The double pun here is extra funny to me today, we’re talking g-words and cashflow.

Let’s lose some subscribers today, shall we?

How would we do that? You query.

Let’s talk about guns.

Oh great! I just joined this f-ing email list to get financial freedom, actually own assets, stop working for a terrible boss, learn about your god-forsaken laundromat trade you keep hyping on Twitter nonstop, ya know… NORMAL THINGS.

And then here you go Codie trying to cram something political down my throat. UGH!

Touché.

I promise I’m not going to do that.

I also promise at the end of this I have one idea to grow your cash by 260-370% that makes anywhere from $133 to $175k a year passively.

You with me?

Point #1 Your financial freedom is why I do all of this.

YOURS. Why? Because financially free people make better decisions. When we all make better decisions my life and all our lives are better. If I’ve realized one thing this year it is that we are all connected. No one exists in a vacuum and if we act like an ostrich with our head in the sand, we will never survive. So I want more people not to make decisions out of fear and scarcity, but decisions from abundance. Understanding that money is just a tool and those who know how to wield it will continue to create wealth for themselves time and time again.

Point #2 Financially free people are also harder to push around.

You have resources that make your voice easier to be heard. Sad but true, those without financial resources are usually those trodden on, victimized and beaten down. SO I try to help as many as possible achieve true financial freedom because it leads to all freedom. Anyone who tells you otherwise is trying to control you.

If you have money in this world today, it is hard to push you around with let’s say regulations. If you don’t like the regulations in your state you take action:

- back a different candidate or party

- lobby for different laws

- leave the state or city

- move your business (and its tax base) from the state or city

You hit ’em in their pocketbooks, that’s the only place you can wound a politician after all.

The same goes for companies.

If you work at one, and you have financial freedom, when they start trying to make you work 100 hours, have unrealistic goals, or treat you poorly, you simply leave.

The same goes for false imprisonment or persecution.

If you have the money you hire the best attorneys, pursue a counter-PR case, you get the right people on your side, you make noise and people pay for their false persecution.

If you don’t have money, you are at the mercy of the state and it can swallow you up.

Point #3 You have what I like to call A F*CK You Fund.

Enough money in the bank so at any point in time, you can tell just about anyone to go pound sand. I like people having that. Why? Because consent is critical. Slavery is the opposite of consent. When people cannot say no because they cannot afford to, they have to stay, they can’t get away, they can’t push back.

So when people talk about Tax the Rich or F*ck the Rich, what those who created that movement are really saying is…

“We want to take your resources away because the fewer resources you have and the more we do, the more we can control you.”

I am all for fair taxes, I am not for government overreach (by any party):

- Because overreach = control.

- Control = no consent.

- No consent = slavery.

This brings me to guns… Guns are like money.

Or hell, they’re like crypto. They are a deterrent to other people pushing things upon you without your consent. Or taking things from you without your consent. I have seen gunfights live in the streets of Mexico, I have wielded a gun, I have had a gun pulled on me, I have had guns pulled on my colleagues, I have lost people to gun violence and I have seen people saved because the right people had them.

Now I am all for smart regulation, background checks even, the ability to insure and protect that they are not in the hands of felons or the mentally unstable. But I feel so strongly about this one statement that encompasses so many things.. that I am willing to lose many of you.

Do not give away your rights.

Go all-in on smart enforcement and regulations. But do not give them away.

“The U.S. has a mental health problem disguised as a gun problem and a tyranny problem disguised as a security problem.” ~ Joe Rogan

Your right to earn, your right to bear arms, your right to live without undue taxation. Never give up a right because once given up, they are rarely returned.

We have been approached by so many on the left and right about acquiring firearms over the past 1.5 years. Whispers of could they “borrow a gun,” which is actually a crime. Whispers of “should we learn how to shoot.” The truth many are realizing is, guns are a tool. Similar to money, you have to know how to wield them. And unlike what politicians say, they do protect us. Why? Because we are an embedded population, you could bomb the whole country I guess, but since red’s live next door to blue’s you’d hit friends and foes alike.

Here are questions I want you to at least start asking yourself:

- Why was Switzerland never invaded by the Nazis? An armed populace one could argue.

