You almost always need to put some cash down to buy someone else’s business.

Sometimes you can buy a business with no down payment, but putting cash on the table will always be more common. And having the cash increases the likelihood of you getting the deal over someone else.

If you want to get in on the sweet deal of running your own business, buying an established company makes it much faster than starting a new biz. You also limit your risk by investing in something with a proven track record.

But figuring out how to afford it presents a challenge.

There are plenty of ways to fund your business purchase. Each has its own pros and cons, and some are better for new business buyers than others.

Here are the most common ways to finance a business acquisition. We’ll break down the upsides and drawbacks so you can decide which one works best for you.

Self-Financing with Cash

If you have savings, you can invest in a business pretty quickly. It’s also the simplest option on this whole list.

If you’ve got the money, you can buy the business.

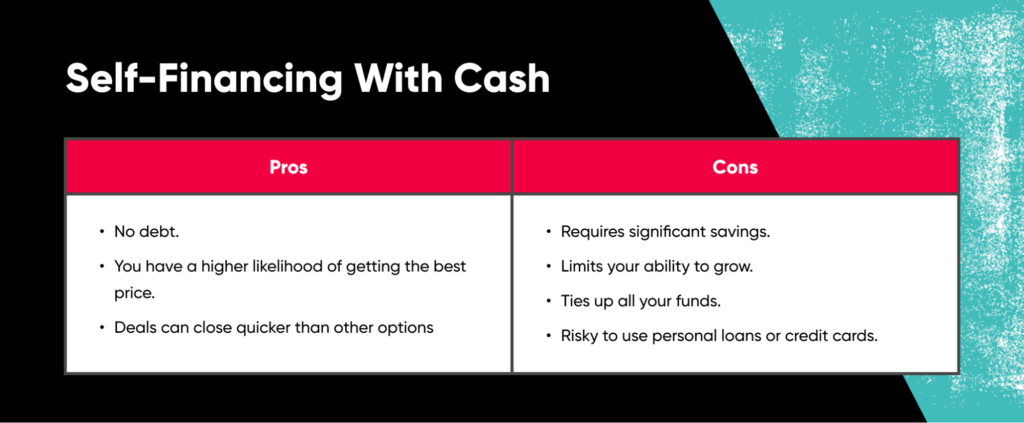

The plus side of using cash:

- No debt.

- It’s cash-in-hand for the seller, so you have a higher likelihood of getting the best price compared to other financing options.

- Cash deals can close quicker than other options.

But hold up. This really only works if you’re rich.

Why? If you only have enough savings to buy the business, you won’t have room to grow it.

You’re out the money, so you can’t use those funds for anything else. This also means you’re limited on how to scale the business since all your funds are tied up in the purchase.

So you need money in savings to buy the business, and you need money in reserve to improve it.

That’s a big ask for a lot of people.

Now, using your savings isn’t the only way to purchase a business. You could use a personal loan or credit cards.

But those are all risky.

With each one, you take on debt that puts you on the hook. And this debt negates the biggest advantage of using your personal funds.

Unless you find a business that costs less than a few thousand bucks, avoid credit cards for a business purchase.

Partnerships and Investors

Option 2: get money from other people.

Sounds good, right?

In this model, you convince other people about the viability of the business and get them to give you the cash you need to jumpstart your ownership.

With a partner, you get someone who will take an active role in running the company. Someone you trust who will play a key role in success.

With investors, you tap into external parties who want to see a return on their investment. They have different motivations than a partner.

The good news about using other people’s money:

- You don’t take on all the risk yourself.

- You can close just as fast as with a self-financed cash deal.

The bad news:

- Most investors want a stake in the company, so you give up equity. Give up too much equity, and you may regret it later.

- It’s not easy to raise capital. Investors have a choice in where they put their money, so you need to present a better offer than anyone else. Investors may not like the industry or the business model, turning this into a hard sell for you.

- You need to know the right people. If your world isn’t already full of wealthy people ready to hear a great business plan, you may find it hard to break into that crowd. You need a skilled and rich partner to help you get in front of the right people.

- Investors want to see the company succeed and may have their own vision about the best way to do that. What happens if it doesn’t align with your own plans? Or if it’s on a different timeline than you intended? This can lead to conflicts.

Traditional Bank Loans

Yes, bank loans exist out there. But don’t assume they’re easy to come by.

Here are the typical business loan approval rates based on lenders:

- Institutional lenders (insurance companies, pension funds): 66%

- Big banks: 27.7%

- Credit unions: 39.9%

- Small banks: 50.1%

- Alternative lenders: 56.8%

If you’re lucky enough to get approval, these can work out well. But you need to read the fine print to make sure you understand all the terms.

Requirements vary from one provider to another, but expect these as a general starting point:

- A personal credit score of at least 690

- At least 2 years of business operation

- Minimum business revenue (for example, Bank of America requires $250,000 annual revenue for their secured loans).

- Debt-to-service ratios that show you’re making more money than you have in debt with the business.

