Plus: A Crazy Prediction & How He Grew to $700k ARR in 4 Years

Today in < 10 minutes → We’re Going to Dive into:

- The soapy business pulling in $700k

- How this college senior bought cashflow for $1k

- From working IN the business to working ON it—How he pivoted to a remote owner-operator model

Contrarian Rant

I have a crazy prediction.

In the future, buying and selling businesses will be as easy and as common as buying and selling houses. We are currently in the first innings of what will be a revolution. Democratization of asset purchases done in the form of business purchases.

Historically speaking, doing M&A used to be for the big leaguers alone. The Wall Streeters. The titans of private equity. Today, not much has changed. Business acquisitions can still be expensive, daunting, and time-consuming.

Like it was for me this week.

- I flew across the country to close a $6.6M deal that does $1.45M in annual profit with projections to double that.

- In the -5 degree weather after a 5 AM wake-up call to get on a flight and hours combing through presentations and site visits, we get into their actual books with the real numbers.

- $400k *adjusted PROJECTED earnings.

- That would mean we would invest at 15x the profit of the company in a company that has 20% margins and is barely covering its cost of debt.

- Aka – not a good m-fing deal.

For all the wins I talk about in business buying, there are at least 10 huge whiffs. Sometimes even after doing innumerable deals, I just want to go crawl into a hole too.

But here’s the truth, that won’t last. It will get easier and faster exponentially.

For example:

- There’s Openstore.com – Allowing e-commerce businesses to be bought in a matter of weeks just like Opendoor.com did for real estate houses.

- Then we’ve got Flippa a true marketplace like MLS or Zillow for online properties (aka websites, e-comm, etc) to be bought and sold in a few clicks.

- Quiet Light Brokerage acts more like a high-end real-estate brokerage like Christie’s or Sotheby’s for vetted online businesses.

People LOVE to tell me right now why the average person can’t buy a business.

They love to say I make it sound too easy. They LOVE to question the numbers. They LOVE to tell me why every industry won’t work despite the literal case studies, sites, financials, P&Ls, etc that we share.

This is the peanut gallery in 2 images. (Welcome to my life).

Why such cognitive dissonance?

Because innovation starts slower than you imagine and then happens faster than you think. Most people are too caught up with their own experiences to anticipate a different future experience. I get it. But I don’t agree with it.

Just you watch, internet. Save this lovely little blog post for another 3-5-10 years and come back and see if my words reached God’s ears. I’d hazard they did.

Doing deals isn’t cool. Doing deals well is cool.

How Did A 23 Year Old Close Two 6-Figure Deals?

Enter the SqueegeeGod

Meet Johnny Robinson.

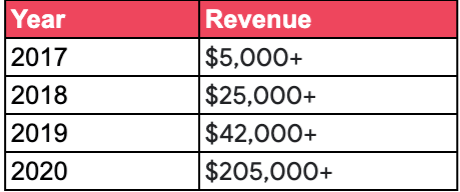

A 23-year-old college senior running a bootstrapped window cleaning business. His revenue this year alone? Close to three-quarters of a million. And his profit margins? 25% of that.

With 2 business acquisitions under his belt, a payroll of 10+ employees, and a well-optimized operation, Johnny apparently had a different college itinerary than I did.

But he wasn’t always this way.

In fact, 4 years ago, he was anything but entrepreneurial. Born into a family of 9-5 workers, Johnny’s notion of a career was the one we all know.

Go to college. Get a job. Then work for 40+ years while inflation and debt slowly chip away at your earnings.

And that was what he did. Or at least, started doing it.

Realizing he wasn’t cut out for the 9-5 rat race, he teamed up with his childhood buddy and started cleaning windows. Their total start-up capital? $150.

After two years of treating the business as a side hustle, Johnny flew out to Dallas for an internship. His first taste of corporate America.

But after a grand total of three weeks, he was done.

Returning to his Orange County home, Johnny rolled up his sleeves and decided to take his window cleaning operation seriously. And if I’m looking at his numbers right, he clearly did.

2020 was when things really got interesting.