- Why in Mexico where there is only ONE gun store in all the country, where it is almost impossible to buy firearms, does the country has one of the highest rates of gun violence.

- Why does Chicago have one of the highest gun homicide rates in the country, while also having incredibly strict gun laws?

We have work to do here, but my hope is each time you see someone try to take away your right to bear arms, to your own reproduction, to medical rights, to your right to earn, your right to buy crypto, or the rights of the person next to you… you push back. Maybe it’s not gun rights for you, knowing how to operate a firearm I can tell you I have a healthy fear of them in the wrong hands. But I have an even bigger fear of what can be done to a populace without them.

We protect lives and we protect rights. That’s the balance.

More consent, less control. ON EVERYTHING.

ON TO MONEY

RV Park: Bought for $400k, cashflows $15,300 a month

I talk a lot about my deals.

Now, this could look like flexing…

BUT – it’s not to show how smart or lucky I am (I assure you I’m no genius and I get luckier the harder I work) but to show you what is possible when you play in the sandboxes they never talk about on Sandhill Road. This week let’s talk not about my deal but about a deal from one of you.

A Contrarian. His name is Kenworth (not Ken, don’t get it twisted). Kenworth is a real estate man from South Carolina, who focused on single-family home investing for years. Then one day he gets a phone call from one of his real estate brokers telling him he had a hot little deal for him on an RVP park, did he want in?

SUMMARY: Purchased for $400k, makes $15,300 a month cashflow

Not too shabby. We’ll break down how Kenworth invested in the deal, his lessons learned, and how you can mimic it too.

Kenworth got that phone call in 2017, despite his 100’s of single-family deals, 5 kids and a brewery he was like… ya I want to own an RV Park.

What made this a good asset?

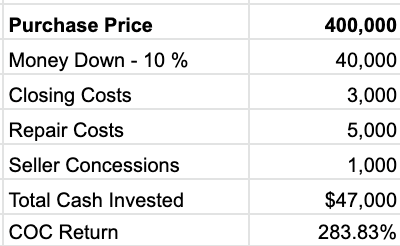

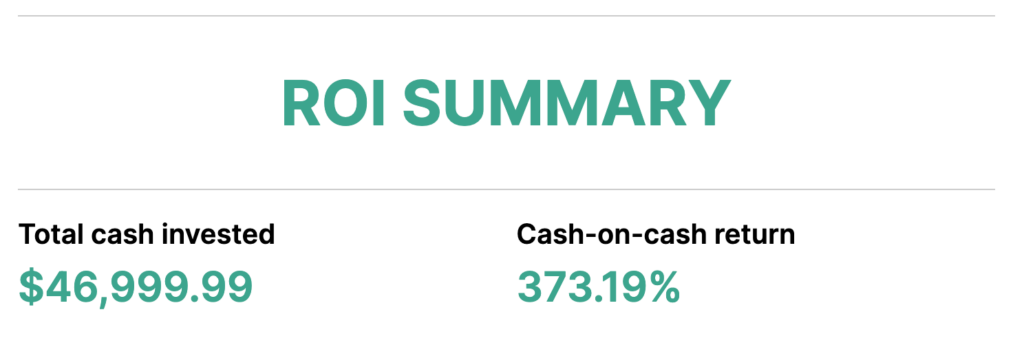

Here’s the deal, he paid $400k for it, let’s say he put 10% down and with closing costs, he’s all in for around $47k.

Thus on his park that has 35 spots at $350 a month, he’s making a nice 283% cash on cash return.

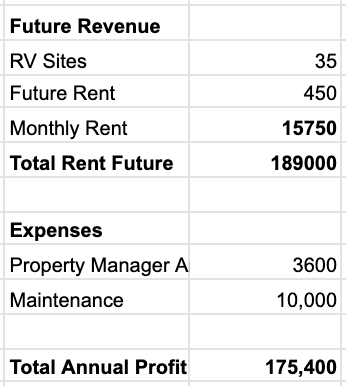

Here’s how it shakes out (btw I have massaged and assumed some of these costs, and loan amounts so that I don’t share every specific of Kenworth’s deal) so we could be off by a few thousand on either side.

