RV Parks: A 21st Century All American Disneyland.

It all started with a phone call, from my friend Mike Dillard.

He said, “Hey Codie, just bought a big RV. I’ve called 10 places in Austin and I can’t get space to put the mfing thing anywhere?!”

My spidey senses went off. Is there an opportunity in them there parking stalls?

The secret to investing is one equation:

Demand > Supply = Opportunity

Opportunity is all around. People don’t want us to realize that today, but there has NEVER been a better time to be alive. You just have to turn off Fox/CNN and turn on your mind. The problem is the narrative is everywhere and we are blinded by it. So first, a rant, take opportunistic bets…

RANT: I Don’t Gamble, I Make Bets (my man’s saying)

I was in Las Vegas this weekend and saw something that stuck with me.

A sea of humans glued to machines desperately hoping for a chance to win. There were slots as far as the eye could see. Humans tangoing with lady luck. Despite the bright lights and blaring music, it made me sad. There is a chasm of difference between betting and gambling. Gambling is being a pawn. Sitting down like anyone else at that casino and hoping with a pull of a lever someone smiles on high. But look around, the odds are not in your favor. Why? Follow the money.

- The average cost to build a Las Vegas Casino on the strip is $1Billion+

- $8.5 billion to build the CityCenter, Aria, Mandarin, Crystals Mall and Veers Tower

- MGM cost $1.9 billion

Do you think they build billion-dollar casinos by losing money? Of course not. Casinos are built by those who win by betting on those who lose.

Don’t gamble, take bets.

The Bet On RV’s

That one phone call led to a hunt for RV storage spaces. Which drew us to unexpected places filled with celebrities, wibits (ya that’s a thing), people making millions off of glorified parking lots and a deal.

This week, in <10 minutes, we’ll talk about earning with RV’s:

- Opportunity in RV parks Is the sh*tter full? (Name that reference)

- Why the space is booming A new way to play real estate

- One crew making millions off RV parks case studies and numbers

- How do they do it? Do I smell a playbook?

- How I’m going to play it 3 ways you can play it with little or big bucks

THE RV Opportunity in 30 seconds:

Has anyone else actually thought about picking up roots and going all #vanlife? Apparently, you are not alone. Although, is anyone actually that happy in 10 sq ft w/ a small child all day? I call lies.

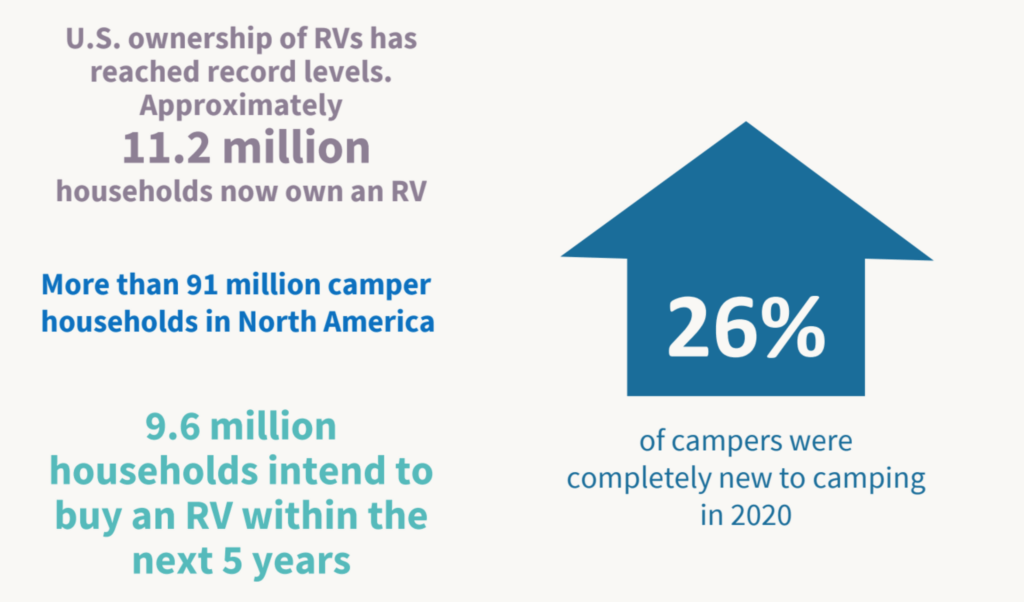

At first, I thought this phenomenon was born of Covid and would die out as we can return to the air and far-flung locales. But it turns out this is a 10-year phenomenon in the making. Here’s why I’m intrigued:

- RV industry is very fragmented (no big Blackrock’s bulk buying), a bunch of mom and pops

- RV parks are similar to the self-storage industry 25 years ago, aka it’s early and not overbuilt

- Apparently, Americans are into camping: 42 million people camp yearly

- Demand is WAY higher than the supply

- In fact, of the 8,750 privately held US RV parks, 94% are owned by owners of less than 5 properties. That means they aren’t pros with scale who are hard to compete with

