Buying a business is a wise decision. But only so long as you know what to look for in a company.

At least half of all business sale transactions fall apart in the due diligence phase.

It makes sense. That is the part of the process when you learn all the problems a company may have. It’s the step where you have the chance to decide between what’s a deal-breaking red flag and a challenge you can handle.

Want to find yourself on the right side of the odds? Master the process of evaluating a business before you buy it.

Once you submit a letter of intent, you need to know what to look for to rule out a disaster in the making. Evaluating a business before you sign on the dotted line is the best way to protect yourself from landing a bad deal.

2 Rules Before You Start: Mitigate Your Go to Zero Risk and Don’t Fall in Love

There’s a lot that goes into evaluating a business, but these 2 rules should guide everything you do throughout that process:

- Mitigate your go-to-zero risk.

- Don’t fall in love with the deal.

Don’t forget these rules because you’ll have to catch yourself at every step to protect your future.

Let’s dig into rule #1.

What happens to you if the business flops because of a problem you find in your evaluation? What options would you have at that point?

If the answer is “filing bankruptcy” or “losing everything I own since I sunk all my savings into this,” stop right there.

Those red flags indicate you’re pursuing the wrong deal.

If the business went to zero and you’d still be able to survive, then proceed with your evaluation process. Or if there are things you could do to limit a personal financial implosion, continue with due diligence.

Now that you’re clear on mitigating your go-to-zero risk, on to golden rule #2.

Do not fall in love with the deal.

If the business is bad, then it’s bad.

If they have massive tax liens? It’s bad.

If they have a string of serious pending lawsuits? It’s bad.

Do not be afraid to walk away. You can find plenty of other businesses for sale, so don’t trap yourself in someone else’s mess.

Evaluating a business is tricky and so is knowing when to walk away. Don’t hesitate to get advice from people who’ve done it before.

If you want advice throughoutt the evaluating process (and every other step in buying a business), our Contrarian Community can help. We have biz buying pros to review all your deals and help you catch any red flags you might have missed.

Let these rules guide you as you follow the due diligence steps below.

1. Look at the Market and Competitive Landscape

Before you buy a business, you need to make sure it even makes sense. Ask yourself:

- Does it have a market of people willing to buy the product or service?

- Does it serve the right market in its current location?

For example, is it a storage unit business that’s just far enough out of town that many customers aren’t willing to drive there? That’s a problem you can’t fix if you buy the facility.

Then start looking at the competition. Figure out how this business stands in comparison to its competitors and the local environment.

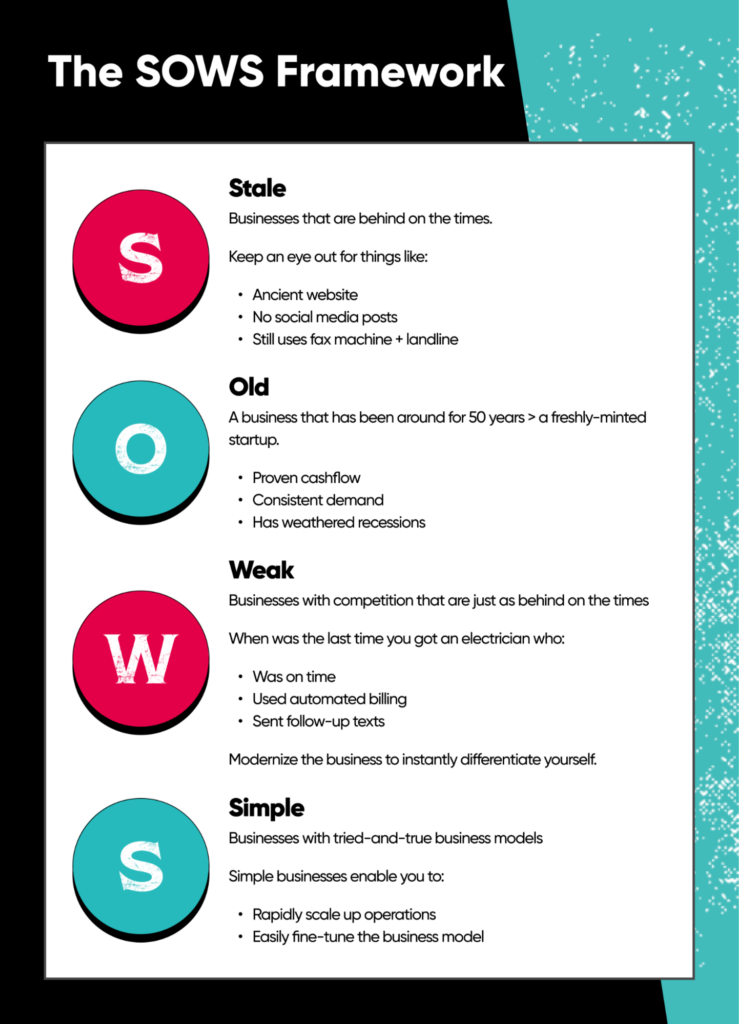

If you followed our tips for finding a business to buy, then you’ve used the SOWS framework to identify a business worth buying. Remember, that means the business is:

