You’ve heard it here before—buying an existing business is a much better option than trying to start something on your own and scale it up.

But it’s important to know what to do (and what NOT to do) when searching businesses and making an offer.

Keeping track of all the stuff you need to get done is a lot easier when you have a checklist you can reference.

Our checklist breaks everything down into simple steps to follow as you go. And you can download a printable version here.

1. Understand Your Goals for Buying a Business

You know it’s a good idea, but go deeper.

What’s your why?

Even with an established business, you’ll face challenges and roadblocks as you go. Not only will knowing your why help you push through them, but it can also help guide your future plans for the company.

You need to know:

- What kind of owner you envision yourself as (a hands-on owner, someone building the roadmap to hand over to an operator, someone who wants to systematize everything to franchise the whole thing, etc.).

- How you’ll know when the company hits its goals and achieves success.

- What kind of team you need to build the business.

- Why you think you’re suited to manage the company.

2. Determine What Kind of Business You Want to Buy

There’s no shortage of boring businesses that make for great choices as a business acquisition. We’ve even come up with a list of the most lucrative businesses to buy for you to get the creative juices flowing.

Start by thinking about your own job history, skills, and background.

What you know and bring to the table provides powerful direction to the type of business that’s best for you. You’ll be able to get more revenue out of a business that needs the skills in your zone of genius.

For example, an operational wiz with skills in developing processes, will provide a lot of value to a business that needs an organizational shape up.

While someone with a background in marketing can get more mileage out of a business where the biggest problem is getting the message out to potential customers.

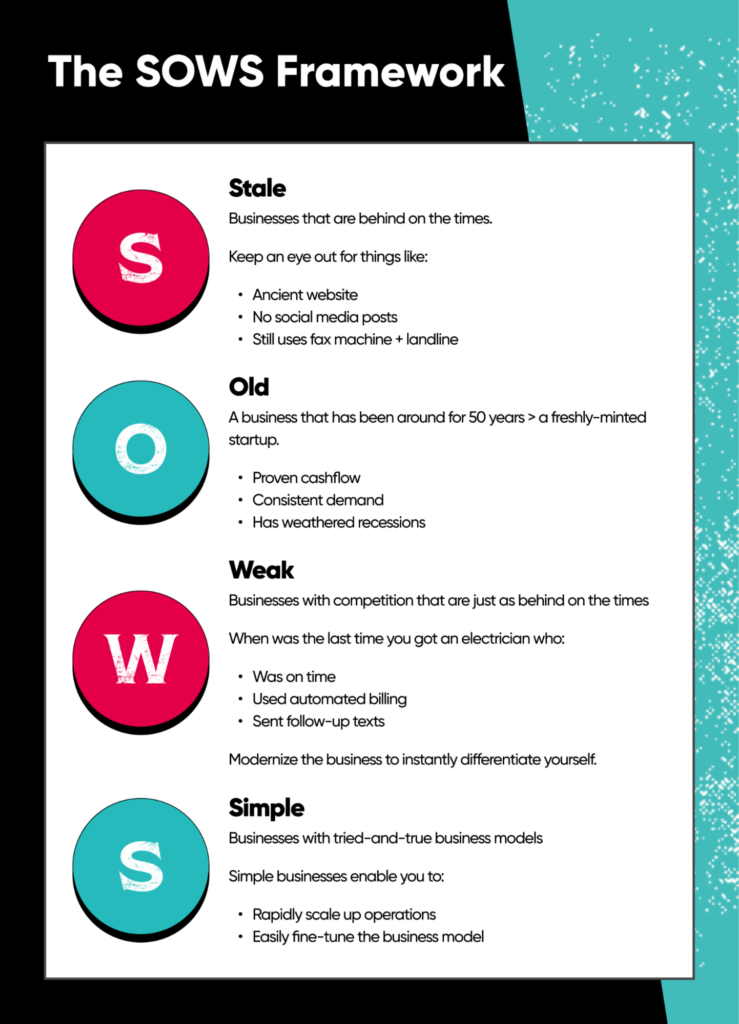

We also recommend that you buy a business that fits our SOWS (stale, old, weak, simple) framework.

These types of boring businesses are stable, simple to scale, and there’s always demand. They’re the perfect acquisition for first timers.

And don’t forget our golden rule of business buying. It’s a two-parter:

- Don’t lose money.

- Don’t buy a business that can bankrupt you.

It’s about so much more than finding something that interests you or the “hot thing” everyone’s promoting. Look beneath the surface to find the real hidden gems.

Sure, placing ATMs sounds easy, but for being a business all about money, it can actually take you years to make some of your own. Same with Amazon FBA and other commonly-promoted business models that face multiple problems.

3. Choose How You Will Finance Your Purchase

Contrary to popular belief, you don’t always need a lot of money to purchase someone’s business. You can get in the doors with $5,000 or less for plenty of boring businesses using seller financing.

Here’s a quick rundown of the best financing options for buying a business:

- Your own cash (savings, personal loan funds, credit)

- Business loans, including SBA loans

- Other people’s money (investors, crowdsourcing)

- Seller financing (using the owner like a bank and paying them back over time)

Your own cash is problematic because it puts all your eggs in one basket. And that’s if you have the money in the first place.

Business loans? Not as easy to get as you might think, and there will be a lot of paperwork and back and forth with the lending officer. It’s still a viable option if your other choices don’t work out, though.

Our favorite? Seller financing. You can work out your own deal terms here, such as limiting your down payment.

