Searching for hidden costs like private water and sewer installation or repair

- Evaluating existing septic or electrical systems

- Verifying that the title and survey are clear to the land

- Reviewing existing expenses

- Knowing all current rent rates for tenants (is it time to increase them?)

- The condition of any park-owned homes that may be in disrepair

Since there are so many factors at play in operating an existing park and finding problems early on, it’s worth hiring an operator to manage this for you.

Your Roadmap to Investing in Your First Mobile Home Park

Ready to invest and start turning a profit with mobile home parks?

You need to know what to look for and exercise patience in finding the ideal location. Follow these steps to avoid bad deals.

Identify Potential Mobile Home Parks for Purchase

Start by visiting mobile home parks in your area and talking to people who own them. You can also find these parks online for sale from time to time.

Make note of the number of tenants, the overall look and condition of the park/any park-owned homes, and opportunities for expansion.

Let realtors in your area and mobile home park owners know you’re looking to make an investment, too. You never know who might have an insider tip on an owner looking to make an exit.

Perform Due Diligence

If you’re serious about buying, you’ll need to see the operating expenses and income for the park. Run your own numbers first anyway so you’re in the best position to negotiate.

Follow these steps for a fair valuation:

- Start with average monthly lot rent (not home rent) and multiply this by the number of paying occupied lots. Subtract any delinquent lots.

- Multiply that number by 12.

- Estimate or include actual operating expenses. Convert that number into a decimal (for example: 50% operating income is .5). Multiply that by what you got in step 2.

- Divide by your cap rate.

The final number you get is your land value pre-repairs.

Here’s an example:

$250 lot rent x 62 paying lots x 12 months x .6 operating income/.07 cap rate= $1,594,285

Conduct a thorough evaluation of all the properties, especially those owned by the park. An inspector should take a look at electric, sewer/septic, water lines, gas lines, etc.

Subtract your estimated repairs and other risks (such as private utilities) from the number you got above.

Get the most accurate numbers by getting all the financial information you can, including the rent rolls, profit and loss statements, and anything else that helps you make your decision.

Navigate the Purchase Process

Make an offer once you’ve gathered all your numbers and completed market research. A project profit and loss statement breaks it all down, including any assumptions you’re making, like operating expenses.

The next step is to determine financing. Your three main options for purchase are:

- Your own cash or funds from private lenders

- Bank loans or SBA loans

- Seller financing

If you go the private lender, bank loan, or SBA loan route, write a full business plan. Include proof of existing revenue. If you can show existing cash flow from a park, loans are easier to get. Bank financing will take longer than a cash closing.

Go in with a strong offer, but prepare to negotiate. If you’re far apart on price, you may need to share some of the research you found with the current park owner. This is especially important in a seller financing deal since you will pay the seller back over time with your revenue.

Finding liabilities will help you negotiate.

If they assume everything is in great shape and want top dollar, bring up the problems you’ll be stuck with. Show them reports that the septic system needs repairs. Or point out that most of the park-owned homes need upgrades.

Start Running Your Mobile Home Park

Let’s keep it simple: one way to learn all the ups and downs of owning a mobile home park is to do it yourself.

But that’s not necessary.

Hire an experienced operator to serve as park manager. Hiring someone who knows what they’re doing will be the key to whether you can run this hands-off or not.

Look for someone who understands these issues and can create clear systems for:

- Handling utilities and other infrastructure maintenance

- Creating and enforcing rules and regulations within the park to maintain a safe and comfortable community for residents

- Handling tenant-related issues and evictions

- Refurbishing and maintaining mobile homes within the park

- Managing the upkeep of the common areas of the park

- Marketing new or vacant lots in the park

Don’t rush to hire someone until you’ve vetted them. You’ll pat yourself on the back when this runs without you onsite.

Dive Into an In-Demand Investment in Mobile Home Parks

If you find the right location, complete all your due diligence, and identify a worthy park operator, you may look for new parks to own as you grow.

Owning a mobile home park provides reliable income for you, but it also makes affordable housing accessible to the millions of Americans who need it.