Hey Contrarians,

Please, for the love of all that is holy, do NOT buy a business.

What? Codie, you literally won’t shut up about buying businesses?

Yes.

But I mean it, please don’t buy a business.

Let me explain…

Today in 10 minutes or less, you’ll learn:

✔️ Contrarian framework: Opportunity vs Ease

✔️ My 2 rules for business-buying

✔️ What a bad deal looks like (ft. my worsts)

✔️ Bare minimum need-to-know terms to CYA as a business owner

✔️ The only circumstances where I’ll let you buy a business

CONTRARIAN FRAMEWORK: OPPORTUNITY VS EASE

Most people will never understand the pain and grit it takes to be a business owner, founder, CEO, or head honcho.

Explaining it is like trying to explain why some humans choose to be Navy SEALs. Why they claw through dirt and muck and sweat and tears to pin on a gold trident.

Business is not war, but it sure can feel like a battle. The thing is, we can’t all be Navy SEALs. But we can have ownership – or skin in the game – of business. In fact, some of us are just absolute psychopaths, so unemployable the only option is entrepreneurship.

If you’re reading this, you may be one of those humans who understands. But I want to make sure of one thing…

Don’t mistake opportunity for ease.

There’s a massive opportunity in biz-buying. A generational-wealth-creating opportunity.

But that doesn’t mean it’s not work. That doesn’t mean there’s no risk.

It’s only worth it if you are consistently good and consistently work hard. That is what it takes, nothing more, nothing less.

MY 2 RULES FOR BUSINESS-BUYING

There are really only two rules. But the thing is, they are everything.

1. DON’T LOSE MONEY.

Warren Buffett famously said, “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.”

We do not buy businesses as charity, though they can do good. We buy them for cashflow.

- If the business is not profitable, we do not buy it.

- If we are not sure the business will keep being profitable, we do not buy it.

- If we are not sure we understand the business and thus are not sure if it’ll be profitable, we do not buy it.

We do everything possible to follow rule #1.

2. DON’T BUY A BUSINESS THAT CAN BANKRUPT YOU.

Please repeat back rule number one to me.

Then, let’s add the idea of existential threat.

Bankruptcy.

In my 15 years of buying businesses and 3,000 students going through our education, I have only ever seen 1 person actually go through bankruptcy from buying a business and 2 students flirt with it. Their faces still haunt me. They knew the risks. They were adults. They’d run businesses before.

Nine times out of 10, bankruptcy can be avoided. Yet, it CAN and WILL happen again.

Business is a risk. A big one. And your very first job is DO NOT LOSE MONEY, but especially do not run out of money entirely. Every time you get excited about a deal, refer back to this rule.

YEAH, NO SH*T WE DON’T WANT TO LOSE MONEY OR GO BANKRUPT

That sounds awful. It’s no entrepreneur’s goal going in to lose everything.

But how do we take risks, grow, and get in the arena without losing our shirt?

Well, you can start here…

BARE MINIMUM NEED-TO-KNOW TERMS TO CYA AS A BIZ OWNER

If you don’t know these terms, you aren’t ready to buy a business yet.

If you don’t know these terms AND how to put them to use, you aren’t ready yet.

Please read sentence 1 and sentence 2 again.

This isn’t to say you’re not smart, or you won’t be ready someday. You just aren’t ready yet. You need to learn these things.

Then, if the song of freedom sings to you loud enough to cover up the pain it takes to get it, you can buy a business.

This is the part where you turn your learning brain on:

- Business reporting terms: 13-week cashflow statement (and how to use one), company scorecard, P&L, capitalization table, cash burn rate or runway, EBITDA.

- Personal finance terms: Net worth, accredited investor, debt-to-assets ratio (and what yours is), cashflow, total liquid assets. You also need to know all this info about a business before you get within a mile of buying it.

- Downside scenario planning: If a biz goes sideways, what your worst-case scenario is (and how to create it).

- Payment terms: 50% upfront, installment agreements, lines of credit, CIA: Cash in advance or immediate payment/payment due upon receipt (when does the money hit your bank account?), PIA: Payment in advance, Net 7, 10, 15, 30, 60, or 90: Payment expected within X days after the invoice date, EOM: End of month, COD: Cash on delivery, CND: Cash next delivery, CBS: Cash before shipment.

