Buying a business always takes some work, but you can cut down that to-do list by purchasing a turnkey business instead.

A turnkey business comes with some room for growth but has the raw goods to make it relatively simple for you to step in as the new owner.

Knowing what makes a company turnkey will reduce your hard work upfront when you take over the business and cut down on the time you spend putting out fires. Here’s how you can spot and buy one to start making revenue and profit right away with as little effort as possible.

Why Choose a Turnkey Business?

Sure, you can start a business from scratch or buy a business that will take a lot of work to earn profits, but there’s a much easier way. Buy a business that’s already doing well.

Turnkey businesses make a lot of sense. You can hit the ground running with a profitable engine. Then you can make optimizations to get even more out of it.

And, if you’re an aspiring serial entrepreneur, knowing how to find them is one of the biggest unlocks you’ll need for success.

The big advantages of buying a turnkey business are that you can:

- Start earning revenue quickly

- Reduce your startup risks

- Benefit from existing operations systems and processes

- Trade on brand recognition and an established customer base

But before we go on, here’s a quick reality check. It’s a fantasy to think you can buy a business that needs no work at all.

Every company could benefit from some changes and optimizations. Even a so-called turnkey business will have room for improvement. These businesses are just a little closer to their ceiling than something that needs a lot of work.

With this in mind, you can find a turnkey business opportunity that’s making money right now and won’t take too much effort to improve.

Examples of Turnkey Businesses

There are many examples of turnkey businesses you can buy and start running right away. Here are some favorites to consider in your search.

Self-Storage Businesses

If you buy a self-storage company with enough paying tenants, it’ll make an ideal choice. These businesses have huge financial upsides and need almost no staff in place.

This is a classic example of a hands-off turnkey business. You’re good to go as soon as you hire an operator to manage day-to-day concerns like security, processing tenant payments, and answering questions.

Many self-storage companies you could buy for a great price are behind the times. It won’t take months of work or thousands of dollars to bring them up to speed, but you will need to put in some effort.

Near-perfect turnkey versions of this business exist, but you’ll pay more for a storage business that requires less upfront work.

Equipment Rental Businesses

The biggest expense for starting an equipment rental? You need costly equipment to rent to other people. Buy an established one and you’ve cut down the headache of building your inventory.

Most people don’t want to take on massive loans or source these machines from vendors. You can slot in and fill that need by buying a turnkey equipment rental business.

This is a super simple business model. Once you get the equipment, you earn money time after time as you rent it out.

The flip side is that it’s a little more complicated than the previous example. You’re going to need a staff to handle equipment check-in/check-out and to do maintenance on your inventory.

An equipment rental business could be turnkey if:

- It has existing staff who know how to manage operations

- The equipment’s in good shape overall

- There’s a maintenance plan or expert you can call if something breaks

Established Service Businesses

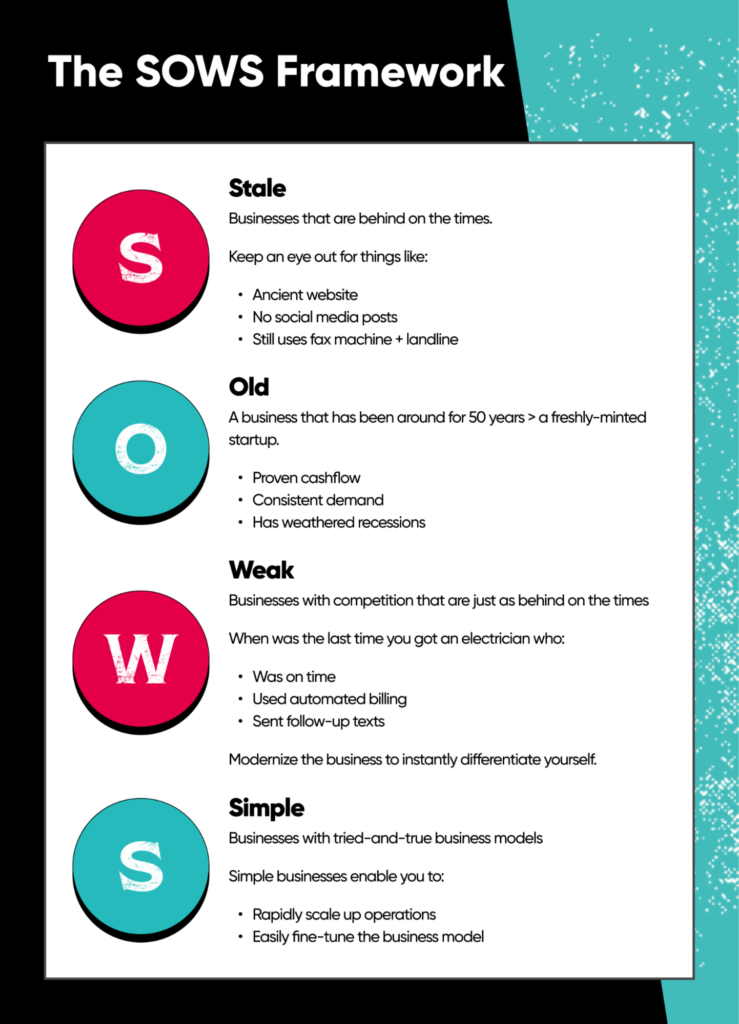

Service businesses often fit the bill for our SOWS model.

