Hi Contrarians,

Ever heard the term “silver tsunami?”

No, it’s not referring to some massive surge in silverware sales or some Hawaiian seniors’ surf competition (as much as we’d all love that).

But it is referring to an AARP armada — an aging population and its impact on society, healthcare, the economy, and, for us, small business acquisitions.

Today we’re here to discuss the latter.

Today in 5 minutes or less, you’ll learn:

Small business owners are getting older…

Many experts think America’s silver tsunami will have a HUGE impact on small business acquisitions.

So let’s take a look under the hood, shall we?

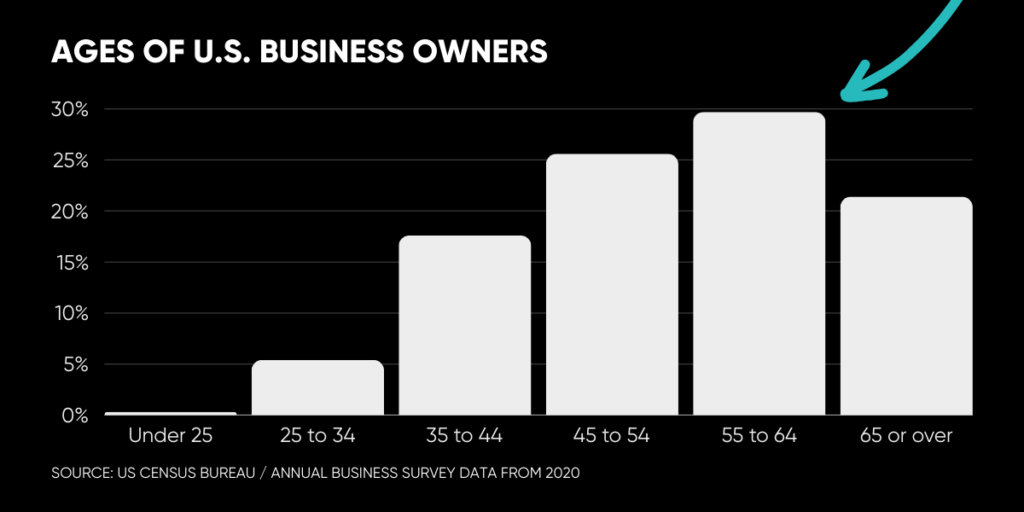

Yup, definitely skewing up and to the right.

To an extent, this makes a lot of sense. If you’re older, you’ve had more time to launch or buy businesses, so of course most business owners are older.

But think about this for a moment.

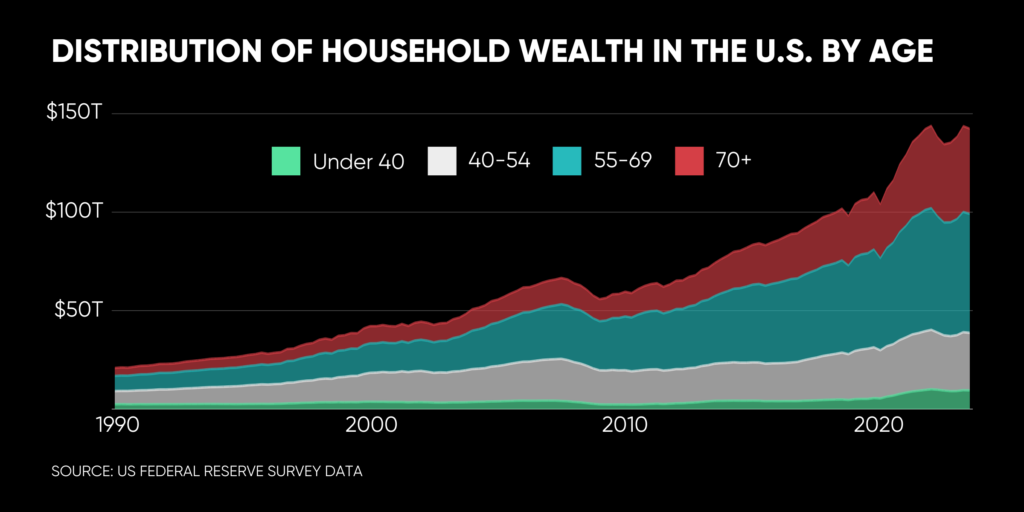

Some 17% of the U.S. population is over 65 years old, about 55.8 million people.

Despite representing less than a fifth of the country, they represent a TON of the wealth.

Per the US Census Bureau, the boomers alone own an estimated 2.34 million small businesses in the U.S., employing more than 25 million people.

We’ve got a lot to learn from them, too — the vast majority of boomer businesses are profitable, according to reports.

