Over 60% of Americans are emotionally detached at work.

Another 19% hate their jobs.

If you’re not committed to putting in the long haul with a job or company that doesn’t light you up each day, there’s another path: Entrepreneurship.

Studies show that self-employment’s picking up steam (thanks, Tim Ferriss and Shark Tank!) In fact, almost half of Americans say they want to start a business.

From being your own boss to the possibility of making more than in your 9 to 5 gig, there’s huge potential in entrepreneurship.

And it’s the perfect time! Baby boomers are exiting the market for retirement (10,000 of them hit retirement age every day). And many of them have established businesses in proven models.

Baby boomers own over 2 million small businesses.

With retirement just around the corner for them, that’s a potential for millions of businesses to go up for sale and change hands.

It’s a huge leverage moment for Millennials and Gen Z to take over those companies while leapfrogging past all the challenges new startups face.

But where to start? Which kind of business should you buy? What do you need to know before you do it?

This guide breaks it down into steps you can follow to buy the right business for you.

1. Understand Why You Want to Buy a Business in the First Place

What’s calling to you with the idea of owning your own business?

Inventory yourself. What speaks to you most? Consider things like:

- Recurring cash flow

- Freedom and flexibility

- Quitting your job and owning a business you believe in

- The opportunity to improve an existing business

- The chance to lead a team

- Hands-off ownership

- Creating a legacy you can pass down to your kids (or sell for generational wealth)

You need to know your “why” since it directs you towards certain kinds of acquisitions.

Keeping the end in mind gives you solid motivation to map out winning strategies in business.

It’s also hella helpful to know the reasons why you chose your business so when shit hits the fan you can push through.

2. Figure Out What Kind Of Business You Want to Buy

Now that you understand your main motivation, you can start creating a list of businesses you may want to buy.

There are hundreds of kinds of boring businesses with big possibilities. But do not pass go or collect $200 without following these 2 golden rules:

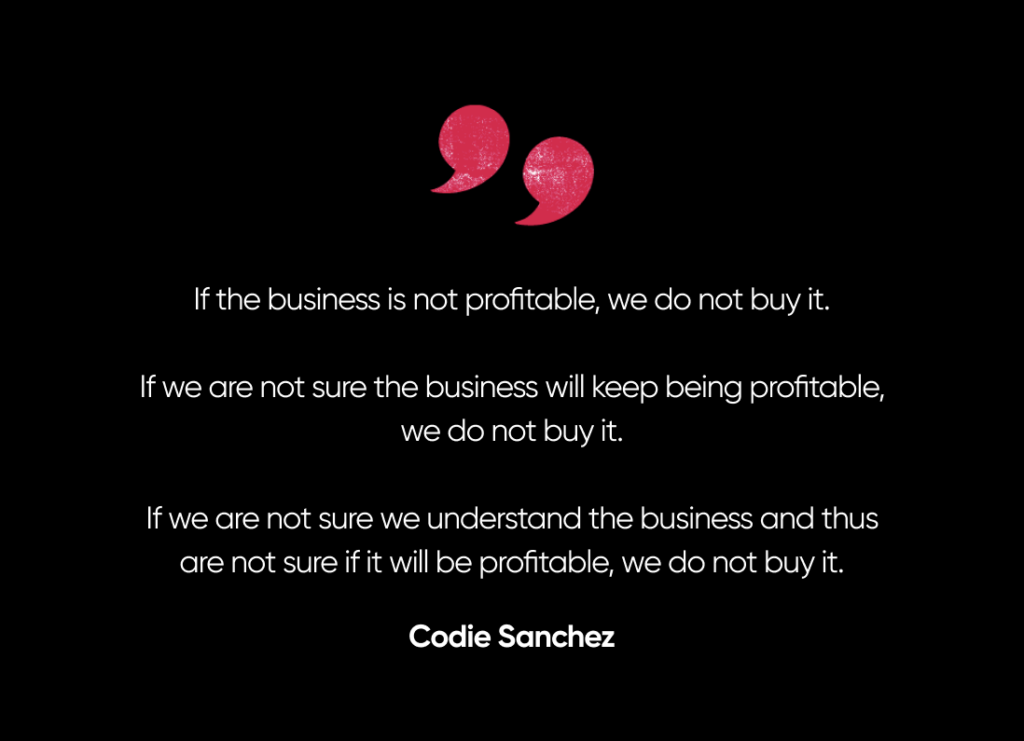

- Don’t lose money: Stay away if the business isn’t making money now, you’re unsure it will make money in the future, or you just flat-out don’t understand the concept.

- Don’t buy a business that can bankrupt you: Become a master in business reporting terms, personal finance terms, planning for downsides, and then structure your deals the right way to keep yourself safe.

Makes sense, right? But how on earth do you find the right businesses?