4. Find Businesses That Are for Sale (Including the Ones that Are Off-Market)

By now, you should already know what kind of business you’re interested in. Combine that with your funding sources, and you should have a narrowed-down list of industries to research.

A few hot spots to check for businesses on the market include:

These are just the places where an owner’s already looking to get out as soon as they can.

You can go deeper and cut out a lot of the competition by looking for off-market deals. You can use BizScout, a service we own, to find business opportunities that haven’t hit the market yet.

And if you’re still having trouble finding the perfect option, check out our guide to finding a business to buy.

5. Send a Letter of Intent to the Business Owner

Great, now you’ve found a business you want to buy. It’s time to start evaluating the business before you buy it.

Make contact with the seller and provide a letter of intent. This signals the seller that you’re a serious prospective buyer and opens the door for future sharing of pertinent info, like financial data.

This is a preliminary commitment to do business with another party and may or may not be binding. But it doesn’t mean you’re obligated to buy the company if you find a big red flag.

6. Run a Financial Health Check

Read through financial records, balance sheets, cashflow statements, and credit reports.

A few questions to ask here:

- Is the business making money?

- Are there concerning seasonal or cyclical issues with income?

- Are expenses way out of whack with earnings?

- Do tax returns match the actual financial statements?

- Are there any tax liens on the company?

- Are there pieces of aging equipment or other things that will require an overhaul?

- How much debt does the company carry?

- What are the profit margins?

- What business assets does the company own?

- Does the company also own any intellectual property?

7. Evaluate the Business’s Operations

If you still feel good about things after looking over the finances, move on to a deep dive into operations.

Review the existing business plan and organizational charts if the owner has them. Dig into how the company works on a nuts-and-bolts level.

Look for any red flags you can’t live with in the business.

The business needs a huge team to process work, and you don’t love being a manager? Red flag.

People putting in 80-hour weeks, and you see no chance of that changing? Red flag.

If the business is a little out of date or the marketing sucks, you can fix those kinds of business operations issues. If they have a complex process in place to systematize, you can fix that, too.

This is also your chance to discuss keeping the owner on for a transition period to work out kinks. It’s also your opportunity to vet key employees for moving up to bigger roles.

8. Run a Competitive Analysis

You can’t feel fully confident when buying an existing business if you don’t know what else is out there. Take a look and answer these questions:

- What unique selling proposition are competitors leaning into?

- Does the business I want to buy have a potential competitive edge I can use?

- Where are the other companies falling short?

- Is it reasonable to think that with my strategic insight, we can improve our competitive standing in the market?

9. Get a Professional Appraisal for all Company Equipment and Assets

Don’t take the current owner’s word for it when it comes to any physical equipment.

Get an independent evaluation from an outside expert. This will really help you when it comes time to make an offer on the business so you get a fair price.

Pay an outside expert to do this. Yes, it will cost you some cash to value all of the tangible and intangible assets. But the peace of mind and negotiation advantage you’ll get are worth it.

10. Check the Business’s Reputation and Relationships

In your list of things to work on once you take over, you might consider some easy wins, like improving the brand’s online presence.

To do this, check out current reviews, feedback, and relationships and ask things like:

- Does the business have an existing customer base?

- What are customers’ sentiments? Do they have positive reviews, mostly positive, mostly negative?

- What relationships does the company have with vendors, suppliers, and partners?

- Do they have any marketing efforts in play right now? If so, what kind and how are they doing?

11. Conduct Legal Due Diligence

Skipping the due diligence process is one of the best ways to totally f*ck up your new business.

You don’t want to step into any surprises once the deal goes through. Check things like:

- Current business licenses and permits.

- Any pending or past litigation.

- Insurance policies (and whether these fully cover all risks and liabilities).

- Existing contracts and legal documents with customers, vendors, and partners.

12. Negotiate the Deal

Now for the fun part: let’s make a deal!

Negotiating can be a challenge if you get pushback, but use all the data you found up to this point to back up your offer.

Don’t fear working through a few rounds of negotiation with the seller. You can use what you learn to come up with a purchase price and terms that work for both of you.

And don’t be discouraged if your deal falls through.

It’s very common for first time buyers to lose on their first go-round. The important part is that you have the ability to dust yourself of and go look for another (better) deal.

13. Close the Deal

Congrats! The ink is dry on the purchase agreement, and it’s time to start working in the business.

Don’t forget to do things like:

- Secure any funding if you took out a loan, including details on repayment dates.

- Transfer all licenses, software, and paperwork into your name.

- Choose an official start date and prepare employees for the transition.

14. Make the Business Your Own

You’re finally in charge. It’s time to optimize the business now. With your due diligence complete, you probably already have a full list of things to tackle. Check out our ideas for the best tools for buying and growing a business.

That could include:

- Upgrading all operations to the 21st century, like using software and automations.

- Leveling up marketing.

- Looking at growth opportunities.

- Tweaking customer service.

- Providing more training to employees.

Make the Right Moves and Buy Now

Now that you know the steps involved in buying a business and what to pay attention to in each one, you’re ready to step out there and start the process.

Knowing what you want and where you’ll shine in the company gives you an initial direction for an informed decision, but spend time researching companies for sale before drafting your first letter of intent.

If you make the right moves, you could find yourself in the owner’s shoes sooner than you expected!

One more thing. We designed this checklist as a quick reference for your first business purchase. If you feel like you need a deep dive, check out our guide to buying a business. And if you really want to drink from a firehose, check out our Small Biz Buying Course.