- Nothing goes up forever. Always prepare for the downside and this industry looks recession-resistant

- In 2008-2011 the industry was up 5% while all other RE asset classes went down

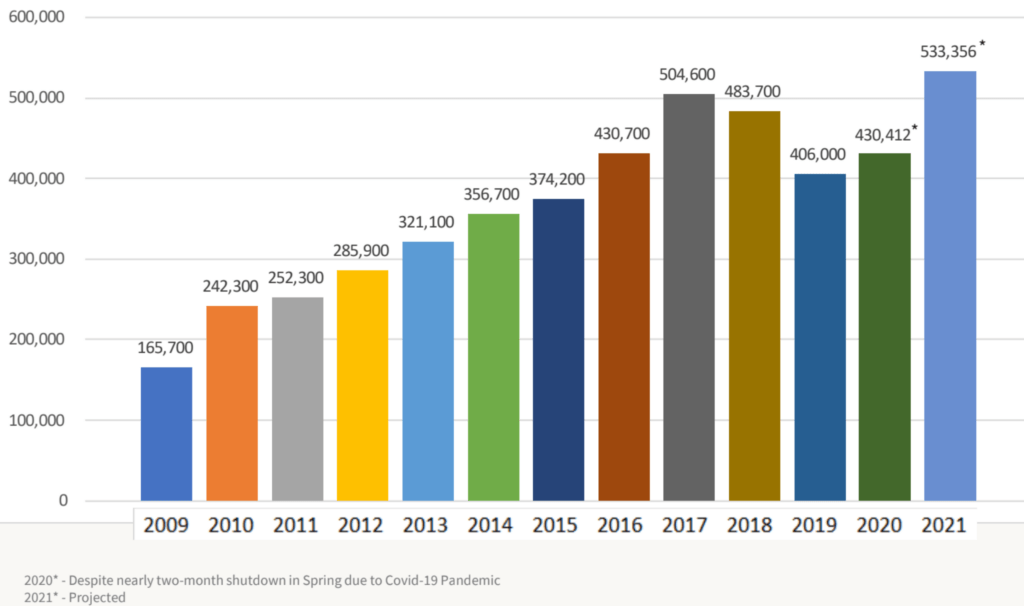

- Demand for RV Sales over the last 10 years is up more than 100%

One Crew Making Millions: RV Park Millionaires

So I talked to the guys at Great Escapes who played in self-storage for 25 years reportedly giving investors 7x their money. Not bad. They moved into RV parks in 2019 and now own 7 parks. But these are not your average parks. They buy an RV park that may look like this…

To one that looks like this…

Their belief is that the future of RV parks is full of floating jungle gyms, water parks, killer locations, and amenities somewhere between Disneyland and a resort. This means when they take over they increased revenue by anywhere from 41%-200%, fascinating.

How Are They Doing it?

High-level it means to glamp it up. Turn something low-cost into a mid-cost experience.

- Expansion = more sites on the property

- Increased Rate & Occupancy

- Resort fees – add new amenities = new revenue lines

- Renovations – patios, doggie dens

- Add glamping sites

- Food trucks etc.

These are just some of the secrets, if you want more we’re doing a full playbook on this AND how we are playing it with an investment opportunity. But since we love ya’ll here are some models and how you can play it.

3 Ways to Play It:

In order from the largest dollar amount, largest return, to the smallest; 3 ways to play RV land. For the curious, I’m going with door #3 to invest in myself.

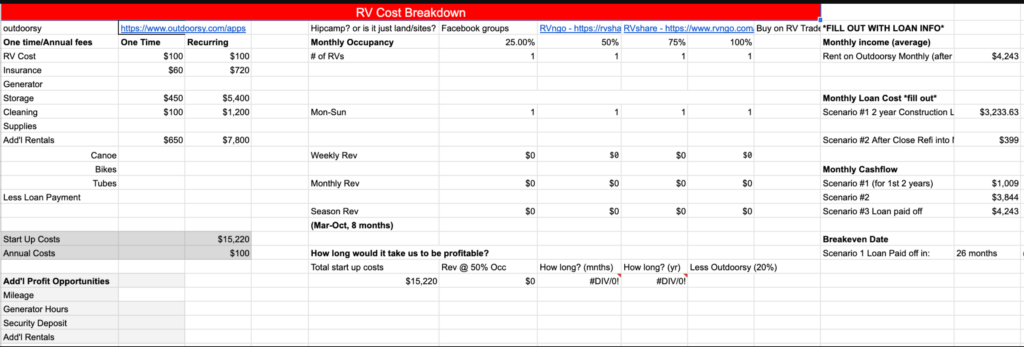

1) Buy an RV And Rent it On HipCamp

Let’s start with the simplest and least expensive model. Buy (or rent and sub rent out) an RV for anywhere from $10-$100k and rent it out to others. We’ve written about this before here: Hipster camping and a mobile wine truck version. I’d follow our playbook for hipster glamping, buy some cheap land, or rent a prime spot, put the RV on it, list it on Airbnb or Hipcamp, and start to cashflow.