At the same time, here’s the truth: They’re getting ready to pass the baton. Many already are, even if they don’t know it yet.

Experts estimate that roughly 10,000 Baby Boomers retire each day.

Think about how many might want to soon but aren’t quite sure how.

- How can you sell a business if you are the business?

- And even if your business can operate without you, it still may be tough to find a buyer

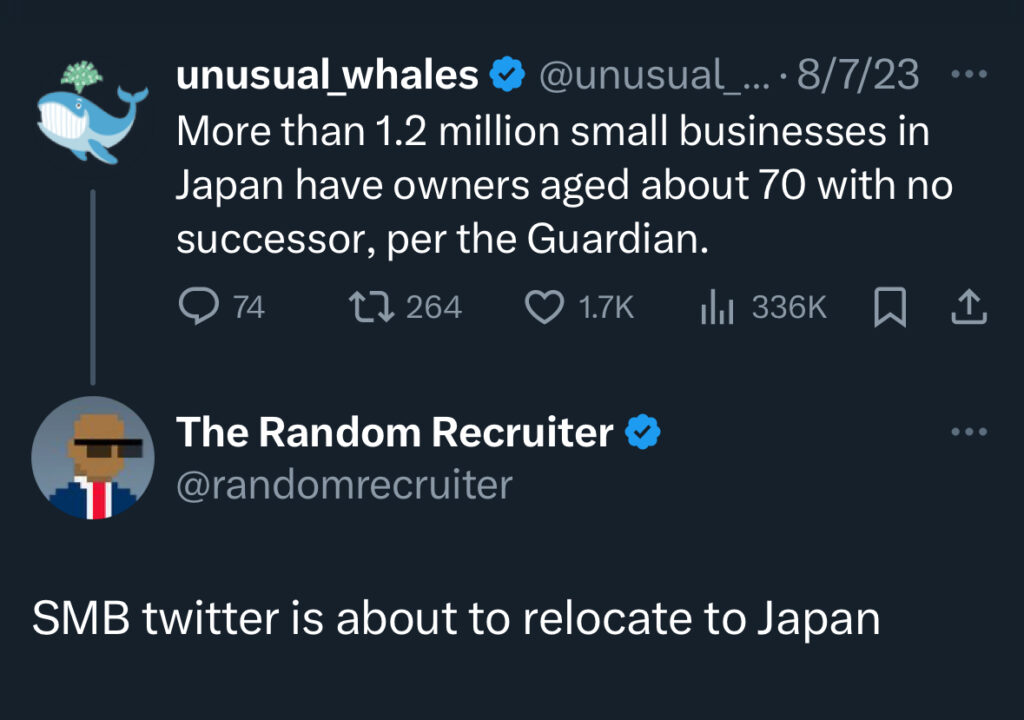

This is becoming an especially challenging issue in other countries, like Japan.

This is a critical problem — and opportunity — for us to confront, and we will confront it by elevating people’s capacity to become owners.

Locally-owned biz’s are said to recycle 3 times the money back into local economies than “absentee-owned firms or corporate chains.”

So it’s critical we do.

Thinking about buying a biz?

You might want to join this list…

(By the way, no one else has heard about this yet…)

One of our favorite ways to take advantage of the boomer small biz boom is seller financing.

Right now, we’re working on the finishing touches of a program to teach you all about it.

Whether you’re new to biz-buying or already have a few biz’s under your belt, this course will offer hands-on tips, real-life case studies, and practical strategies to help you learn how to fund deals with “Other People’s Money” (OPM).

Be among the first to know when it goes live:

Why you should give a damn (look at the data)