What was once a two-man show had grown into a full-blown business with marketing, lead gen systems, and five W2 employees. To top it off, they had managed to 4x their revenue from the previous year…while balancing online classes and a lockdown.

Not bad for a couple of 20-year-olds, eh?

Pulling Off The Ultimate Seller Financing Heist

A few weeks ago, I posted a tweet that ruffled some feathers.

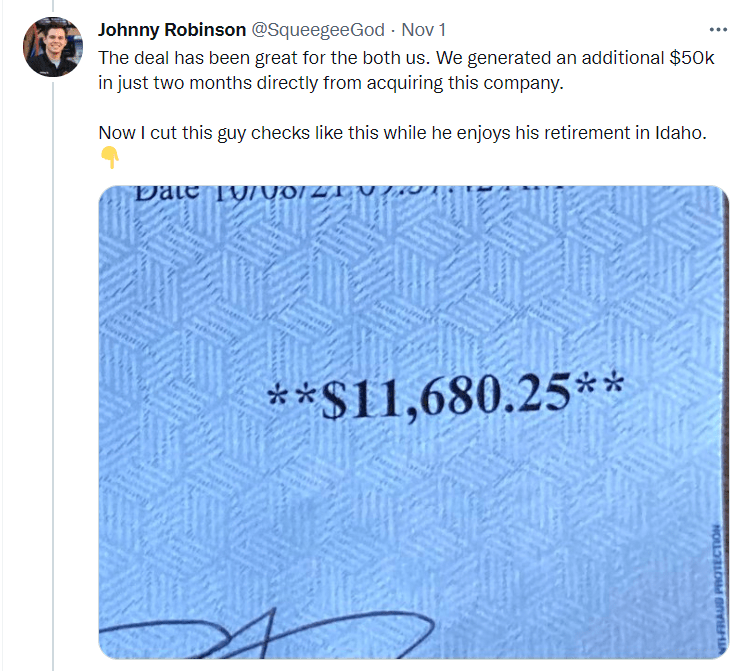

Johnny’s 2021 acquisition confirmed my theory.

In summer earlier this year, Johnny got a call from an insurance agent with a deal for him.

You might be wondering. How does a 23-year-old have an insurance agent in his corner?

Because he networks.

Johnny belongs to a BNI-style group where there’s only one member of any profession.

And in line with the group’s rules, whenever members meet someone who needs certain services, they can ONLY refer to their fellow members who offer the corresponding services.

Think of it as an outsourced sales force where the only currency is shared referrals.

Moving on, the insurance agent told Johnny he had a Medicare client who was looking to sell his window cleaning business. The seller was a 60-year-old man eager to hang up his hat due to health reasons.

Johnny worried about being able to do a buyout but got curious.

He arranged a meeting and found the seller’s business had been consistently generating $200k+ in revenue over the last 3 years.

But there was a problem.

Johnny’s seller was out of touch with the market. For one thing, he was charging his clients way below the market price. If Johnny was to buy those accounts and raise prices right off the bat, he would most likely lose much of that business.

He also couldn’t afford to raise his prices slowly.

So, Johnny made an unconventional proposition.

He suggested that for every client of the seller that converted into Johnny’s, he would pay 15% of that account in their first year. Then, 10% in their second and finally, 5% in their third.

Needless to say, tempers flared.

Negotiations stretched on for three months.

But with a little patience and a whole lot of educating, Johnny was able to close the deal.

While he did raise the first-year commission on commercial buildings to 25%, he ended up putting down only $1k upfront. For goodwill.

And the seller?

Talk about a win-win.

The best part of this is Johnny now builds in public. He’s done 2 M&A deals. Built a business to almost 7 figures in revenue. Hosts a podcast. And has a pretty phenomenal Twitter account if you’re into entrepreneurship through acquisition or ya know, window cleaning.

From $205k to $700K: How He Scaled & Pivoted To A Remote Operation

It’s All About Reputation

Here’s a question for you. How many boomers do you know that are tech-savvy? Sorry, Dad but typing with your index fingers doesn’t count.