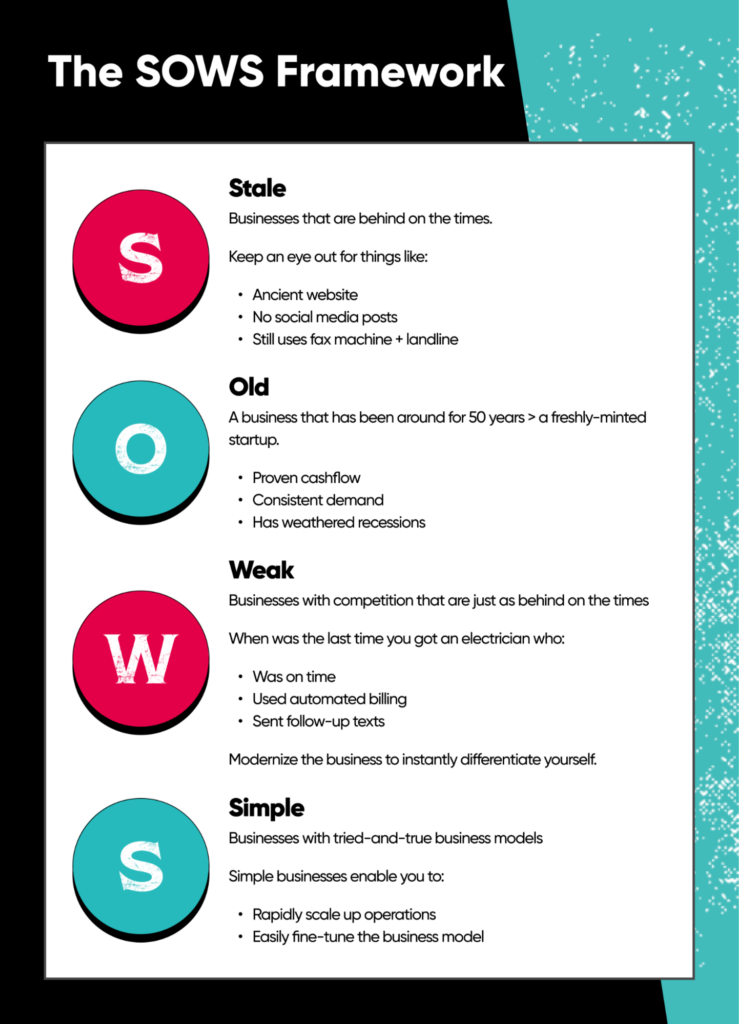

Follow the SOWS framework. Look for companies that are:

- Stale: Businesses that are behind on the times (keep your eyes peeled for fax machines)

- Old: Businesses that have been around and will stay around (thank you, Lindy Effect)

- Weak: Businesses with competition that are just as behind on the times

- Simple: Tried-and-true business models

Check out this video where Codie Sanchez breaks down the framework and how to find businesses that fit it:

And if you want some more ideas, here are a few to get your creative juices flowing:

- Convenience businesses: vending machines, ice machines, car washes

- Needed service businesses: pack and ship centers, laundromats

- Professional service businesses: videography, podcast production

- Home services: Junk removal, window cleaning, home cleaning, lawn care

- Real estate: tiny homes, RV parks, campgrounds

- Event businesses: party rental services, photography, food trucks, catering

Browse through different business types to see what fits you and your goals. Once you find a category you like, it’s time to start looking for one to buy.

3. Find Businesses For Sale in the Market

You’ll find business for sale everywhere once you know where to look.

Specialty websites list out all kinds of proven businesses waiting for a new owner. Check out places like:

- BizBuySell

- BizQuest

- Loopnet

- Businesses for Sale

- Flippa (ideal for online-based, domain, and e-commerce companies)

But you can also score an awesome lead through off-market channels like networking and mastermind groups (shameless plug: our Contrarian community kicks ass.)

A mastermind is a great place to shop deal terms and make sure you’re committed before you go all-in. Other people can call out your blind spots and help you avoid bad business deals.

Hint hint: We also started BizScout as a tool for finding off-market business deals.

Need some help finding the right business? Check out Codie’s breakdown on searching for businesses to acquire:

Keep digging. With enough persistence, you’ll be able to create a shortlist of businesses that look like a good fit.

4. Evaluate the Business and Do Your Due Diligence

Congrats! You went down the rabbit hole and found the “perfect business.”

But all that glitters is not gold, my friend.

It’s time to take a look under the hood.

You can avoid many business buying mistakes by conducting thorough due diligence.

Contact the seller and position yourself as a serious buyer using a letter of intent. It’s a non-binding agreement between you and the seller that allows you to get a look at non-public details about the business for valuation purposes.

Here’s what you’re looking for in this process:

- A deep dive into the financials, including tax returns, to back up P/L statements, financial statements, and balance sheets.

- The true value of the equipment and business assets (get a pro to appraise everything).

- Things that indicate you’re buying into a job you’d hate (not enough staff, long hours, difficult customers).

- Anything that indicates you’d put more than 20% of your net worth at risk by doing the deal (like a previous business turnaround or unpredictable cash flow).