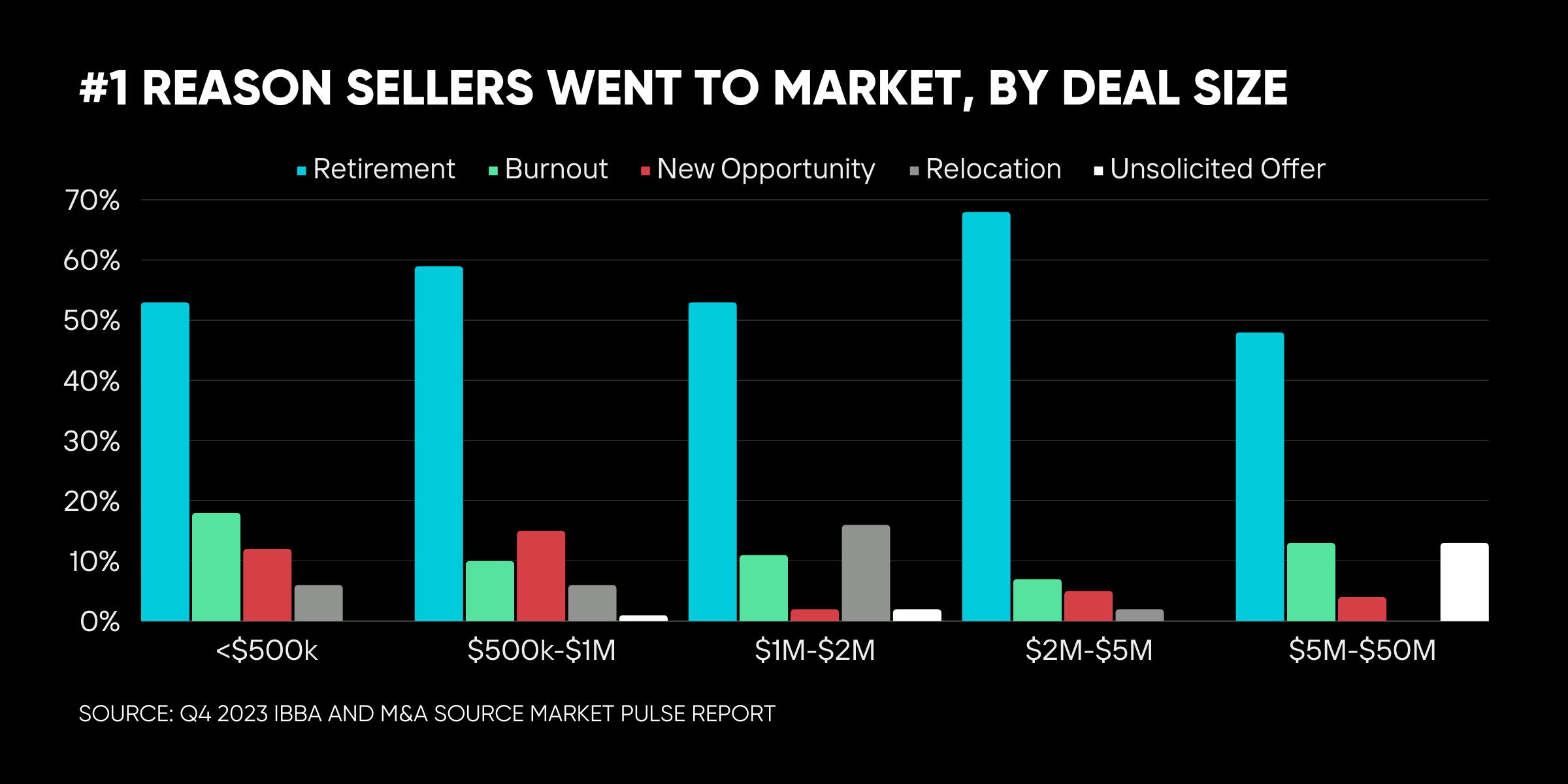

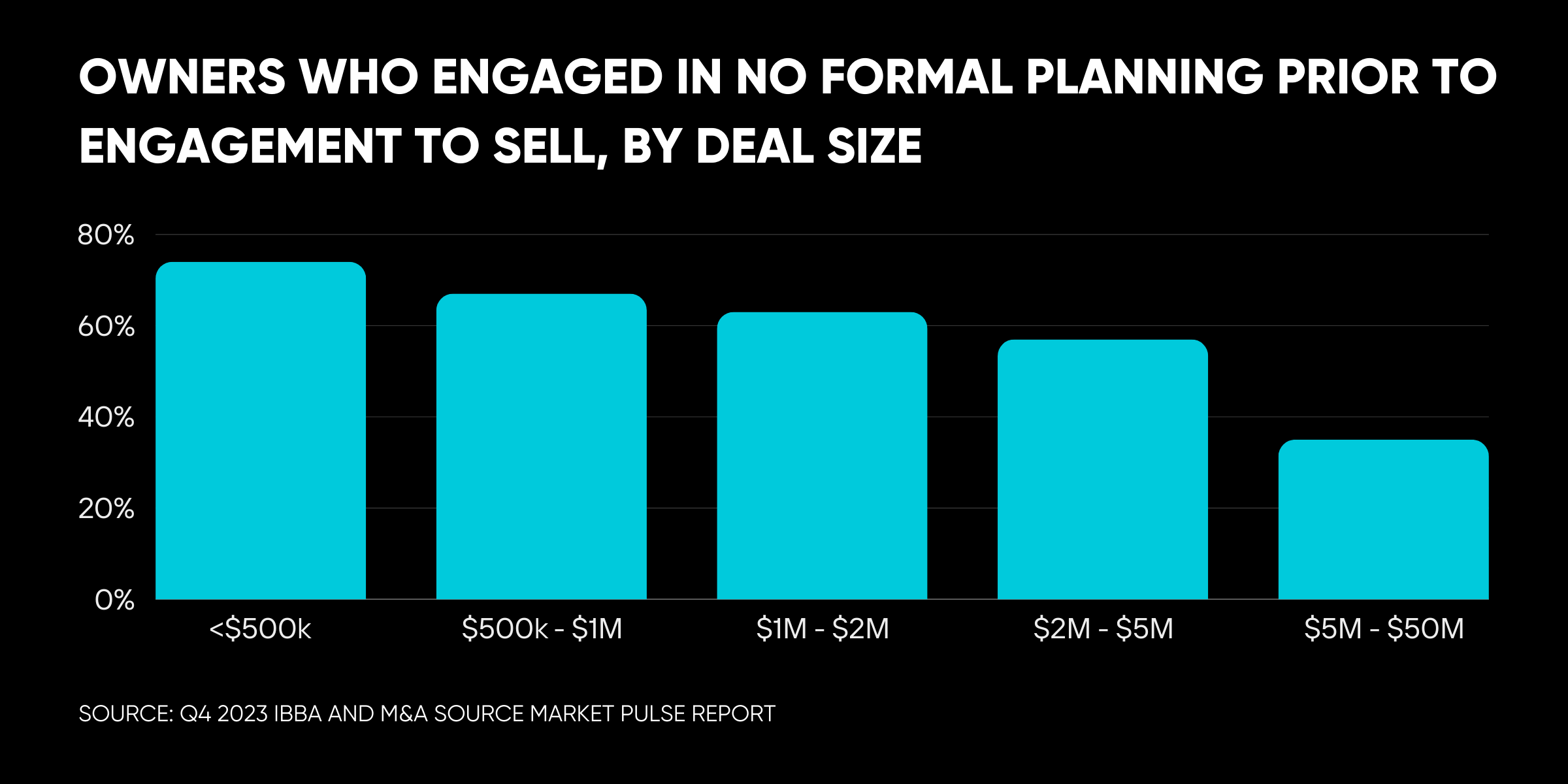

Here’s the deal: Most business owners DO NOT have a succession plan in place.

That much is clear.

Recent survey data on hundreds of American small businesses from Live Oak Bank found 70% have no real succession plan, yet nearly 1/3 plan to transition ownership within 5 years.

Additionally, Live Oak found that 26% have accelerated transition plans due to the state of the economy.

Many aging business owners will soon be looking for an out. What do these people care about when they sell? According to the research:

- 43% care about the preservation of company legacy/integrity

- 24% care about the price they can sell at

- 22% care about the next owner’s treatment of their customers and employees

It’s no longer as simple as handing off a farm to your kids for them to manage.

(Not that that’s ever been particularly simple…)

So say a buyer commits to those items above, that could be all an owner needs to hear…

Across the board, as passing on a business to your kids becomes less common, other options will probably increase in popularity.

5 things to think about before you ride this wave…

1. Don’t lose sight of reality

While many existing businesses will likely go up for sale in the coming years, they certainly aren’t all going to be good businesses, and they certainly won’t all be available at good terms. As you already know, terms are king.

2. Business ownership isn’t for everyone