- You must be current on any and all government loans, if applicable.

You may also need to back your business acquisition loan with personal assets and collateral, depending on your financial situation.

The benefits of using bank loans include:

- You get to work within a well-established structure.

- You have access to bigger amounts of capital than most other financing options.

The disadvantages, though, are steep:

- You’re taking on debt.

- Your debt will accrue interest.

- Terms are almost always less friendly than other options (like SBA loans).

- You have to deal with rigorous approval criteria and a slow approval process.

Online Business Loans

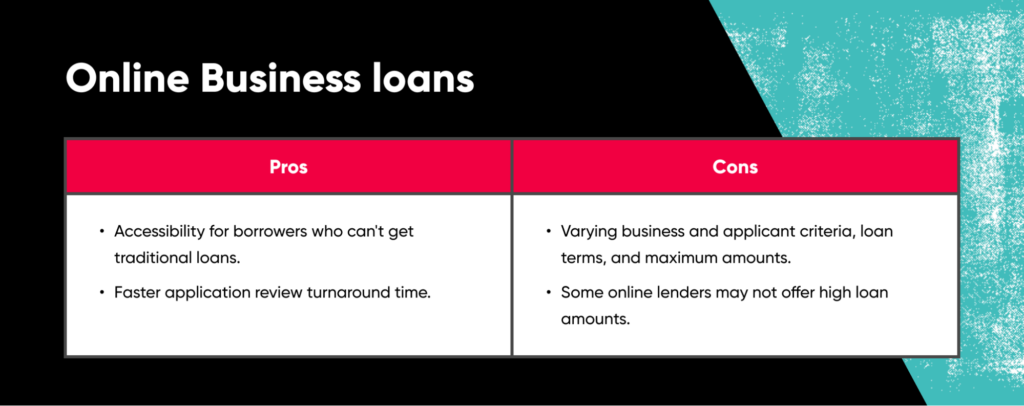

Online business loans open up a whole world of opportunities for borrowers. These may be attractive to you if you can’t get approved for traditional loans or don’t want the hassle of dealing with an old-school bank.

But don’t get us wrong. These still have their own business and applicant criteria, loan terms, and maximum loan amounts.

If you don’t have the patience to wait for the bank, online lenders do carry faster turnaround time for application review.

Not all online lenders are created equal, either. Traditional bank and commercial lending institutions approve an average of $663,000, and many online lenders just won’t go that high, so keep that in mind.

And there’s another big (and annoying) drawback.

Once your name is out there on any of these online business loan websites, you will get bombarded with emails, texts, and phone calls. Some of these sites sell your information to others.

We’d recommend avoiding this financing option unless:

- Seller financing just won’t work for you.

- You can’t get a bank to approve you for a traditional business loan.

- You can’t get an SBA loan.

But if you’re really interested in taking out an online loan, here are some of the most reputable ones worth exploring.

| Lender | Amount Available | Minimum Credit Score Requirements |

| OnDeck | Up to $250,000 | 625 |

| Lendio Note: one application submits your info to 75 lenders at once | Up to $5 million | 560 |

| American Express Business Line of Credit Note: requires personal guarantee and monthly fees on unpaid balances | Up to $250,000 | 660 minimum |