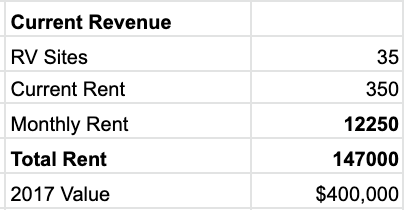

At the time in 2017, they were charging $350 a spot and Kenworth was bringing in about $147k a year in total return (not including extra services etc).

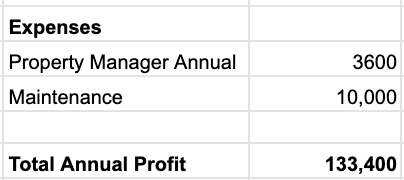

Then we throw the costs on top of it, and he’s looking at making almost half of his whole loan amount back in year one.

Now that in itself is awesome, I love a $133k profit with someone else managing my asset and an almost 300% COC return. Ooof. That’s almost as good as a JPEG Rock NFT. But here’s where it gets even better, with a few site upgrades and getting the right tenants on board Kenworth can up the rate to $450 a month.

Which means he’s making $175,400 a year profit.

That is a 373% cash on cash return. I’d do that deal all day long.

What Made This Such a Good Deal?

We did a whole piece on RV park investing, but here are Kenworth’s rules:

- Location – Make sure you like the trajectory of the park.

- Bankable – If you can’t get a loan, it’s not worth doing.

- Get In the Deal – Make calls to competitors, go visit parks, go stay in one.

- Cashflow – Make sure it nets enough to pay an operator and you.

- Marketability – Is the place getting calls? Can you fill it?

No Free Lunches

Now nothing in this world is free, so let me tell you the good, the bad, and the lessons learned from this RV park deal.

- Be Wary of Contractor Tenants

- He bought the park originally when it was full of local construction contractors building a power plant. Then one day the plant was completed (ahead of schedule) and when he came home from a Christmas vacation the park was empty. Figure out the average length of stay before you do the deal.

- Path To Progress

- Kenworth likes to invest, build and buy on fringes that are on the path to growth and progress. That way he makes money on the cashflow and the appreciation.

- Worked in Construction and Saw An Opportunity

- Whatever sector you work in, look at the growth around you. He was in construction and saw the booming houses demands but limited supply aka RV park needs. What is your unfair insight and how can you leverage it?

- Tell People What You’re Looking For

- He didn’t even have to go find this deal, it found him. How? He told people over days, months and years what he was looking for. Then they’d bring deals to him.

- Be Easy to Work With

- They’d bring him deals because if you’ve met the guy he is all Southern class. Nice, funny, easy-going. Hell, I had him do a call as a favor and by the end of it, he’s sending me free beer and merch. THAT is how you sow seeds for the future.

- Do the Deals You Say You’re Going to Do

- He has NEVER not followed through and closed a deal he said he was going to do. That is incredibly rare. I certainly have had deals fall through on my side. An ability like this to execute is incredibly powerful. You know the old adage, just do what you say you’re going to do and you’ll be the 1%.

- Never Do the Deal w/o An Onsite Operator

- EVERY single RV and mobile home park owner I speak to tells me the same thing. Your operator is crucial. They are inexpensive but crucial. Usually, a few hundred to a few thousand dollars a month but they live completely for free and run the show. Don’t do a deal like this without one. Shout out to Karen, his operator, who he said is the sht. Well, he didn’t say sht because he is classier than I am.

- If You Refuse to Give Up You’ll Never Lose

- When he came home to all 35 of those spots largely empty, it could have broken him. But he said, we are going to figure it out, that attitude will take you far in SMB space. It’s not rocket science but you do have to get your hands dirty every now and again.

THE ICING ON THE CAKE?

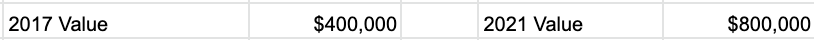

He bought it for $400k in 2017 and just got an offer on it for $800k.

He said no thanks, but that is a mighty nice return.

Keep your rights & keep your cashflow,

Codie

FOR THE NEWBIES:

We have an entire series on side hustles that don’t suck on TikTok so far.

- Renting surfboards – $1190 startup cost = $15k a month cashflow

- Antlers – Bedazzling bones to thousands a month

- Twitter meme lord – $2k a month slanging funny tweets

Are sewage businesses the ones no one is talking about?