Take the time to talk to other experts in the same industry, too. They can give you insights into the industry and operational nuggets of wisdom that make evaluating the business easier.

This phase may take months, but that’s because it’s also where you’re most likely to f*ck up the business deal.

As you gather data, model out to 0. That means looking at what would happen if the whole company folded.

Let’s say you’re looking at a service-based company with 20 clients, for example. What happens if all of them fire you overnight? Could you survive?

This strategy helps you spot risks in the company and weigh out whether it’s worth it to take them on as a new owner.

One other thing: You’re not just valuing the business to see if it’s worth buying today. You’re also looking for opportunities where you can make the business even better.

You will find plenty of room for improvement during due diligence. And that’s okay.

What you’re looking for here is anything that you cannot live with. Find your deal breakers and move on if the business crosses any of your red lines.

5. Understand Your Financing Options

Once you look over the financial details and factor in your own risk concerns, you need a plan for how you’ll finance things. Do this before presenting an offer to the seller.

You have tons of financing options. Here are some of the most common:

- Personal cash: Great if you have it, but it’s dangerous to tie up all your working cash.

- Traditional bank loans/business loans: You’ll get the cash if you work through the red tape, but you’ll take on debt, too.

- SBA loans: Good terms, but they’re tricky, so we recommend not using them for your very first buy unless you have no other choice.

- Partnerships/investors: You’ll get a hold of your dream business, and so will your new partners. We recommend avoiding partnerships on your first deal, as there are land mines with this one.

- Seller financing: One of the best ways to do business deals with little or no upfront money.

With seller financing, you work out your own terms with the current owner.

Not sure how it works? Check out how 2 guys new to the pool cleaning industry used seller financing to get in with only $35k of their own cash:

6. Negotiate and Make an Offer

When it comes to dealing, keep in mind one important thing: You can get your price or your terms.

And it’s the terms that matter the most for a good offer.

Use what you found in due diligence to craft an offer. If they push back, you can highlight some of the challenges you found.

For example, maybe you discovered a severe shortage of staff. You know that you’ll have to really beef up the team when you take over.

Since that’s extra work you didn’t plan on, you can factor that into your offer.

Know this:

- Deals can take a long time. Like, a year. That’s normal. Don’t rush it.

- Know when you’ll walk away, and it’s just not worth it to you anymore.

- Understand your seller: What’s their motivation? Play to that.

- Don’t focus on the price terms alone, either. Plan for a smooth transition, like keeping the old business owner on as an operator for a period of time.

7. Close the Deal

When you finally get close to taking over this biz yourself, make a business checklist of all the things you’ll need to do once the ink is dry on the contract.

That includes things like:

- Swapping things into your own name with the state.

- Acquiring any other licenses/permits you need.

- Set up your business bank account.

- Verifying your relationship with the full list of vendors and meeting with them, if needed.

- Confirming all software and ongoing subscriptions come to you.

What To Do After You’ve Bought the Business

The deal’s done! But the real work has just begun.

Now that you have your hands on a SOWS business, you can optimize it.

Thankfully, plenty of your research from the due diligence phase and your analysis during the transition period will give you a roadmap for how to approach your next steps.

It might include things like:

- Upgrading an outdated business with modern software and automation.

- Providing more training to employees for consistency across the board.

- Developing workflows that save time and clarify expectations.

- Creating a marketing engine that pulls in new customers.

- Leveraging promotions and tools like a CRM to generate repeat business from existing customers.

- Forging new relationships with collaborators or partners.

- Planning to branch out or franchise in nearby areas.

- Offering new services.

- Customer service improvements.

- Hiring a team (especially an operator, so you’re not stuck running this forever).

One place where established businesses miss out is in their marketing. The beauty of buying a boring business is that you’ll start with a built-in customer base. But a lot of owners are behind on the times when it comes to reaching new customers.

Boring businesses are easy to market, and most of your competitors don’t have a clue how to do it.

That’s called claiming a competitive advantage.

Find out where your potential customers spend time and develop clear ways to connect with them there.

Direct your focus to four main aspects of marketing:

- An SEO-optimized website that makes it easy to see what you offer, who you help, and how to reach you.

- Social media profiles to highlight your work and keep your name out there.

- A Google Business profile with reviews that serve as digital word-of-mouth.

- Offline marketing methods like partnership promotions, local advertising, or community events.

And, if you want some more tips on growing from the minute you take over, check out this video on how to 10x a boring business with marketing:

Launching Your Entrepreneurial Empire: What Now?

Now you know everything involved in buying a business, but it might still feel overwhelming.

Make no bones about it: Buying a business is a shit ton of work.

But, if you put that work in, you’ll play the long game for years and have it paying off in spades.

By buying someone else’s small business, you get in with less risk (and potentially less money) than it would take to start your own thing. A strong track record is a good place to build from, but that path is still ripe with potential pitfalls.

The good news? We consolidated all the best advice from years of hands-on experience and tons of deals into a course on buying your first small business.