Expected Return: Estimate about $2-4k profit per month if done well

Expected Upfront Cost: $3k-30k

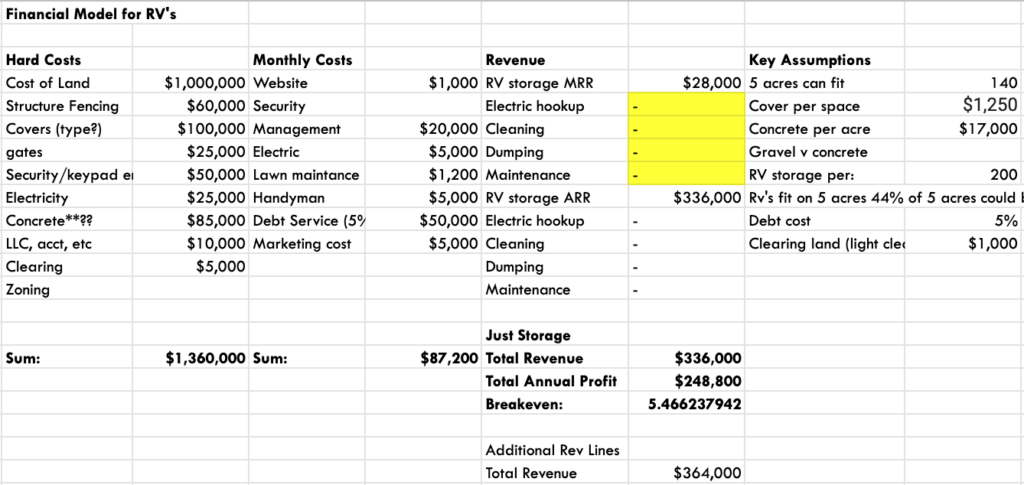

- Buy Land for RV Storage or RV Park

Our original plan was RV storage. Buy land, add some gravel and overhangs, rent it out and make Mike happy that he doesn’t have to pay $250 to someone besides himself. Quickly we realized a slight problem: RV storage is not the best use of land. It’s why you see a self-storage unit on more corners than 7/11’s and not a ton of RV storage lots. They take up a lot of room, and you can’t charge the same amount. Here’s a model we used, this first model is hyper simplified but does the job.

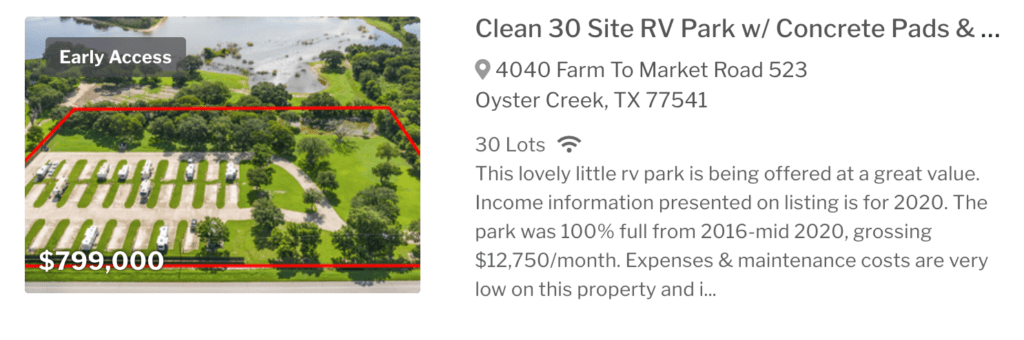

Instead, we got more intrigued by RV Parks outright. You can store them there, but you can also rent them out with much higher returns and margins. This RV park below makes about $61,000 a year and is for sale for $799k.

The second model is much more complex if you want to get into the nitty-gritty.

Expected Return: Estimate about $10-100k profit per month if done well

Expected Upfront Cost: $800k – $5+ million

3. Invest in a Fund & Watch the Pros

Before I invest in an asset class I typically like to invest in a diversified fund to learn. Much harder to lose money if you own multiple assets with a group of professionals instead of going it alone. Then once we have the model down we will invest or buy our own. That’s when you get into generational-style wealth by owning the assets outright. However, it’s also where you can lose your shirt. And no one needs to see me topless.

Expected Return: Estimate about 20-30% IRR (your return on investment)

Expected Upfront Cost: $25k – $100k

And just like that, 4 wheels… 4-7 figures.

They see me rolling… they hating…

Question everything and get rolling,

Codie & Your Contrarian Crew

For the TL;DR, watch this brief overview video