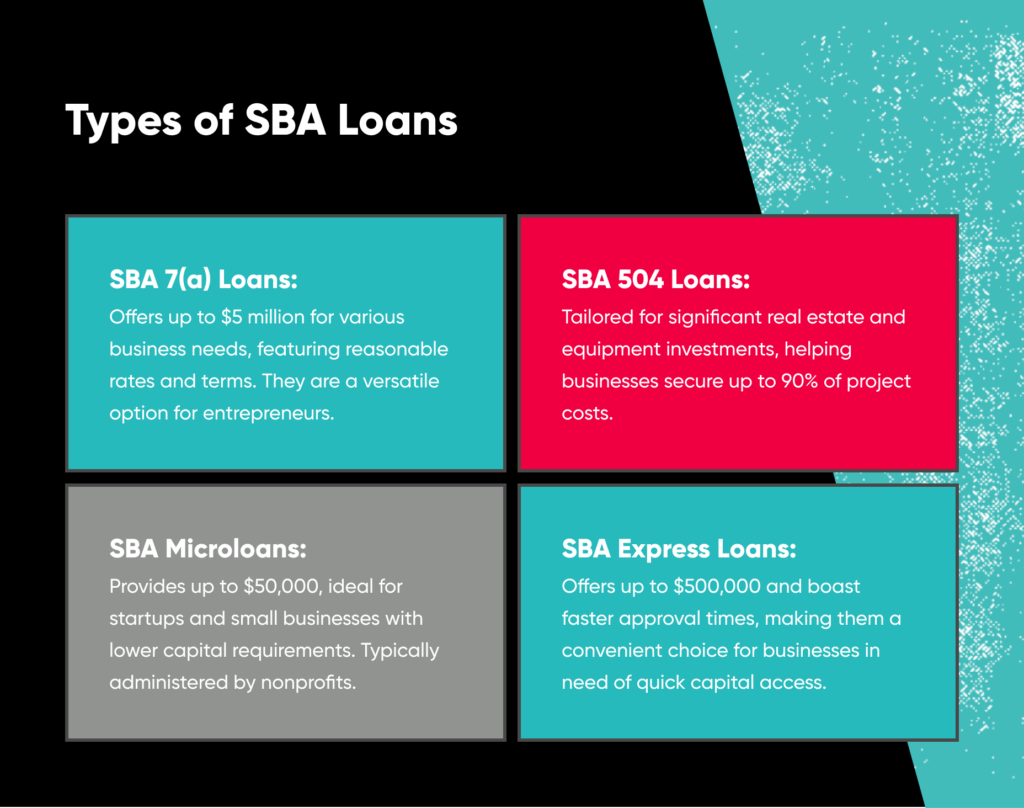

SBA Loans

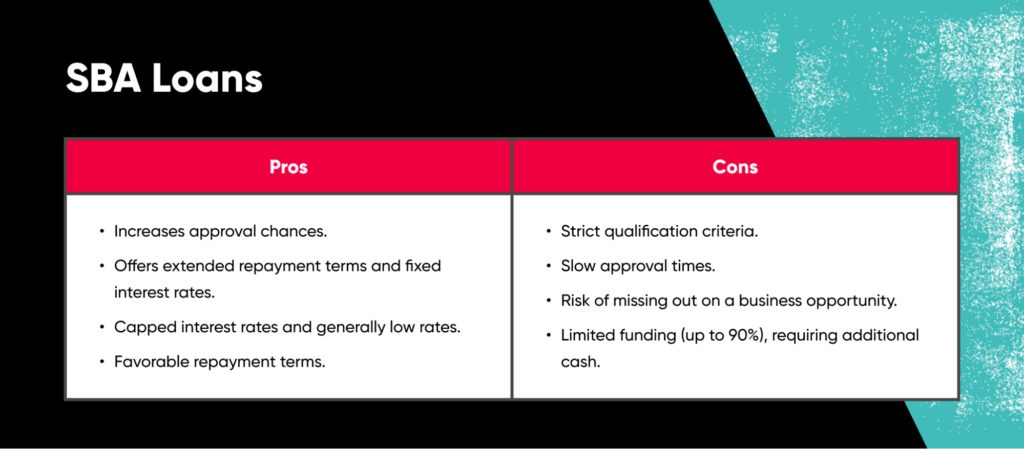

If you can’t get seller financing, using an SBA loan to buy a business is the best backup plan.

The Small Business Administration doesn’t loan you the money directly. Instead, they back a big part of the loan, which makes SBA-approved lenders more likely to approve your application.

The flagship offering under the SBA is called the 7(a) loan. Repayment terms can go out as far as 25 years, and you could get fixed interest rates. The SBA guarantees only up to 85% of 7(a) loans of $150,000 or less and up to 75% of loans over $150,000.

You can get SBA loans to fund expenses like equipment, inventory, and working capital.

Here’s why they’re so popular with business buyers:

- The SBA puts a cap on how much interest any SBA lender can charge.

- Low interest rates in general (check out current interest rates here).

- Favorable terms that give you more time to pay back the loan than some other lenders.

But the SBA maintains strict qualification criteria, and their approval times are notoriously slow.

Your chance to buy the business may pass while you wait. The SBA also will only fund most of your business purchase (a max of 90%), so you still need cash from elsewhere.

Seller Financing

Finally, our favorite way to get your foot in the door with a new business: seller financing.

Buying a business with seller financing is like working with a bank, only without all the pain-in-the-ass paperwork and criteria.

You use the seller like a bank, coming up with terms that specify your down payment and payback period for the cost of the business.

Why they’re great:

- Potential for flexible terms (if you’re a good negotiator).

- You can control the terms.

- You can buy a business with no money down or almost no money down.

- Seller financing works well in a shifting economy where banks may not approve you

- The seller may get tax benefits.

- The current business owner gets the interest payment on top of their purchase price.

The big drawback?

Most buyers don’t know about seller financing.

You have to negotiate to get a truly good deal. And you need to educate the seller about why it’s a win for them.

Seller financing can take longer to close than other options because of back-and-forth negotiating. But it is worth it.

We walk the walk with this one, too. This is by far our preferred method of buying a business, and we use it.

Check out how Codie Sanchez used seller financing to make a deal work with only a 10% down payment:

Break in & Buy Your First or Next Biz

Now that you know all the financing options available to you, you can start the process of trying to find a great business to purchase.

The right type of financing makes it possible for you to score an incredible deal and become a full-time entrepreneur.

You may need to mix and match funding methods to get the full amount needed for your buy, such as using your own savings for the down payment and then SBA loans or seller financing for the rest of the deal.

To see what it takes to start beyond financing, check out our Buying a Business Guide to gain clarity on how to do it.