- Due diligence terms: LOI, purchase agreement, operating agreement, add-backs, break-up fee, data room, due diligence questionnaire or checklist, guarantees, historical lawsuits.

- Debt terms: Interest (variable vs fixed), SBA loans, debt service ratio, warrants, buy-out provision, closings, debt service cost, promissory notes, lines of credit.

- Business operating terms: Budget, capacity planning, quality assurance, supply chain, procurement.

- Revenue: Did you know revenue is not actually one thing? It could be couched in many ways, such as net revenue, net income, gross revenue, gross income, profit, cashflow, SDE, owner’s salary.

- Investing terms: Fund term, investment period, LP, GP, distribution waterfall, GP or LP clawbacks, catchups, capital calls, in-kind distributions, management fees, closings, fund expenses, gates, lockups.

- Business acquisition terms: Key person provision, owner transfer period, noncompete, indemnification, reporting, financial reporting requirements, non-solicitation, nondisclosure.

It’s a lot, but it’s necessary. Save this list, refer to it often, learn until you have it all memorized. If you’re not sure where to start, this course is a good option.

Then, you’ll speak the language of money. And then, you’ll be a step closer to smarter deals.

But terminology doesn’t tell you everything…

WHAT’S A BAD DEAL LOOK LIKE?

Ya know what a raccoon looks like, right? Black and white striped, tiny hands, oddly cute yet highly feral.

You will develop that same instant recognition for bad deals. Let’s break down some of my stripey ones.

I’ve had three deals go bad in our groups (that I’m aware of), and I’ve had 4 deals go bad for myself. You can learn from all of them.

Want to know what happened?

OTHERS’ DEALS:

- Deal #1: 1st-time construction company

❌ Never brought the final deal to the group to review. Never got an industry expert to review it. Used all own cash, no seller financing. Bought a deal not near him. Moved states and quit his job to do it.

- Deal #2: 1st-time restaurant

❌ Never brought the final deal to the group to review. Bought a restaurant. Bought an unprofitable business. Brought on a 50/50 partner with unvested equity who brought no cash then bailed on them. Bought a declining franchise. Bought in another state.

- Deal #3: 1st-time trucking company

❌ Never brought the final deal to the group to review. (Noticing a pattern with the fails of our Contrarian Community members? It happens when they don’t use the f-ing Contrarian Community Ugh.) Used all own cash. Moved states and quit job to do it. Never got an equipment valuation. Didn’t have full set of financials. Didn’t do a 50% downside protection plan.

MY DEALS:

- Deal #1: E-commerce brand

❌ Bought an unprofitable business. Had an operator who put no cash in. Operated in a different state. Didn’t bring in an industry expert. Used all cash, no seller financing.

- Deal #2: CPG brand

❌ Bought an unprofitable business. Didn’t require weekly/monthly financial reporting. Bought in another state.

- Deal #3: Service business

❌ Bought an only-slightly-profitable business. More like a job than a business. Not enough cash to hire a great operator. No time to do it myself. Just coasting on empty basically.

- Deal #4: Home service business

❌ Bought an only-slightly-profitable business. Kind of let myself get guilted into the deal by knowing the operator well. Bought in another state. Operator not tested. Three partners in the deal (two too many).

Note: You can have all of these things exist in the business you’re buying and still win.

But damn do you have better odds if you just start with a better deal.

(Want to know what a good deal looks like? I’ve got a massive list coming at you in next week’s newsletter for EVERYTHING you need to know to make your first deal great… So you better make sure you’ve got this thing in your primary inbox, you’re not gonna want to miss it.)

THE ONLY CIRCUMSTANCES WHERE I’LL LET YOU BUY A BUSINESS

Can you confidently answer these questions?

I think business buying and building gets overcomplicated, but it really comes down to two things:

1) Does it make money?

Does the business make money, enough of it, consistently, to the level you need, with little chance it’ll stop, and enough to handle inevitable problems…

And if yes…

Are you sure?