- Stale: Uses out-of-date tech, operations techniques, and marketing tactics

- Old: Has been in business for a long time

- Weak: Has competition that is just as out of date

- Simple: Uses a basic, proven business model

It’s the 3rd element that gives you a leg up during this step.

The competition may be just as backward as the business you’re interested in. That’s a golden opportunity for you to swoop in, make improvements, and win in the market.

But there are some cases where the competition has already modernized. If they’re edging out your prospective business, you need to weigh if you can catch up after buying in.

2. Run a Complete Financial Assessment

After you confirm that the business makes sense and have a clear picture of the competition, you’re ready to run the numbers.

You’ll need to dig deep into the data in this step.

Ask to see everything and anything. And don’t be afraid to ask for clarification if things that don’t make sense.

If the business is raking in cash but reporting huge losses to the IRS? Steer clear.

Here’s a quick checklist of what to look for while you assess financial records:

- Look at the balance sheet, income statement, and cash flow statement. Do they all tell the same story?

- What’s the total amount of debt and liabilities the business faces?

- Is the business profitable or on the path to increasing profit potential in the near future?

- Are there pending lawsuits or loan payments that impact the business value?

And watch out for these 5 common mistakes in financial records.

Common mistake #1: A seller “weighting” the business value by looking at the most recent high-performance year while ignoring other issues or the fact that said year was an outlier.

If they’re using that to determine the valuation, you’re right to question it if the other data doesn’t match up.

Common mistake #2: Questionable normalization adjustments.

For example, say a large expense will pop up periodically for you once every 5 years. Break down that expense and spread it over 5 years rather than ignoring it entirely. That goes in your projections.

Common mistake #3: Failure to acknowledge rent adjustment for leased real estate.

If the budget for a commercial space assumes the same rent in perpetuity, that’s a mistake. You need to account for regular rent increases.

Common mistake #4: The business owner classifies their pay as seller discretionary earnings when they really put in 40+ hours a week.

If you encounter this, add back the owner’s pay. Then subtract market pay for someone doing the X hours per week over 40.

Common mistake #5: Lowball expenses when family members put in free work.

Be honest in your assessment of the amount of work it takes to run the whole business and the cost that comes with that. Properly calculating payroll and staffing needs can make a huge impact on your offer and your ongoing profitability.

These mistakes aren’t necessarily red flags, but overlooking them will give you an incomplete picture of the business’s value. It’ll impact your final offer and can lead to nasty surprises after you close the deal.

3. Dive into Operations and Processes

You need a handle on operations and processes for 2 reasons.

The obvious one is to put a price on the business. Less obvious is that you need to know what you’re getting into.

There’s a huge difference between needing to invest in streamlining the business and trying to overhaul the entire thing. Looking before you leap stops you from getting into the latter situation.

Look at:

- Average time spent doing specific things (like service delivery or putting out fires)

- Wasted time with unnecessary meetings, waiting for approvals, or useless paperwork

- Inconsistencies due to lack of automation/software

- Pay rate, work effort, and morale of all staff members

Chances are, the problems you find here are fixable.

But knowing about them can be a factor in your purchase price.

For example, you might discover that you’ll need to invest a ton of money into modernizing operations. Add that fact to your negotiation and you can angle for a discount for your trouble.

4. Have a Professional Appraise All Business Assets

The owner might ballpark some of these costs for you but don’t leave it there.

Get a neutral and professional opinion from an outsider on all major tangible assets. That includes:

- Inventory

- Equipment

- Real estate

Some sellers are honest, but others may try to cover up equipment or assets in bad shape. If you have to repair or replace something, it’s far better to know that going in.

Using an outside appraiser also takes the pressure off you when you negotiate. You can point out that a third party came up with the valuation instead of relying on subjective gut instinct on value.

5. Check That All Licenses and Permits Are Up To Date

Look into all required licenses, insurance policies, and permits for each business location/operating area.

Then match the requirements up with what the business holds right now. If you spot gaps, include the time and expenses you’ll spend getting the right paperwork in place.