That means they typically earn profits even though they’re:

- Stale

- Old

- Weak

- Simple

We’re talking roofing, HVAC, pool cleaning, lawn care, landscaping, and plumbing. They’re stable markets, people need them, and it takes just enough specialized skills that not everyone can start a company doing these services.

Even complicated businesses that take specific skills can be turnkey if the crew’s already in place and if the company brings a good track record to the table with past customer service. You don’t need to learn the skills yourself if you have a team of ace techs ready to roll.

Finding Turnkey Businesses

Now that you’re sold on buying a turnkey business, it’s time to find the right business to buy.

Whenever you can, look for businesses for sale that align with the SOWS model.

In order to find these companies, you need to commit to a few things. That includes:

- Setting aside time to look, like 20 minutes every single day.

- Check out online marketplaces like BizBuySell, Flippa, and LoopNet. You can also look for off-market deals through BizScout, a service that we own and built to help entrepreneurs find their next business opportunity.

- Getting your name out there through networking

If you’re not sure where to look or you’re having trouble finding your Goldilocks fit, check out our guide to finding a business to buy.

Evaluating a Turnkey Business for Purchase

You evaluate a turnkey business just like any other company. Look deep into things to make sure you’re comfortable with the current standing of the business and the factors you’ll need to tweak.

Your initial evaluation helps you confirm you’re serious. From there, you can write a letter of intent to get more behind-the-scenes details about the business.

Here’s what to evaluate in your research:

- The company’s financial health by looking at things like tax returns, cashflow statements, and profit and loss reports.

- Review operations and processes. Are things more complicated than they should be? Could anything benefit from automation?

- The current value of any assets.

- The existence of any pending legal liabilities or risk exposure.

- The company’s reputation and online presence.

If you spot any big red flags here, it’s not too late to keep looking around the market. Your evaluation should dredge up anything that you will not be able to live with if you buy the business.

Financing Your Turnkey Business Purchase

Once you’ve got a firm handle on the general value of the company and you feel confident about making an offer, you need to look into ways to finance your business.

Here’s a rundown of the most frequently used options:

- Cash (your own savings, credit cards, or personal loans).

- Bank business loans.

- SBA loans.

- Seller financing (a non-bank deal where you work out terms with the business owner).

Cash may tie up all your money, but could help you get a cheaper price and get into the owner’s role faster.

Bank business loans can be a huge hassle since each bank has its own requirements. If you must go the loan route, look into the SBA.

The best way to jumpstart your business is through seller financing. You work out a deal with the seller and pay them back as if you would the bank. You can even try to negotiate a lower down payment and pay the owner back from business profits once you take over in your new role.

You could even buy a business with no money down using seller financing. Here’s a quick breakdown if that sounds intriguing to you:

Negotiating and Closing the Deal

Depending on the financing you choose, you may reach the negotiating or closing phase faster.

Closing could take longer if you’re waiting for the SBA to approve your loan than it would for an all-cash deal, for instance.

But one thing holds true no matter the timeline. You can get one or the other in your deal:

- Your terms or

- Your price

What’s more important to you?

Use that information to craft your initial offer and know what you’re willing to compromise on to get to a final number and terms that work for everyone involved.

Maybe you want to keep the previous owner in place for 3 months, and you’re willing to offer a higher price to make that happen. Or maybe you’re coming in with a cash offer and want a fast close and takeover so you can start focusing on the company right away.

Once you close the deal, don’t forget about all the final legal details. This includes transferring insurance, accounts, and more into your name.

Even a turnkey business requires some changes and optimizations, so compile your research from the due diligence phase. That way, you’ll know what’s critical for you to tackle first.

A smooth handover will make things much easier not just for you but for the entire team, vendors, and customers. Create an incremental plan of what you want to focus on each week during the transition phase to keep you on track.

Avoid These Common Mistakes

It’s very tempting to buy one of the first companies you scout, but it’s all too easy to mistake a money pit for a great buy.

First of all, follow the golden rules of buying a business:

- Don’t lose money

- Don’t buy a business that will bankrupt you.

If you’re taking on a massive amount of risk for something with a high failure rate, you are setting yourself up for failure.

Also, avoid these costly business-buying mistakes that could leave you responsible for a dumpster fire:

- Skipping or skimming through the due diligence process.

- Avoiding professional valuations on equipment or assets and instead taking the owner’s word for it.

- Not factoring in hidden costs or post-purchase investments.

- Ignoring cultural or team dynamics when taking over.

- Not recognizing the work it will take to overcome challenges for a business with dozens of bad online reviews and a bad overall reputation.

And, of course, don’t even waste your time with businesses that are never a good deal.

Hotels, ATM routes, and restaurants are 3 things you should leave to someone else. You’ll save a lot of time because these businesses, even when “successful,” have lots of behind-the-scenes problems.

Turnkey Triumph: Buying Your Next Business

If you’ve run through your entire checklist and feel great about making an offer on a turnkey business, congrats! You’re one step closer to entrepreneurship.

By leveraging the strategic choice to invest in a turnkey operation, there’s a much higher chance you can make the necessary changes quickly and start seeing returns.