Hang on, let us repeat that: Business ownership 👏 is 👏 not 👏 for 👏 everyone.

Hiring good talent, firing people to their face, managing terrible customers, making loan payments, meeting payroll… A good portion of the population is simply not built for that.

3. Know what you’re getting into

Sure, there’s a Harvard MBA out there who thinks he can roll up 3 HVAC businesses in Bismark, North Dakota no sweat, mix in some digital marketing, and call it a day. Maybe he can.

But maybe he doesn’t even know what HVAC stands for yet, let alone how to operate a screwdriver. Know what you’re getting into.

4. Don’t assume all boomers will sell

Some owners may opt for the stable cash flow and choose to hold on to their businesses as long as humanely possible.

This could present a major opportunity where “sweat equity” comes into play, meaning, you could partner with (and work for) an aging owner in a way that sees your compensation and ownership stake grow over time.

5. Call in the military

In the U.S., hundreds of thousands shift from active military service to civilian life every few years. According to the Bureau of Labor Statistics, “Veterans are 45% more likely to be self-employed than non-veterans.”

As owners across the country seek out compelling buyers, this group could stand to benefit big time — if they act.

SO not boring…

It’s so over: OpenAI debuted a truly unbelievable text-to-video AI tool

This is cool: We recently invested in a company called Sunset… check it out

Reminder: Want to be in the know when our new course drops? Sign up here.