This is your chance to identify anything that’s lapsed or incorrect. Finding out months after you buy that some critical coverage or license never existed is a nightmare.

6. Review The Business’s Intellectual Property, Contracts, and Agreements

A business is so much more than its customer list and equipment. Some of the most valuable materials can include intellectual property or contracts.

For that reason, spend the time looking into each one. Hire an outside professional to help with your research, especially when looking at things like:

- Patents

- Trademarks

- Copyrights

Page through all existing contracts with suppliers, customers, and employees to look for any troubling terms.

Find any potential legal disputes or liabilities, too. Maybe the company is dangerously close to violating someone else’s intellectual property. That’s something you want to know well in advance to decide if the risk is worth it.

Most people who are trying to buy a boring business won’t need to worry about special IP or patents. But that doesn’t mean you shouldn’t look, just in case.

7. Review and Pending, In-Progress, or Past Legal Actions

Business lawsuits destroy profits.

Hundreds of dollars an hour for lawyers plus all the time it takes to gather and provide evidence for discovery exposes you to unnecessary risk.

Investigate any ongoing lawsuits or legal disputes that could cause problems once you take over. Run the math to determine the possible implications of these actions.

Look back, too.

Evaluate any prior legal disputes and their resolutions. If the business has a history of suits against it, something may be wrong that’s not worth trying to fix

8. Evaluate the Business’s Reputation and Brand Equity

One of the main goals of buying a business is growing it into something that’s more profitable after you take over.

It’s harder to grow a business when the previous owner burned every bridge with customers and vendors. You need to be able to build on a healthy business, not one with a damaged reputation.

Do an in-depth study of things like:

- Online reviews

- Testimonials

- Customer loyalty

- Complaints with the BBB or similar organizations

There’s only so much that hanging up an “under new management” sign can do to save a business. If it has a ton of 1-star reviews, you need to decide whether you should cut your losses and look for a better deal.

9. Look into Active Marketing Activities and Initiatives

This goes hand in hand with customer feedback. Ask to see information from the current marketing plan and any metrics that go along with it.

You’ll need to evaluate:

- The marketing channels they use, such as digital ads.

- The company’s online presence such as its website and social media accounts.

- How effective these channels and campaigns are for the business.

Here’s the thing about buying a boring business, though: you’re going to find issues in the marketing department.

That’s normal.

Most owners of boring businesses have no idea how to market themselves. You might find that the business gets all of its customers through word of mouth.

But the beauty is that these types of businesses are really easy to market.

With a little marketing know-how, you can outpace the competition soon after you take over the business. If the business doesn’t have a marketing plan, that’s not a red flag. It’s an opportunity for you to take it to the next level.

10. Investigate Growth Potential and Future Projections

Here’s where all of the previous assessments come together.

By now you know:

- How the business fits into the market

- The business’s financial and operational health

- Any past, present, or potential legal issues

- The relationship between the business and its customers and vendors

- Where the business stands on marketing

Now you need to look at all of these factors and determine how they impact the business’s future growth potential.

Ask yourself these questions as you look into the future:

- Can I scale this? How?

- Are there places to expand or diversify?

- How has the business grown year-over-year in the past? Can I improve those future projections?

For example, maybe the current owner has turned down a lot of business in a nearby area by saying it’s too far away. You might run the numbers on opening a second location or servicing a batch of customers in that area once a month.

Or you might see that the business is losing its ass on something that you can automate for pennies each month.

What to Do After Evaluating the Business

If the business passes all of the assessments above, it’s a good buy.

Now it’s time to move into the next phase: crafting an offer to buy it.

Before you present a formal offer to the seller, make sure you account for everything you found in your research.

Use that to alter any price up or down based on what you discovered. Be ready to argue your case with the seller.

This is your opportunity to do a final gut check on this business. Will you fit well into the culture? Does the opportunity spark your personal interest?

We can’t fit all the details on how to finance or negotiate your business acquisition into this article.

But we do have plenty of resources to help you if that’s what you need. We recommend you check out our guide to financing to buy a business, as well as our guide to buying a business with seller financing.

And, if you want something to walk you through all the steps in buying a business, check out this checklist for a quick rundown.

From Prospect to Purchase

The more you prepare for due diligence, the easier it is to present a compelling, data-backed offer to a seller.

You can confidently make your offer and negotiate effectively by following all these steps and asking questions throughout due diligence.

You also set yourself up for success by identifying as many challenges as possible and getting the opportunity to back out of the deal if it’s a nightmare.