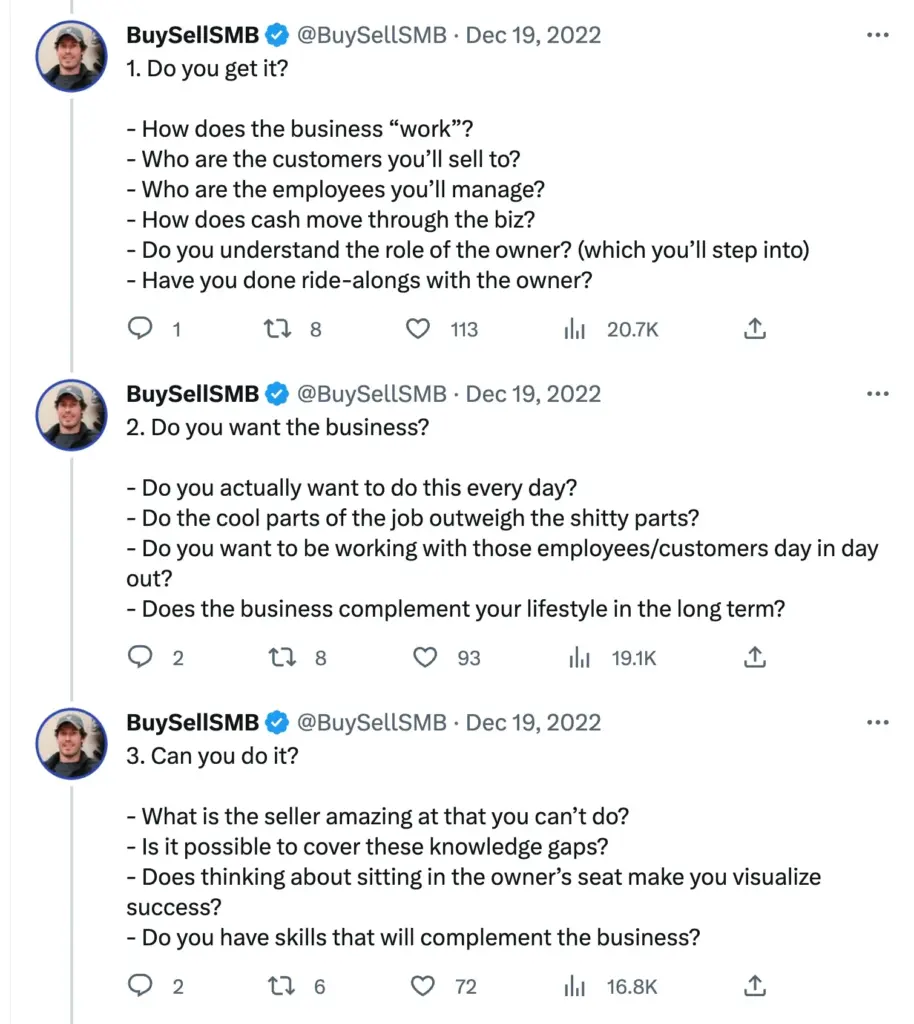

2) GWD Framework: Get it. Want it. Do it.

Well-synthesized by Will Fry, a business broker at Beacon, who has a great Twitter thread on it. These three questions stand out:

- Do you Get it? (What the biz is & does.)

- Do you Want it? (Do you want to do those things, and run this business.)

- Can you Do it? (Are you capable even if you want to do it.)

That said, inside these questions is a world of information. It’s why I obsess on sharing and distributing all I can about business buying.

FINAL TAKEAWAYS

I hope this scares you a bit.

It shouldn’t make you run away from ownership, but it should make you respect the hell out of the process. Dealmaking and buying small businesses is not easy. It can be simple, but it is not easy.

YOU have to do the work up-front to create the life, legacy, income, and business you desire. I happen to believe anyone can start and run a business, but only with the right:

Knowledge + Desire + Pain Tolerance

But I also know most people won’t do the hard. Most people will cut corners. Most people will say their due diligence is “good enough,” or they can figure it out later.

You, my Contrarian, will not be most people.

Don’t F This Up,

– Codie

Taylor is the 34th richest self-made woman & Eras is about to make $1B

Meta’s new app is respectfully called “Threads,” not “Twitter Killer“

Tennis elbow, swimmer’s ear, now introducing… Popcorn lung (worth $7M)

Economic growth is up in 2023. So is online harassment. Not related.

Money may not buy happiness, but ya can’t argue with this correlation…