Household services as an industry are filled with our parents. But while the rest of the world is going nuts over the metaverse and crypto punk NFTs, how many of them do you think are maximizing the online world?

Hell, I could barely figure out how to set up my Solana wallet.

Which is more likely…that a 60-year-old plumber records his revenue on Quickbooks, APIs into Stripe, with auto subscriptions and an SMS text reminder system? Or that he has an 80’s binder chock full of checks, receipts, and whatnot?

By leveraging tech tools in a space that’s otherwise antiquated, Johnny was able to exponentially increase his profits. Starting with reviews.

Even when his business was just him, his best friend, and their Toyota RAV4 Jalopy, Johnny was always particular about getting good reviews. Fast forward four years and he’s glad he was.

Here’s why.

Showing up in the top 3 of Google My Business = More Organic Leads = Free money.

But how do you climb that high?

The billions are made in the boring.

Rather than using word-of-mouth to ask his clients for reviews, Johnny set up a drip campaign.

By integrating NiceJob with his CRM, his customers got an automated SMS text immediately after their job was finished, leading them to Facebook/GMB to leave a review.

If that went unanswered, the SMS text was followed by two well-timed follow-up emails, each asking for a review.

Did it work though?

You tell me. In less than a year, they added 300+ reviews across Yelp, Facebook, and Google and claimed the No 1 spot for ‘window cleaning’ searches in their area. Their review count is so high that it’s 3x more than those of the next two companies combined.

With that kind of social proof, it’s no wonder why their sales pipeline is never dry.

Switching from W2s to 1099s

We’ve established that Johnny had no problem attracting new business. But what if he was attracting too much?

Believe it or not, that was once a problem for Orange Window Cleaning.

With dozens of leads in their pipeline, Johnny was booked as far as six weeks out. Which is longer than anyone would wait for their windows to be cleaned.

Day in and day out, Johnny, his co-founder, and their five in-house employees, were out on the field working as efficiently as they could. But even that wasn’t enough to keep up with the demand. Bookings ended up getting canceled every which way. And to top it all off, the founders realized they were burning themselves out.

The duo considered hiring more W2 employees. But it would have cost too much time and money to train new hires. Especially with the ongoing labor crisis.

Shoutout to McDonald’s for… ahem, early exploitation?

So they switched to the next best thing. Subcontractors.

By outsourcing their workload to smaller window cleaning companies, Johnny’s entire operation took an uptick.

For one thing, the subcontractors came with their own trucks and equipment…which translated as less overhead costs for Johnny. Plus, the 1099s consistently outperformed his W2 employees while maintaining the quality of work he was known for.

After testing a hybrid model for several months, he went all-in on subcontractors. All he had to do in return was split the outsourced accounts 50-50.

Now, with four subcontractors under him and a VA in the Philippines remotely managing his bookings and subs, Johnny works less than 5 hours every week…while cash flowing $100’s of thousands.

Ain’t that something?

Question everything and stack squeegee sticks,

Codie

Contrarian Mind, Body, Bank Giveaway (10K Value)*

We have a motto here at Contrarian Thinking

Civilize the MIND.

Make savage the BODY.

Build the BANK ACCOUNT.

Each pillar is designed to help you level the f up in your journey to financial and philosophical freedom.

And we want to share that motto with as many people as possible.

To do that though, we need your help.

This is why from December 6th to December 17th, we’re running the Contrarian Mind, Body, Bank Giveaway, where you can win a package worth up to $10,000 just for referring some friends to sign up for the newsletter.

Here is how it works:

1. Subscribe to the Contrarian Thinking Newsletter

2. Share your unique referral link with your friends for more entries to win

Note: When you subscribe you will get a welcome email with your unique referral link. If you are already a subscriber just go back to a previous email from us and your referral link is at the bottom.

3. On Dec 18th we announce the winner!

What can you win???

For the mind – our top books on investing + an Oculus VR

For the body – an Apple Watch Series 6

For the bank – $1,000 cold hard cash

So stack cash, and get referring!

*no purchase necessary. For all rules, visit – https://contrarianthinking.co/contrarian-mind-body-bank-giveaway-rules/